- SUI price dropped 22% in 24 hours, trading near $2.72.

- TVL down 19%, signaling reduced confidence across the network.

- Reclaiming $3 could hint at a bullish reversal, but trend indicators remain bearish for now.

Sui (SUI) is in a tough spot right now. Even though trading activity has exploded, the price has tumbled more than 22% in a single day — a sign that the bears are taking over again.

At the time of writing, SUI sits around $2.72, slipping fast after what looked like a promising run earlier this month. And the sharp decline didn’t come quietly. According to CoinMarketCap, trading volume skyrocketed 350% to $434 million in the past 24 hours. That kind of spike usually means one thing — panic in the market.

The setup paints a clear picture: high activity, low confidence. Traders seem to be dumping their bags as fear ripples across the ecosystem.

On-Chain Data Paints a Bearish Picture

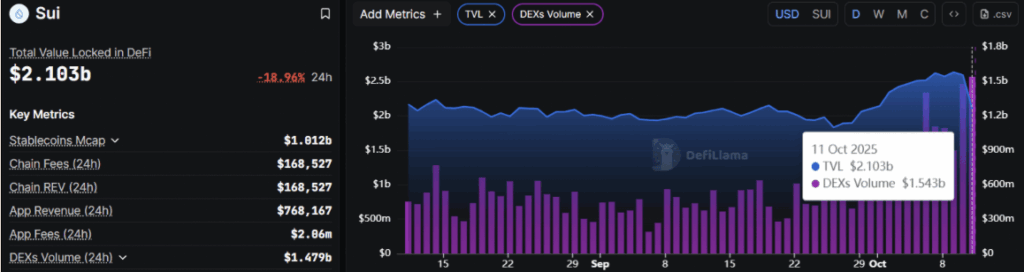

Digging deeper into the chain, things aren’t looking too great either. Data from DeFiLlama shows that SUI’s Total Value Locked (TVL) fell by nearly 19%, now sitting at around $2.1 billion.

That’s not just a dip — it’s a warning. TVL outflows usually mean investors are pulling liquidity out of DeFi pools, which often signals declining trust in the network. And even though trading volume on decentralized exchanges has shot up to a record $1.54 billion, it’s not the kind of volume bulls like to see.

It’s panic-driven. Fear-fueled. The kind of activity that shows more people are trying to get out than get in.

Technical Breakdown: Trend Turns Bearish

From a technical standpoint, SUI just lost a crucial support line. After months of riding an ascending trendline that started back in August 2024, the token finally broke below it — a move that often flips the structure from bullish to bearish.

The daily chart shows SUI stuck in a tight range between $2.52 and $2.81. That’s basically no man’s land. If it can’t recover soon, analysts warn the next stop could be $1.65, marking another 40% slide from current levels.

At the same time, the Average Directional Index (ADX) is sitting around 22, which points to weak trend strength. The Supertrend indicator is still flashing red too, perched above the price — confirming that bearish pressure remains heavy.

What Would It Take for a Reversal?

For SUI to shake off the bleeding and flip back to bullish, it needs to reclaim the $3 zone and break back above that old ascending trendline. That move would signal renewed strength and possibly trigger a rebound toward previous highs.

But until that happens, the market seems more interested in selling than buying. For now, traders are watching to see if this downtrend slows — or if SUI’s latest slip is just the start of a deeper fall.