- Strategy adds 3,081 BTC for $356.9M during the latest dip.

- Total stash now sits at 632,457 BTC, worth over $46B.

- Buying pace has slowed, but yield targets and long-term accumulation remain aggressive.

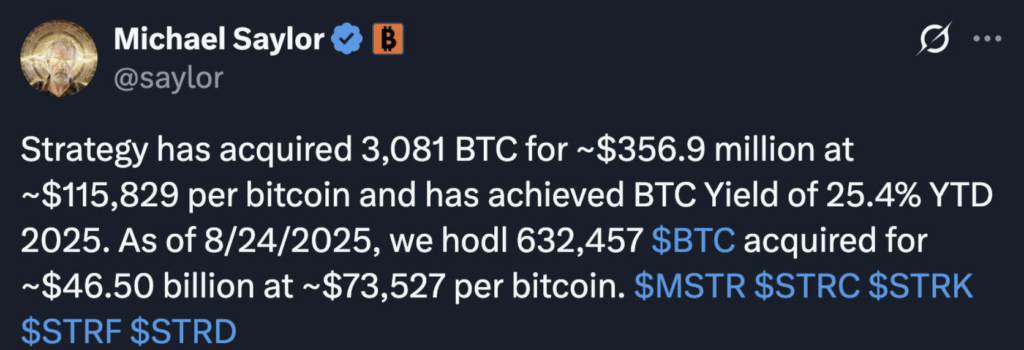

Michael Saylor isn’t done yet. His company, Strategy, already the biggest corporate Bitcoin whale on the planet, just dropped another $356.9 million into BTC. According to an SEC filing, they scooped up 3,081 coins during last week’s dip, when Bitcoin briefly slid to $112,000. For August, that brings their total to 3,666 BTC. By Strategy’s standards though, that’s almost modest—July saw them pile in with over 31,000 coins, and June wasn’t far behind with 17,000+. Compared to those frenzies, August feels more like a light snack.

The Running Tally

With this latest grab, Strategy now holds a jaw-dropping 632,457 BTC. Altogether, they’ve spent about $46.5 billion at an average price of $73,527 per coin. That’s the kind of stack you’d expect from a nation-state, not a corporation. True to form, Saylor keeps hammering the same playbook: buy, buy, and buy some more. He’s even said before, half joking, half serious, “I’m going to be buying the top forever. Bitcoin is the exit strategy.” Funny enough, this time the move actually came closer to a dip-buy than he usually admits—timed right as the broader crypto market was in the red.

Bitcoin Yield Rising

Beyond the headline numbers, Strategy also obsesses over something it calls “BTC yield.” It’s basically the change in Bitcoin per diluted share, and it’s become one of their core KPIs. After smashing its 25% year-to-date target in July, yield is still climbing, sitting now at 25.4%. Late last month, the company even revised 2025 goals higher: bumping yield targets up to 30% and Bitcoin gains from $15 billion to $20 billion. For perspective, their 2024 yield hit a staggering 74.3%, with gains of more than 140,000 BTC. This year’s tally already sits at 113,524 BTC—and we’re not even done with Q3.

A Bitcoin Central Bank in Disguise?

The story here isn’t just about accumulation—it’s about positioning. At this point, Strategy isn’t behaving like a corporate treasury anymore. With every filing, it looks more like a shadow central bank, quietly cornering a slice of Bitcoin’s finite supply. Wall Street, regulators, even governments can’t really ignore a stash this big. Whether this slower pace is just a pause before the next feeding frenzy remains to be seen, but with BTC hovering around $112K, another aggressive buy could easily send shockwaves through both the market and the headlines.