- Bitmine Immersion added 234,850 ETH worth $963M, expanding its total Ethereum treasury to 2.65M ETH ($10.9B).

- BMNR stock surged over 3% pre-market, now up nearly 596% year-to-date, with daily volumes averaging $2.6B.

- Ethereum rebounded above $4,100, backed by an 80% volume spike and rising futures open interest on CME and Binance.

Bitmine Immersion, the firm known for holding the largest Ethereum stash worldwide, just added another massive chunk to its treasury. Backed by Tom Lee of Fundstrat, the company scooped up 234,850 ETH worth $963 million between September 22 and 28. That move pushed its total Ethereum holdings to nearly 2.65 million ETH, valued at over $10.9 billion at current prices.

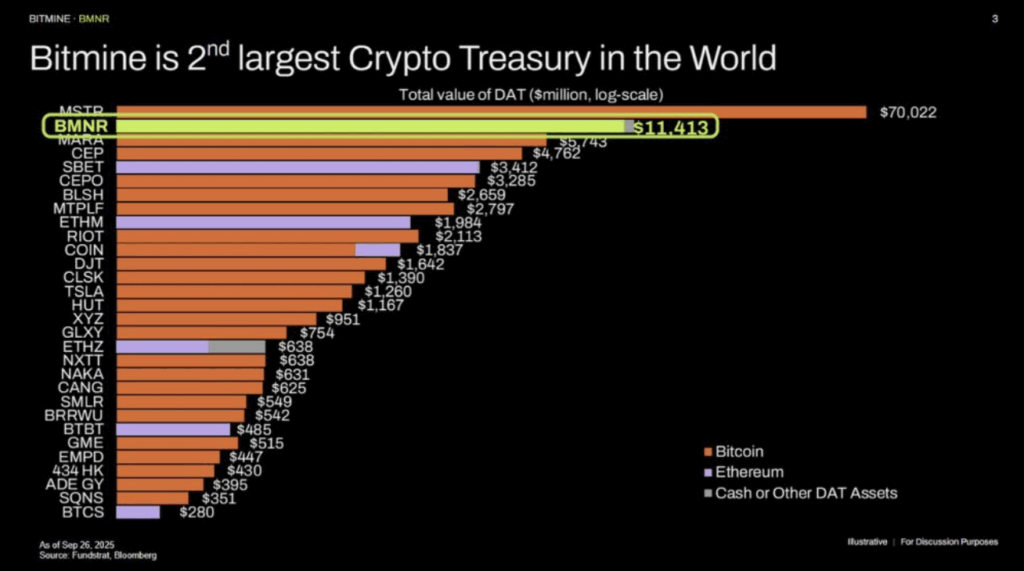

The company’s disclosure on September 29 also showed $436 million in cash and 192 BTC on its balance sheet. This latest buy cements Bitmine Immersion’s spot as the number one Ethereum treasury and second-largest overall crypto treasury, right behind Strategy Inc. (MSTR). On top of that, Bitmine boosted its investment in Eightco Holdings to $157 million, further diversifying its exposure.

Stock Price Surge After Ethereum Buy

News of the purchase immediately sparked movement in Bitmine Immersion’s stock (BMNR). Pre-market trading on Monday saw the price jump more than 3% to $52.07. This followed Friday’s close at $50.50, which already marked a 1.88% daily gain. Remarkably, BMNR stock is up nearly 596% year-to-date, making it one of the hottest tickers on Wall Street.

Traders also reacted to the firm’s decision to sell 5.22 million shares at $70 per share and 10.4 million warrants with a strike price of $87.50—well above the current market price. According to Fundstrat, BMNR has now become one of the most traded stocks in the US, clocking in an average daily volume of $2.6 billion. Tom Lee, who chairs the company, framed the latest moves as part of their aggressive long-term strategy.

Ethereum Price Rebounds Above $4,100

Meanwhile, Ethereum itself gave bulls something to cheer about. ETH price rebounded strongly from its $3,800 dip, bouncing back above $4,100. Over the past 24 hours, ETH gained roughly 3%, moving between an intraday low of $3,979 and a high of $4,145.

The rally was fueled by an 80% surge in trading volume, signaling renewed investor appetite. Analysts pointed to Tom Lee’s earlier “bottom signals” as helping restore confidence. On the derivatives side, ETH futures open interest jumped by over 1% to $55.43 billion. Data from CoinGlass showed that futures OI climbed 3% in a day, with CME and Binance leading gains at 3% and 4% respectively—suggesting institutional traders are stepping back in.

Key Takeaway

Bitmine Immersion continues to flex as Ethereum’s top treasury holder, and its aggressive accumulation lines up with bullish sentiment in ETH’s recovery above $4,100. With BMNR stock skyrocketing and ETH futures heating up, momentum seems to be building, but whether this translates into sustained price growth will depend on broader market conditions.