- Cardano (ADA) is defending key support at $0.70, hinting at a potential 40% rally.

- Analysts see a possible move toward $0.82–$0.92 short term and $1.20 if the breakout confirms.

- Derivatives data shows $62M in liquidation clusters, signaling volatility and potential upside pressure.

Cardano (ADA) has been holding firm after one of its sharpest pullbacks this quarter, defending key support levels and flashing signs of renewed buying momentum. Despite widespread sell pressure, traders appear optimistic that ADA’s price structure remains intact — and that the next leg higher could be forming if bulls continue to protect the $0.70 support zone.

Cardano’s Technical Setup Points to Recovery

Technical charts from Growk Finance highlight that ADA is still trading within a four-year symmetrical triangle, a consolidation pattern that has historically preceded major breakouts. The current structure shows ADA repeatedly defending the $0.70–$0.72 range, confirming this zone as strong short-term support.

Momentum indicators are also shifting upward from oversold levels, signaling that buyers may be regaining control. Analysts suggest that if ADA holds above $0.68, the recent flush could serve as the final shakeout before a sustained rebound. A confirmed breakout from the upper trendline of the pattern could propel ADA toward $1.10–$1.20, aligning with the top boundary of its long-term formation.

Price Targets and Short-Term Outlook

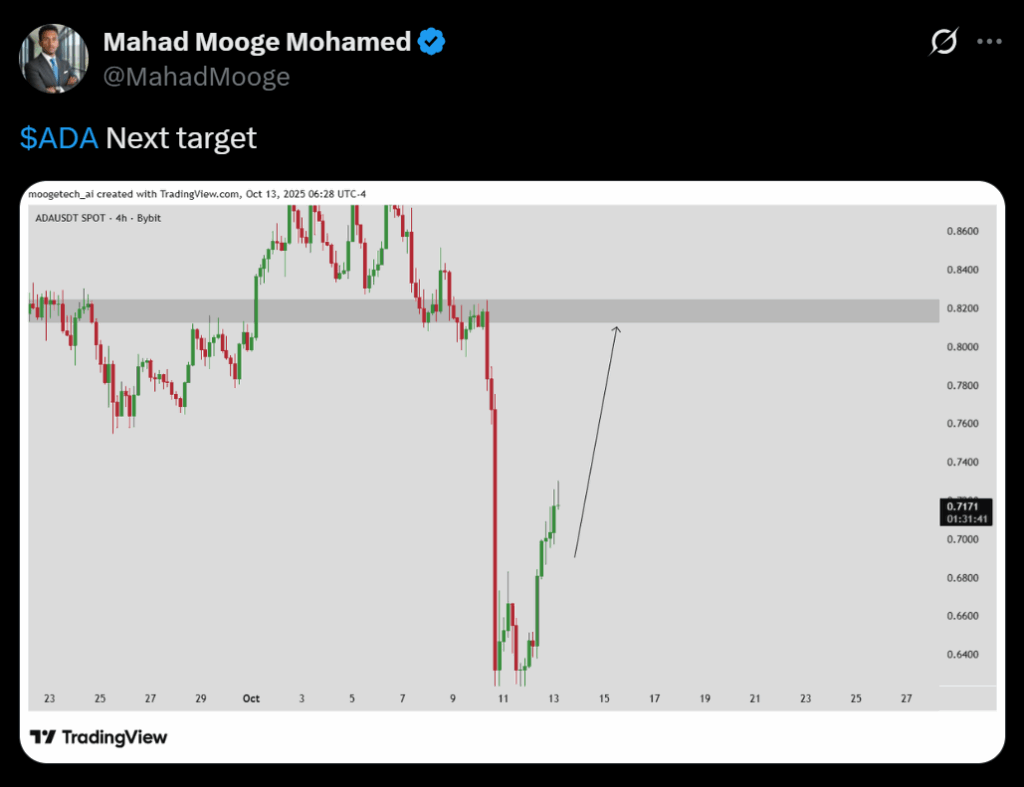

In the short term, ADA is forming a V-shaped recovery, reclaiming key price levels after briefly dipping below $0.65. Charts shared by Mahad Mooge show ADA targeting $0.82 as the next resistance zone — an area that coincides with historical supply and trading volume imbalances. If buyers manage to maintain strength above $0.70, analysts expect a move toward $0.92, which would complete a full retrace of last week’s decline.

However, failure to hold the $0.70 support could trigger renewed downside pressure, pushing prices back toward $0.65. The reaction around $0.82 will likely determine whether ADA enters a new bullish phase or remains range-bound through the end of October.

Derivatives Data Signals Incoming Volatility

Data from TapTools reveals that more than $62 million in leveraged ADA positions sit near the $0.81 level, making it a key liquidity zone. If price moves higher, these positions could be liquidated, leading to a short squeeze and amplifying ADA’s upside momentum.

Analyst Deezy added that most long positions from the November 2024 rally have been wiped out, resetting open interest and creating ideal conditions for a clean structural rebound. This reset could pave the way for a long squeeze-driven rally, with volatility expected to rise sharply between $0.78 and $0.82.

Historical Parallels and Long-Term Outlook

When compared to ADA’s 2020–2021 cycle, current patterns show remarkable similarities. Both phases feature deep corrections followed by months of tight consolidation within descending channels. Historically, such formations have preceded explosive upward moves once momentum returns.

Technically, the ADA/BTC pair is also sitting near a major support zone that previously marked macro bottoms. A breakout above diagonal resistance could reestablish ADA’s longer-term uptrend against Bitcoin, potentially setting the stage for a broader bull rotation into altcoins.

Final Thoughts: ADA’s Path Ahead

Cardano’s price remains in a recovery phase, with traders watching the $0.70 support as the make-or-break level. Sustained buying above this zone could drive ADA toward the $0.82–$0.92 corridor in the coming weeks, with a longer-term target of $1.20–$1.40 if the 4-year triangle finally breaks to the upside.

At press time, ADA trades near $0.72, up 0.66% in 24 hours — a small but steady sign that the market may be stabilizing before its next move.