- XRP sits in oversold territory with ETF approvals potentially driving a rally toward $5 by year-end.

- Solana gains strength from institutional accumulation and could climb from $220 to $500 in the coming months.

- Cardano shows whale accumulation signals and steady growth, with forecasts pointing to $2.50 before year-end.

The crypto market clawed its way back to a $4 trillion cap, powered in part by Metaplanet’s hefty purchase of 5,419 BTC yesterday. That move seems to have lifted sentiment across the board, with traders turning bullish again on major altcoins. XRP, Solana, and Cardano are all flashing signs of recovery after weeks of sluggish price action, and analysts think ETF approvals could add fuel to the fire in the weeks ahead.

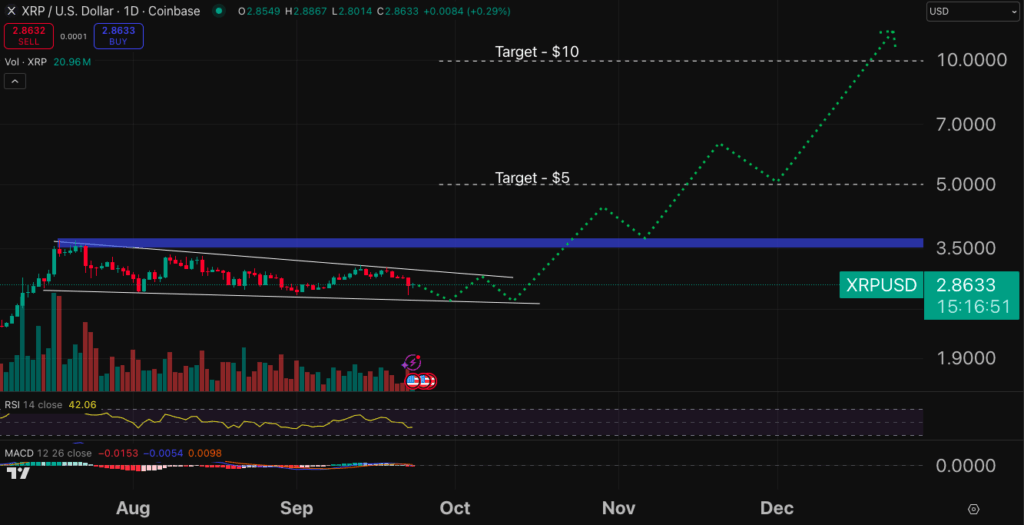

XRP Price Prediction – Oversold and Eyeing ETF Boost

XRP is holding at $2.87 after a mild 2% bounce, though it’s still down over the past month. Technicals paint the token as oversold—its RSI dipped under 50 and MACD momentum has been weak—both signs that a rebound could be close. Fundamentals may do the heavy lifting too, since the SEC is considering up to ten XRP ETF applications. If even a few get the green light, institutional inflows could help push XRP toward $5 by year-end, especially with Ripple expanding its cross-border payments reach.

Solana Price Prediction – Institutions Accumulating

Solana trades near $220, down slightly on the day, but still up 50% year-over-year. While its recent moves haven’t been explosive, the tide may be shifting. Public companies are starting to scoop up SOL as a reserve asset, with Forward Industries buying $1.65 billion worth. On top of that, pending ETF approvals could supercharge Solana’s market position. Analysts are calling for $250 in October, $350 in November, and possibly $500 by year-end if momentum builds.

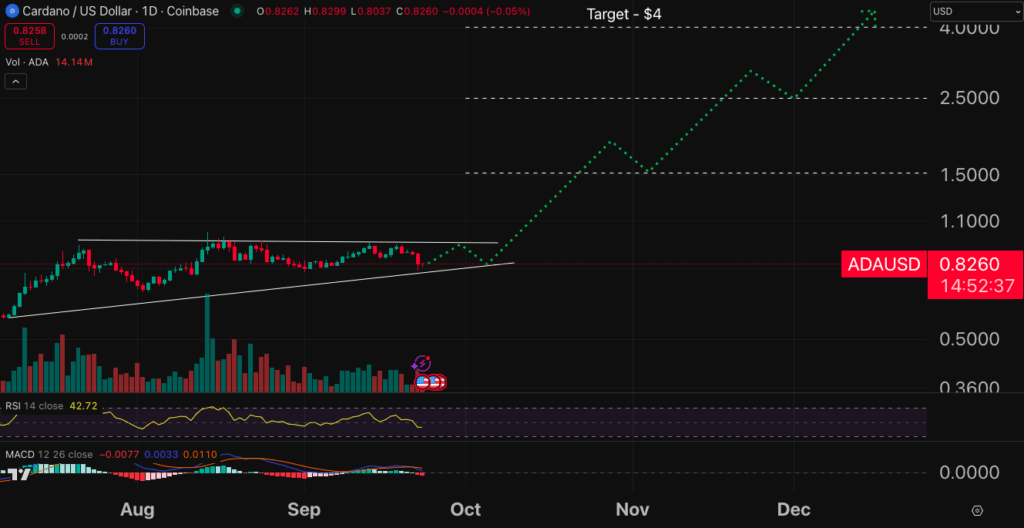

Cardano Price Prediction – Whale Activity Signals a Shift

Cardano sits at $0.82, weighed down by short-term losses but still up 130% year-over-year. The token is trading far below its all-time high of $3.09, leaving plenty of room for a big catch-up rally. Technicals show ADA’s RSI struggling to break higher, suggesting a buildup before a move. Recent whale transfers are also raising eyebrows, hinting at accumulation. With one ETF application in the pipeline and steady growth in DeFi adoption, ADA could hit $1 in October and push closer to $2.50 before the year is out.