- The US Treasury is moving to seize $15B in Bitcoin tied to the Cambodian Prince Group.

- Huione Group sanctioned for enabling large-scale money laundering.

- If successful, seized BTC could bolster Trump’s Strategic Reserve, but victim restitution may complicate ownership.

The US government is preparing to seize nearly $15 billion in Bitcoin linked to Cambodia’s Prince Group, one of the largest players in global pig-butchering scams. The operation, which allegedly defrauded Americans of over $10 billion, also involves sanctions against the Huione Group, a financial conglomerate accused of enabling massive money laundering.

According to the Treasury’s statement, this multinational investigation marks a major escalation in the US campaign against crypto-linked fraud networks. The seizure, if successful, would rank among the largest crypto confiscations in history, underscoring how digital assets have become a new front in global financial enforcement.

What Happens to the Seized Bitcoin?

If the Treasury secures legal ownership of the assets, the Bitcoin could potentially flow into President Trump’s Strategic Reserve, a growing federal stockpile of seized crypto meant to serve as a “digital reserve asset.” However, there’s a catch — many victims of the scam may still be eligible to reclaim their funds.

Under US law, crypto obtained through criminal means can’t be repurposed by the government unless all restitution claims are resolved. That creates a legal gray area: the Treasury may hold the Bitcoin, but unless ownership officially transfers, it can’t yet deploy or invest it.

Still, even partial control of $15 billion in BTC could significantly boost Washington’s crypto footprint. At current prices, the seized Bitcoin would represent nearly 3% of the US government’s known digital holdings.

The Bigger Picture: Crypto, Crime, and Control

The Prince Group’s criminal network reportedly extended far beyond financial scams — including human trafficking, forced labor, and exploitation, according to the Treasury report. Meanwhile, the Huione Group has been effectively cut off from the US financial system, with both public and private crypto firms freezing related accounts.

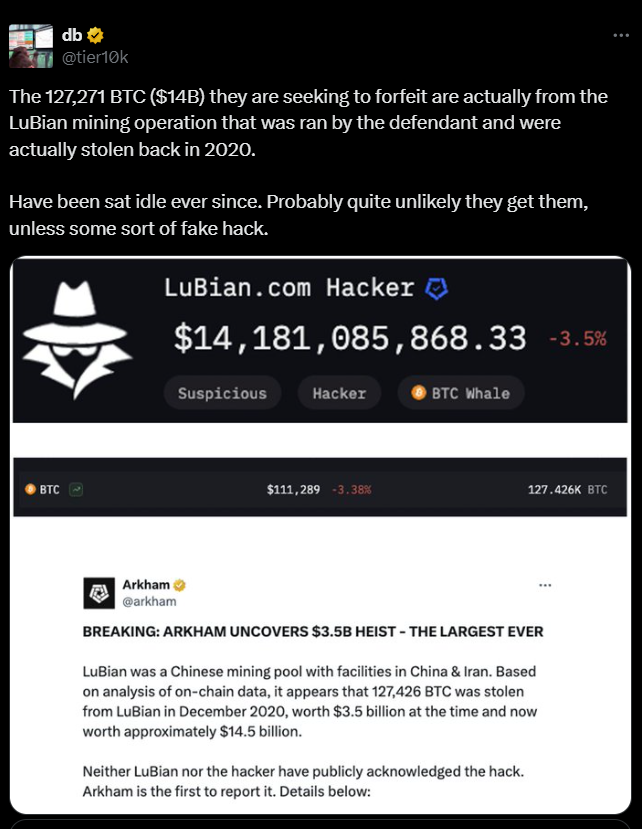

Some blockchain analysts even suggest that parts of the seized funds could be linked to the LuBian mining pool hack, one of the biggest in crypto history. That adds another layer of complexity to tracing ownership and returning assets.

Strategic Implications

If even a fraction of the $15 billion remains in federal hands after restitution, it would give the Trump administration a serious asset base for its Bitcoin Strategic Reserve initiative — a plan aimed at positioning the US as a leading state-level BTC holder.

But if restitution claims move forward quickly, most of those funds may simply flow back to defrauded victims, leaving the government empty-handed. Either way, the outcome could reshape how the US handles seized crypto assets — setting a precedent for future enforcement actions and reserve-building strategies.