- BNB trades near $1,190 after a 21% weekly surge, with $1,300 the next target.

- Binance recorded $14.8B in Q3 inflows, 158x more than its nearest rival.

- Technicals suggest a breakout trend that could push BNB toward $1,500.

Binance Coin (BNB) has been climbing fast, showing the kind of momentum traders haven’t seen in months. In just a week, it’s pumped more than 21%, now trading around $1,190, and the bulls don’t look done yet. Renewed optimism around Binance’s ecosystem and solid fundamentals are fueling this surge, with analysts already pointing to $1,300 as the next big hurdle.

Binance Coin Trading Volume Jumps as Futures Open Interest Rises

In the last 24 hours alone, BNB jumped another 8%, setting new highs near $1,190. Trading volume soared 40% to hit $5.85 billion, a clear signal that investors are stepping in. Futures data backs this up—open interest for BNB contracts rose 18% to $2.5 billion, showing traders are betting on more upside. Analyst Ali Martinez flagged $1,300 as the key resistance level ahead, noting that a weekly close above $1,150 would confirm BNB’s breakout structure. So far, each rally has been followed by healthy consolidation, and then more buying. That pattern is keeping confidence high.

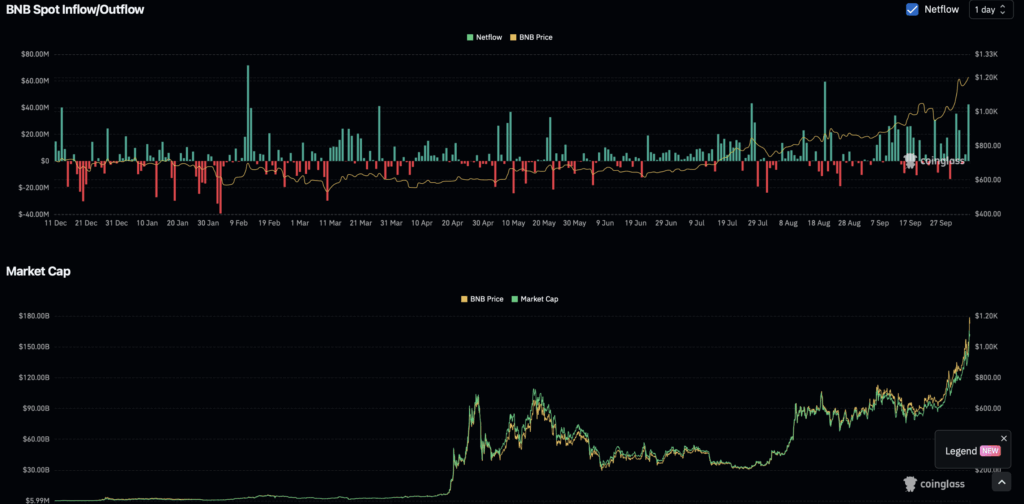

Binance Records $14.8 Billion Inflows, Outpacing Competitors

The rally isn’t just hype—it’s supported by real numbers. Binance recorded net inflows of $14.8 billion in Q3 2025, completely dwarfing the combined $94 million of its top ten competitors, most of which actually reported outflows. Martinez noted Binance’s inflows were 158 times higher than the nearest rival, underlining its market dominance. CEO Changpeng Zhao added his own bullish perspective, comparing today’s market conditions to October 2017—the turning point of the last bull run. If history rhymes, Binance Coin could have a lot more room to run.

BNB Price Prediction: Breakout Structure Points Toward $1,500

Technical analysts see this rally as part of a larger continuation trend. NekoZ highlighted three major breakout phases so far—July, September, and now October—each followed by 30%–50% expansions. If that pattern holds, BNB could break past $1,300 and run toward $1,500, setting a new all-time high. The daily chart supports this idea: breakout, consolidation, breakout again. The rhythm suggests sustained momentum rather than a short-lived spike, supported by strong participation and deep liquidity.

BNB Chain Cuts Gas Fees to $0.005, Strengthening Fundamentals

Beyond the charts, BNB’s fundamentals are also improving. The BNB Smart Chain (BSC) recently cut its minimum gas fee to just 0.05 Gwei, slashing average transaction costs to about $0.005. That makes BSC one of the cheapest blockchains to use. Developers are already calling it a big win for accessibility and efficiency, with all validators and builders adopting the new standard. Centralized exchanges and wallets are expected to follow soon. Analysts say this upgrade not only boosts user adoption but also strengthens BNB’s position as a leader in affordable, scalable blockchain infrastructure.