- Prestige Wealth rebrands to Aurelion Treasury, launching Nasdaq’s first corporate treasury backed by Tether Gold (XAUT).

- The company raised $150 million through PIPE financing and debt to acquire Tether Gold as its main reserve asset.

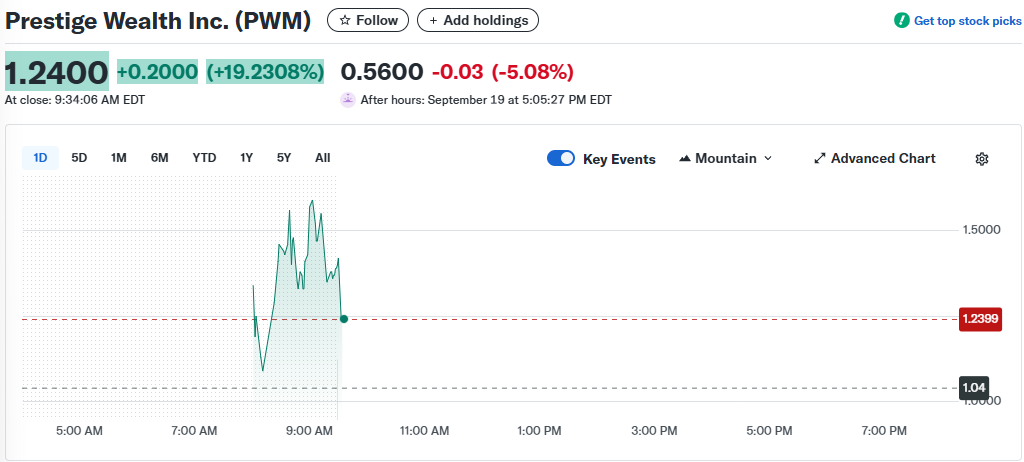

- Aurelion’s stock jumped 19% after the announcement, with plans to trade under the new ticker symbol AURE on Nasdaq.

In a bold new direction, Nasdaq-listed firm Prestige Wealth is rebranding to Aurelion Treasury—and it’s not just a name change. The company is making history as the first Nasdaq-listed corporate treasury backed by Tether Gold (XAUT). The announcement follows a $150 million financing round that combines a $100 million PIPE investment and a $50 million senior debt facility from Antalpha Management. The funds will be used mainly to buy Tether Gold, turning the token into Aurelion’s primary reserve asset.

CEO Björn Schmidtke called the move a long-term play on stability in the digital asset space. “I’m bullish on bitcoin,” he said, “but I think Tether Gold is the real digital gold—something that can hold value and even be used for everyday payments someday.” The plan, according to filings with the SEC, is to position Aurelion as a bridge between traditional finance and tokenized commodities.

A Vision for Tangible Digital Assets

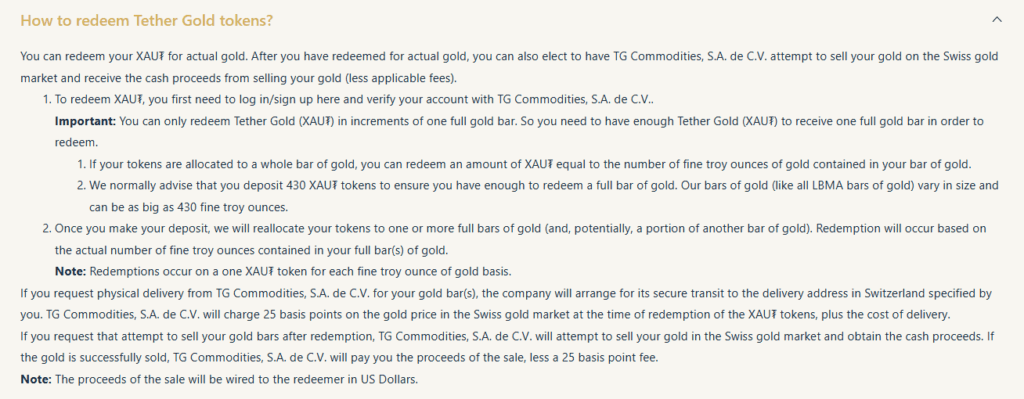

Aurelion’s move could change how Wall Street views digital reserves. By backing its treasury with Tether Gold, the company hopes to make digital assets feel more real—literally. Paul Liang, CFO of Antalpha (Aurelion’s parent company), said that over time, XAUT could become redeemable for physical gold. “Imagine walking into a jewelry store and exchanging your tokens for a gold bar,” he explained, noting that Tether already allows redemptions with a minimum of 430 XAUT for one full bar.

This push to connect physical and digital assets comes as investors increasingly look for inflation-resistant stores of value. While stablecoins like USDT dominate liquidity, tokenized gold offers a unique balance between security and tangibility—two things investors crave in an uncertain economy.

Market Reaction and Stock Boost

The market didn’t take long to react. Prestige Wealth’s stock (ticker: PWM) jumped 19% after the Tether-backed treasury announcement, signaling optimism about the pivot. Still, the company’s shares remain down over 94% since launch, based on Yahoo Finance data. Aurelion expects to officially trade under its new ticker, AURE, starting Monday, pending regulatory approval.

Even with the drop in long-term performance, this new direction could mark a turning point. Investors are watching closely to see if Aurelion’s strategy sparks a trend among other publicly listed firms exploring tokenized gold as a corporate reserve.

A New Era for Corporate Treasuries

Aurelion’s shift isn’t just a PR move—it’s a glimpse into what the next generation of corporate treasuries might look like. Backing reserves with tokenized commodities could redefine balance sheet strategies, offering transparency and liquidity while tying assets to something tangible. It’s part of a broader shift where blockchain and traditional finance continue to blur together.

Whether it becomes a blueprint or just a bold experiment, one thing’s clear—Aurelion has set the bar (quite literally, in gold) for how corporations can adopt tokenized assets in a regulated, public framework.