- XRP jumped 8.7% amid a wider crypto market recovery.

- Trade tensions between the U.S. and China caused the earlier crash.

- Analysts expect XRP to hit $2.87 by November if sentiment improves.

The cryptocurrency market is showing early signs of recovery after last week’s steep correction, and XRP is back in the green. The token surged 8.7% in the past 24 hours, mirroring gains across major cryptocurrencies. Bitcoin reclaimed the $115,000 level, while the global crypto market cap once again crossed $4 trillion, signaling cautious optimism among traders.

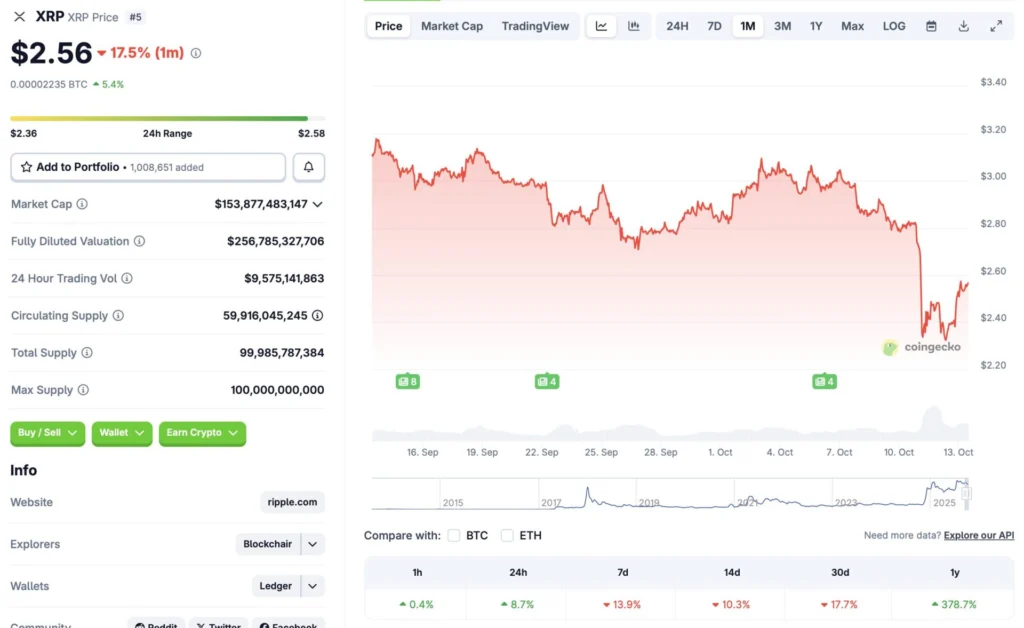

Despite the short-term bounce, XRP remains down 13.9% over the week and 17.7% in the past month, according to CoinGecko data. Still, analysts note that the latest rebound could mark the beginning of a broader recovery phase, with upcoming regulatory decisions and macro shifts likely to play key roles in XRP’s direction through October.

Why the Market Crashed

Earlier this month, the entire crypto market plunged amid escalating U.S.–China trade tensions. President Donald Trump’s announcement of 100% tariffs on Chinese goods, in response to Beijing’s rare earth export restrictions, sent risk assets tumbling. XRP, which had been rallying steadily throughout 2025, suffered heavy losses alongside major altcoins.

Before the correction, XRP had reached an all-time high of $3.65 in July, boosted by the final settlement of the SEC vs. Ripple lawsuit. The resolution renewed investor confidence, bringing institutional inflows and restoring XRP’s standing as one of the top-performing altcoins of the year.

What’s Next for XRP in October

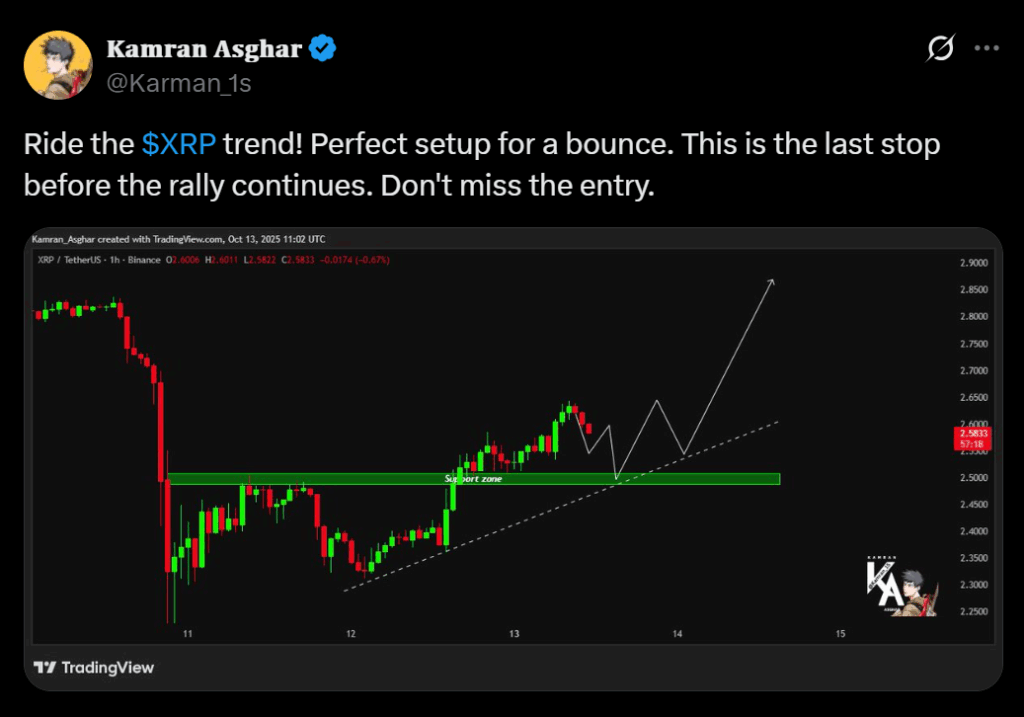

Market sentiment is now cautiously shifting as investors anticipate a potential Federal Reserve rate cut in the coming weeks. A reduction in interest rates could reignite risk appetite, fueling a new wave of capital into crypto markets. Analysts at CoinCodex forecast a modest 12% upside, projecting XRP to trade near $2.87 by November 1 if bullish momentum continues.

However, the real catalyst may come from the SEC’s upcoming decisions on six proposed XRP ETFs, expected between October 18 and 24. A favorable ruling could accelerate institutional adoption and help XRP retest key resistance at $3, setting up a path toward new highs later this quarter.

The Bottom Line

While XRP’s recovery is still in its early stages, the mix of macroeconomic easing and regulatory milestones gives bulls reason to stay hopeful. A confirmed ETF approval or stronger market sentiment could be enough to push the token back toward its $3 psychological level, but until then, volatility will remain high.