- BNB forms a double-top pattern near $1,350, hinting at a 30% correction toward $835.

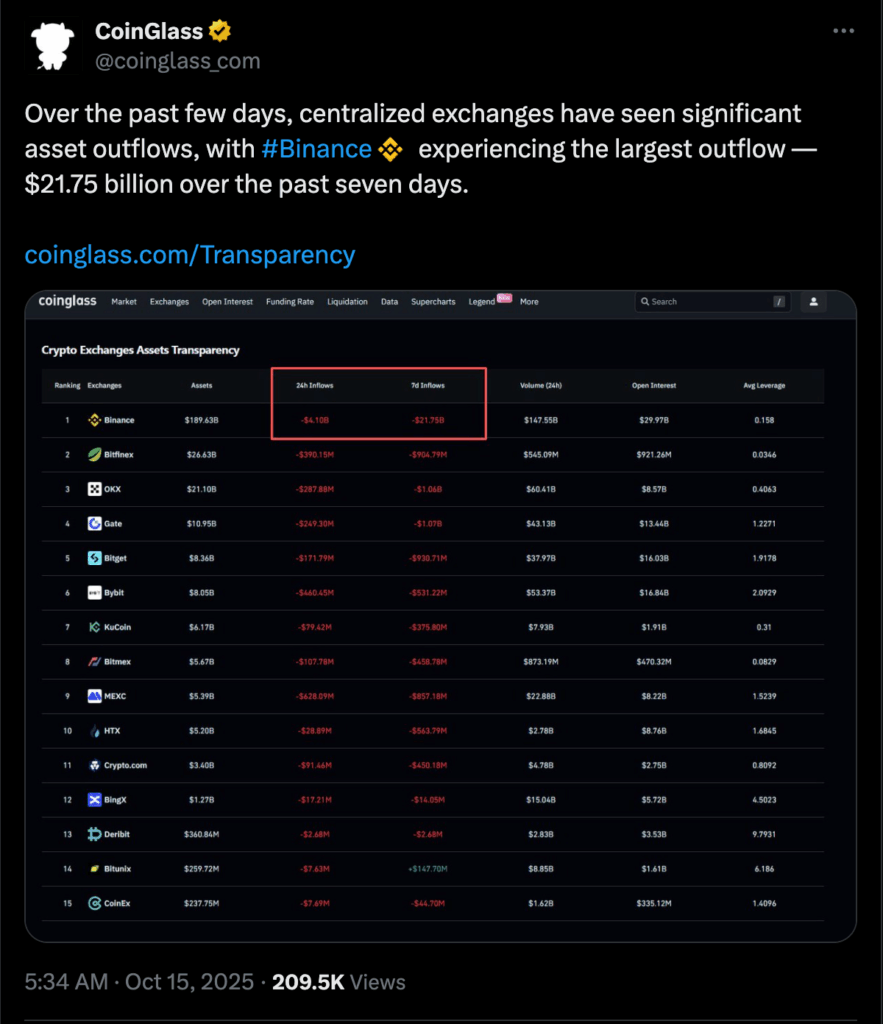

- Binance saw $21.75B in outflows, sparking fears of a confidence crisis.

- Holding above $1,155–$1,042 EMAs could invalidate the bearish setup and revive the uptrend.

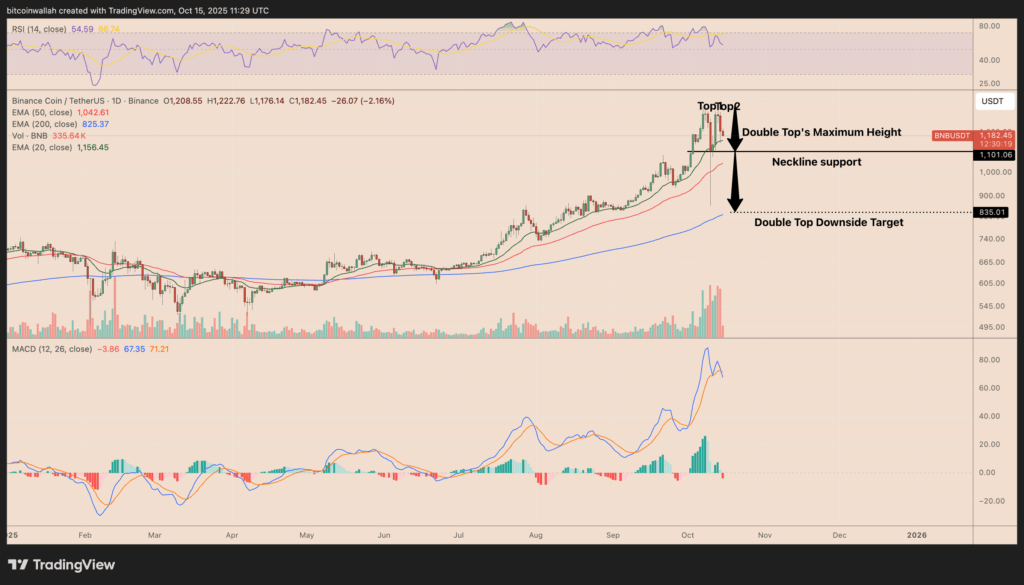

BNB’s strong 2025 rally may be running out of steam. After touching highs near $1,375 twice last week, the token is showing signs of exhaustion, forming a potential double-top pattern that could point to a 30% decline if key supports fail. As Binance faces accusations of a margin system exploit and massive user outflows, the market’s confidence in BNB’s short-term strength is wavering.

Double Top Formation Points to Possible 30% Drop

Technical charts show that BNB has struggled to break above the $1,350–$1,375 zone, creating two clear peaks — a textbook double-top structure. The neckline support currently sits around $1,100, and a confirmed break below this level could validate a deeper correction toward $835, marking a 30% downside from current prices.

Momentum indicators are reinforcing the caution. The RSI has cooled off sharply from its overbought range above 70, while the MACD just flashed a bearish crossover — a sign that buying strength is fading. Traders warn that a close below the $1,100 level could accelerate bearish momentum through the rest of October.

Binance Outflows Add to Market Pressure

Adding to the bearish setup, Binance saw a staggering $21.75 billion in outflows over the past week — the largest among centralized exchanges. A single-day exodus of $4.1 billion occurred following Friday’s liquidation crisis, when Binance’s oracles reportedly mispriced collateral assets, leading to a cascade of forced liquidations.

While daily outflows have eased, Binance’s seven-day balance remains down by nearly $3.7 billion, according to CoinGlass data. Analysts, including Dr. Martin Hiesboeck from Uphold, suggested the liquidation chaos may have stemmed from a targeted exploit within Binance’s Unified Margin Account system, estimating losses between $500 million and $1 billion. Hiesboeck compared the event to a “Luna 2” scenario, further eroding market confidence despite Binance’s $400 million Together Initiative aimed at restoring trust.

Support Zones That Could Save the Rally

Despite the sell-off fears, BNB still sits above major exponential moving averages (EMAs) — the 20-day EMA at $1,155 and the 50-day EMA at $1,042. A solid rebound from these levels could keep the uptrend alive and invalidate the double-top thesis.

If bulls manage to push prices back above $1,350, BNB could re-enter price discovery mode, opening the door to fresh highs later this month. However, if support breaks, the market could see a steep slide toward the $830–$850 zone before stabilizing.

Outlook

BNB’s short-term path hinges on whether it can hold above its EMA supports amid growing pressure from exchange-related uncertainty. A close above $1,200 would restore bullish confidence, while any break below $1,100 could confirm the double-top breakdown. Either way, traders expect heightened volatility as Binance works to rebuild trust following one of the most turbulent weeks of the year.