- Monero’s community raised nearly $1M in 2025 through its CCS, funding core upgrades, wallets, and research.

- The network continues to face selfish mining attacks from Qubic Pool, causing deep chain reorganizations and orphaned blocks.

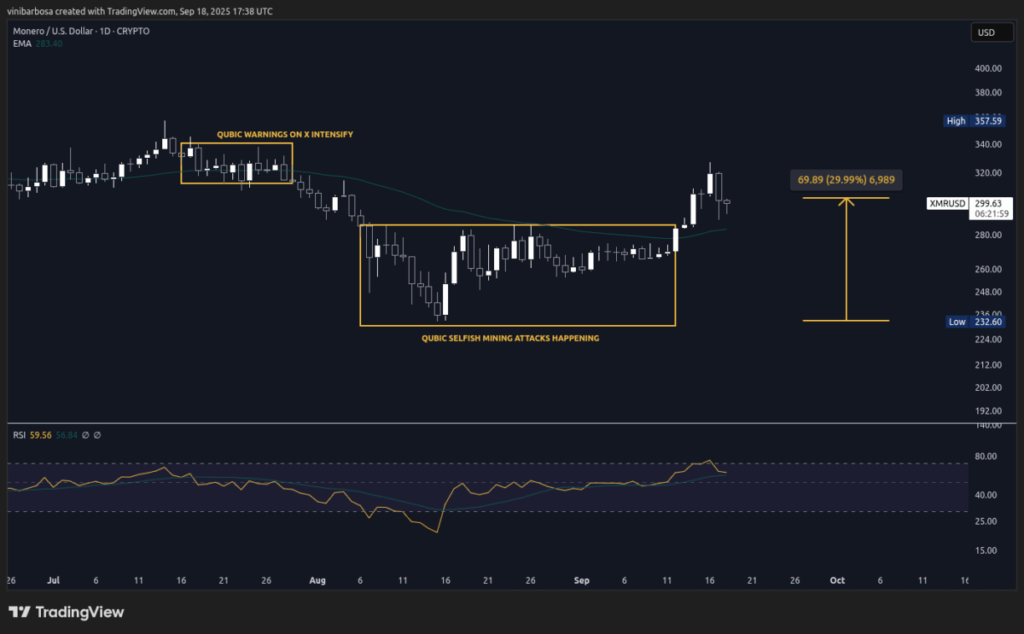

- XMR price rebounded 30% from August lows, climbing to around $299 and holding above the 50-day EMA.

Monero’s community has been busy in 2025, raising close to $1 million through donations for protocol development and other projects, even as the network faces heavy turbulence. Selfish mining attacks from Qubic Pool keep hammering the blockchain with chain reorganizations and orphaned blocks, yet the community continues to double down on funding open-source progress. It’s a messy backdrop, but the donations show there’s still a strong will to keep Monero moving forward.

Funding the Core and Beyond

The bulk of this year’s contributions—2,294 XMR—went directly into Monero’s core development. That covered the FCMP++ implementation, consensus tweaks, optimization, and even a dedicated testnet. Developers also launched “Carrot,” a new addressing scheme, and expanded hardware wallet support. Beyond the protocol layer, funds trickled into Cuprate, a Rust-based node alternative, wallet projects like Feather and Monfluo, plus research into privacy improvements and defenses against spy nodes and 51% attacks. Even smaller things—like PR reviews, audits, and BTCPay Server plugins—got attention thanks to these donations.

Community-Driven System

All of this money was raised through the Community Crowdfunding System (CCS) on getmonero.org. Since 2020, the CCS has pulled in almost 36,000 XMR—worth around $10 million today. The data was compiled by a contributor called “Untraceable,” who amusingly admitted to using ChatGPT-5 to scrape donation figures and generate charts. What’s striking is how quickly the momentum is building: over 630 XMR, worth nearly $190k, was donated in just one week this September. That’s roughly 20% of all funds raised this year.

Price Resilience Amid Attacks

Monero’s price has shown surprising strength despite the Qubic Pool’s selfish mining exploits. After dropping hard in mid-August, XMR has climbed back nearly 30% to around $299, now sitting above its 50-day EMA—a bullish indicator. RSI readings also suggest strong momentum. Still, the network isn’t out of the woods. Attacks remain ongoing, with a recent 18-block reorg adding fresh doubts about long-term stability. The balance right now feels fragile: strong community funding on one side, serious security concerns on the other.