- Toronto-based mining company clears debt with the bankrupt crypto lending company, BlockFi.

- How Bitfarms was able to secure a great deal for itself.

- BlockFi is still in the throes of bankruptcy.

A Toronto-based Bitcoin company has found a shortcut to reducing its debt which has piled up since June 2022, by nearly 85%.

The bitcoin miner, Bitfarms, was able to settle the debt obligations that tied it with BlockFi and closed its short attachment with the bankrupt crypto lending platform.

The mining company disclosed that they had settled their $21 million debt obligations with BlockFi in return for a $7.75 million cash payment. And both companies reached the settlement weeks after Bitfarms reported that they could default on their BlockFi loan.

Alongside the earlier reorganization and elimination of capital expenditure obligations of the mining company in December, the successful negotiations between BlockFi and Bitfarms helped with Bitfarms’ intent to reduce indebtedness.

The relationship between BlockFi and Bitfarms centers around Backbone Mining Company, the company’s wholly-owned subsidiary in Washington State.

A year back, around February 2022, Backbone mining received a $32 million equipment financing loan through BlockFi. By the beginning of the year, the debt left to be paid, including principal and interest on the loan totaling $21 million.

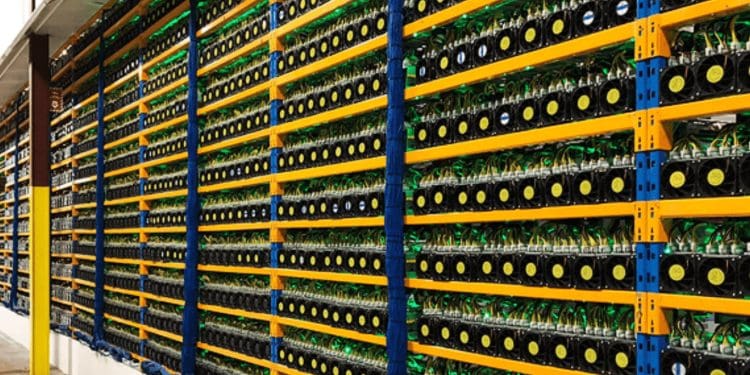

Now that Bitfarms has been able to settle with BlockFi, all of Backbone’s assets, with the inclusion of 6,100 miners, are now unencumbered.

However, back in January, Bitfarms had been seeking to modify its loan agreement with BlockFi, in a bid to obtain more favorable conditions in the contract and also to reduce Backbone’s mining obligations.

The loan had first been secured with Backbone’s assets as collateral, including the mining company’s mining equipment. A percentage of the Bitcoins produced by their rigs. Unfortunately for Backbone, the support securing their loans experienced a drastic drop during the harsh bear market.

BlockFi has unfortunately not been able to get out of its debts as it collapsed shortly after the collapse of FTX, and the company filed for chapter 11 bankruptcy. Even after being exposed to FTX from the company receiving a $240 million rescue package from FTX back in the middle of 2022 before things went awry for the former crypto giant.

Conclusion

BlockFi was on the list of one of the most exposed to FTX collapse, which was responsible for shaking the entire crypto space towards the end of last year. As the crypto giant was viewed as a savior by many and either had assets in the company or had partnerships with the collapsed crypto giant, all of which crumbled immediately, FTX filed for chapter 11 bankruptcy.

All this happened even after the former CEO, Sam Bankman-Fried, had reassured users and investors alike that the company was still safe. It collapsed just a few days after Binance was reported to buy the exchange but eventually dropped it due to its state.