- Whales and Abraxas Capital opened massive shorts, putting fresh pressure on HYPE.

- Price stuck in a $36–$50 range, with $36 as key support and $50 still unbroken resistance.

- Despite weakness, record DEX volumes and strong open interest suggest hidden long-term strength.

Hyperliquid’s HYPE token managed a small bounce, climbing from its $43 open to nearly $45 during the day, keeping its $15 billion market cap intact. But despite the flicker of green, the broader trend has been sliding ever since the token topped out near $51. Whales and funds circling the ecosystem haven’t helped either, as heavy shorting pressure has added more weight to the price action.

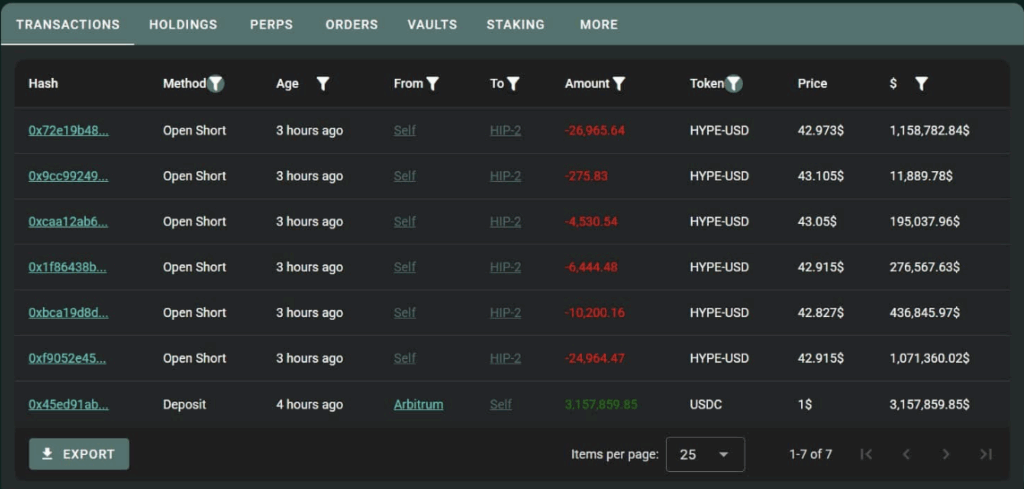

Whales and Institutions Pile On Shorts

Onchain data revealed that big players were lining up against HYPE. One whale opened a short position worth around $3 million in the $42.82–$43 range, currently sitting on a modest unrealized loss of just over $28,000. At the same time, Abraxas Capital leaned even harder, placing a $64.39 million short at 5x leverage.

They didn’t stop with HYPE. The fund also went short on Bitcoin, Ethereum, Solana, and Sui Network with even higher leverage — 10x — plus smaller bets against Injective and World Liberty Finance. This wave of shorts signals broader bearish sentiment across majors, though traders are quick to note that heavy positioning often creates room for sharp reversals.

Price Stuck Between Range and Resistance

Technically, HYPE remains caught in a tricky spot. It has slipped under a rising trendline yet still hovers above the SuperTrend indicator, leaving signals mixed. Since mid-July, the token has repeatedly tested but failed to break the $50 zone, with three hard rejections keeping price capped.

For now, HYPE oscillates between $36 and $50, carving out higher lows but unable to push past the ceiling. Analysts are watching $36 as the critical “make-or-break” level. A retest there could reset momentum for a stronger breakout attempt — but a clean breakdown would shatter the current bullish structure and tilt the charts bearish.

Under the Hood: Hidden Strength Persists

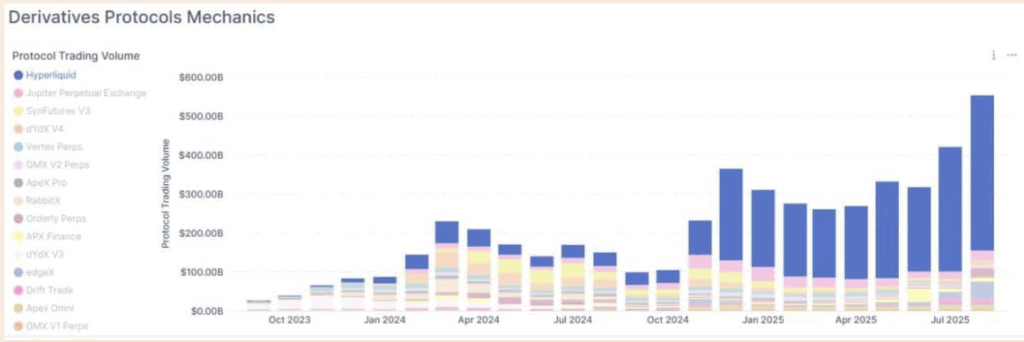

Despite the wobbly chart, on-chain data shows hints of resilience. Open interest sits at $1.84 billion, still elevated compared to recent days, though off its $2.06B high. DEX volume has been booming as well, with Hyperliquid processing a record $398 billion in the last month and $1.2 billion in just the past 24 hours.

This combination of strong trading activity and heavy shorting leaves HYPE in an odd middle ground: pressured in the short term, but carrying long-term bullish fuel if momentum shifts. For traders, the next moves by whales and institutions — plus whether price defends $36 or cracks $50 — will likely decide HYPE’s direction into the next leg.