- Solana dropped to $204.17 on shutdown fears but bounced back above $209.50 as larger players bought the dip.

- Retail longs were liquidated on the flush, but pro traders used negative funding rates to open new longs.

- Market focus now shifts to SEC’s October 10 decision on spot Solana ETFs and broader Fed rate-cut expectations.

Solana (SOL) saw a sharp drop on Tuesday, falling from $208.94 to $204.17 as U.S. stock markets wobbled on news that the government is headed toward a potential shutdown on October 1. Lawmakers once again failed to secure a funding deal, sparking headlines of political deadlock.

Interestingly, equities shook off the early jitters. The DOW, S&P 500, Nasdaq, and Russell 2000 all managed to close in the green, with the DOW clocking yet another record high. Crypto followed suit, mirroring stocks’ late-day reversal, though most altcoins—including SOL—are still shy of Monday’s peaks.

SOL Price Recaptures Weekly Range

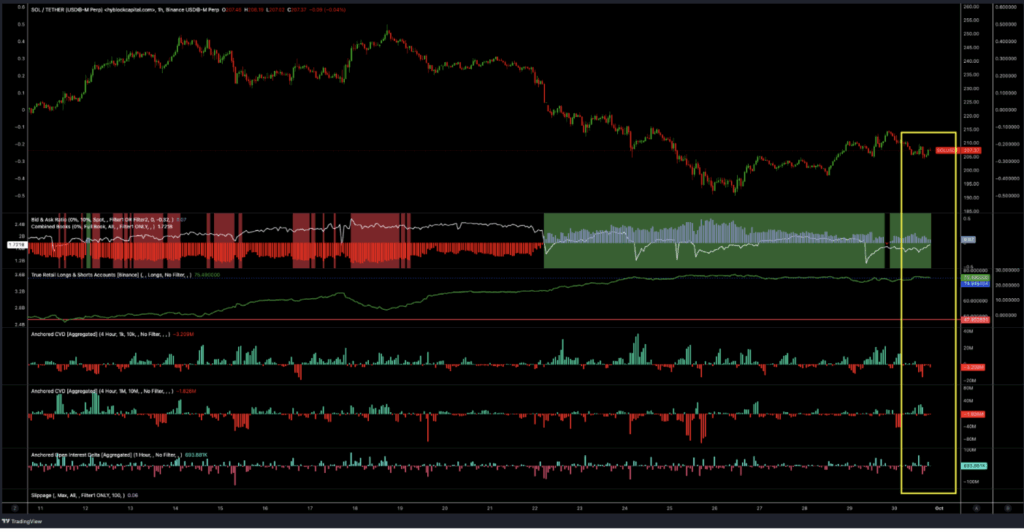

Despite the dip, SOL clawed back losses and is trading above $209.50, down just 1.38% on the day. Data from Hyblock shows that retail traders took the hardest hit, with late leveraged longs flushed out around $205. At the same time, the bigger players—wallets in the $1M–$10M cohort—stepped in to buy the dip, signaling institutional support at lower levels.

Charts confirm this pattern: the liquidation cascade cleared out smaller longs, while pro day traders and retail opportunists used the negative funding rates that followed to reload fresh spot and leveraged long positions.

Broader Market Context

Bitcoin, as usual, led the turnaround. After sinking to an intraday low of $112,656, BTC quickly rebounded to $114,400. The bounce appears to have steadied nerves across the board, halting declines in both large- and small-cap cryptos. For SOL traders, this relief rally helped restore price to its median weekly range, providing a short-term floor after the volatility.

Beyond the noise of U.S. politics, crypto markets remain focused on more bullish catalysts. Bitcoin traders are eyeing the expected trio of Federal Reserve rate cuts and the possibility of a Trump-aligned Fed chair, both of which could inject fresh liquidity into risk assets.

SOL Eyes ETF Deadline

For Solana specifically, attention is on the October 10 SEC deadline, when regulators are set to rule on several spot SOL ETF applications. Many in the market believe Bitcoin’s strength will naturally spill over into altcoins, and ETFs could become a major spark for SOL’s next leg higher. Until then, traders remain split between caution over macro headlines and optimism tied to upcoming crypto-specific catalysts.