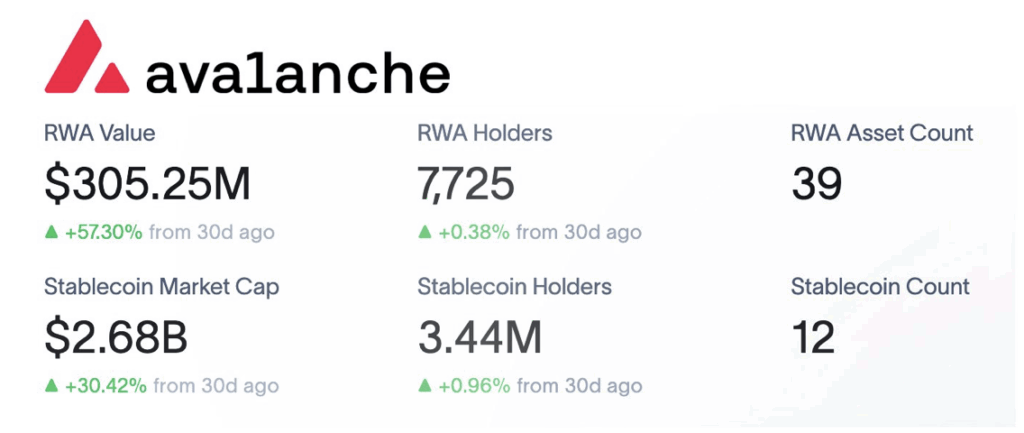

- Avalanche’s RWA market cap surged nearly 58% in days, while stablecoin transfers jumped 6x in 3 months, fueling institutional attention.

- AVAX price is consolidating between $22–$26, holding bullish structure above the SuperTrend but facing weak momentum signals.

- Futures volume crossed $1B, with funding rates steady — hinting at whale activity and a potential push back above $25.

Avalanche (AVAX) might finally be catching that big break it’s been waiting on. The Layer 1 has been pulling more eyes lately, not just because of its price moves but also thanks to a sharp pickup in on-chain activity. Two things stand out as the fuel here: stablecoins and real-world assets (RWAs).

RWA and Stablecoins Take Center Stage

Fresh data on X showed that Avalanche’s RWA market cap ballooned nearly 58% in just a few days, now sitting around $305.25 million spread across 39 instruments. Holders also crept higher, climbing to about 7,725. That’s not mind-blowing growth, but it’s steady enough to show traction.

Stablecoins told an even louder story. Transfer volume shot up 6x over the past three months, while their combined market cap rose 30% in just a month. Holder count hit 3.44 million — a serious base of activity. Big institutions like Franklin Templeton, Grove Finance, and Centrifuge are already circling the ecosystem, hinting that DeFi and TradFi might be stitching closer together on Avalanche than most expected.

Price Action Stalls, But Structure Holds

AVAX itself has been trying to keep pace. Over the last 30 days, it’s up just under 10%. That said, momentum feels like it’s cooling a bit. After rallying to $27 on July 28, the token has been stuck in a sideways shuffle between $22 and $26.

Still, it’s not all gloomy. AVAX trades above the SuperTrend indicator, which usually signals a bullish structure is intact. But here’s the catch — momentum readings dipped into the negative, sitting at –0.66. If buyers can defend the SuperTrend and push through resistance, AVAX could bounce above $25, a modest 5% gain. On the flip side, failure at this level risks a slide under $23, maybe even testing $21 again.

Futures Market Flashes Growing Interest

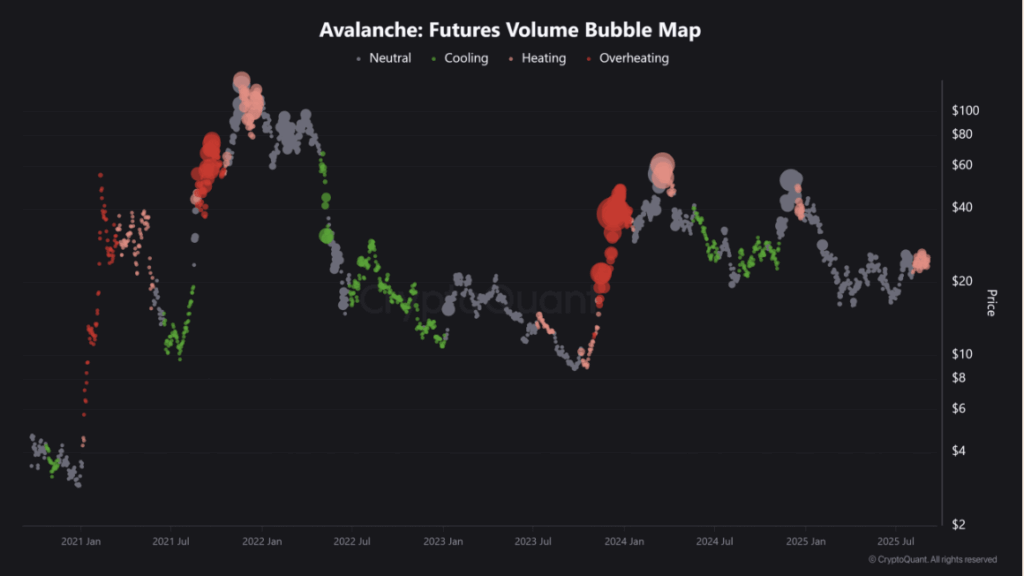

Where things get more interesting is the Futures data. Volume has surged to around $1.018 billion, and Bubble Map visuals show that big positions are forming. This often hints at whales stirring or institutional money quietly stepping in.

Funding rates and open interest also line up with the story. CoinGlass showed the OI-weighted funding rate ticking slightly higher at 0.0058%, though still down from recent peaks of 0.01%. That drop suggests traders are cautious, but the gradual return of activity since the RWA and stablecoin growth reports points toward building momentum under the surface.