- SOL breaks $200 with a 15% daily surge, fueled by developer growth, whale accumulation, and NFT/meme coin demand.

- Key resistance sits at $219–$222; breaking it could send SOL toward $250, with $268 possible in a strong rally.

- Failure to hold $200 could mean a pullback to $180–$185 before another breakout attempt.

Solana just ripped through the $200 barrier with a 15% daily jump, reigniting bullish sentiment across the market. The breakout comes on the back of surging network activity, rising institutional attention, and steady developer expansion. Traders are now looking ahead, wondering if SOL can power toward $220 this month — and maybe even $250 before August closes.

What’s Driving the Surge

SOL’s momentum is riding on three big factors. First, developer activity and continuous protocol upgrades are keeping the chain at the forefront of high-performance blockchains. Second, on-chain accumulation by long-term holders is signaling deep confidence in sustained growth. And third, the NFT and meme coin sectors on Solana are booming, driving transaction volumes and network demand. Together, these trends have created a perfect storm for bullish action, with $240–$250 already on some traders’ radar.

Technicals Point to Higher Levels

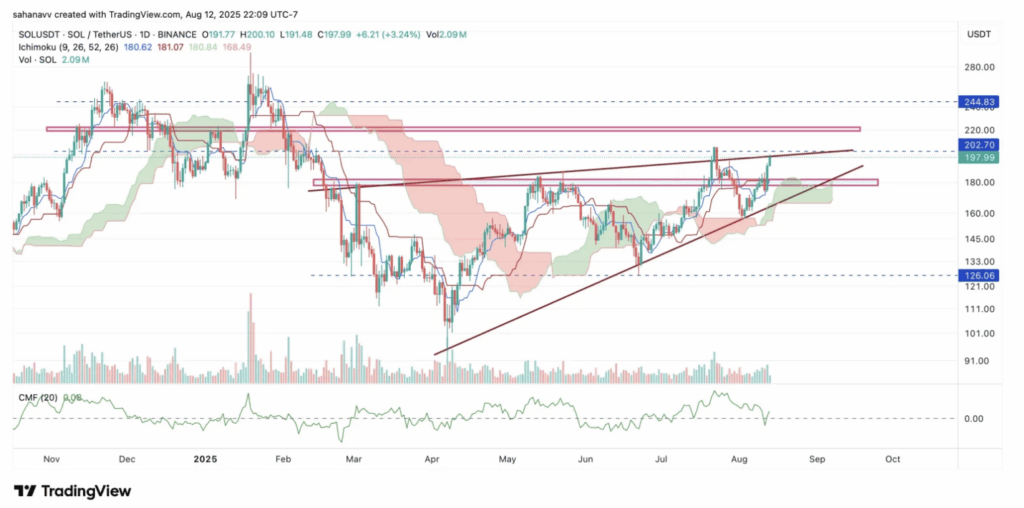

From a chart perspective, SOL has been moving within a rising wedge — normally a bearish pattern — but a clean breakout could flip the script. Price action is sitting above the Ichimoku cloud, with a bullish crossover looming. The Chaikin Money Flow recently snapped back into positive territory, showing fresh inflows into the market. If buyers can hold the $200 level and break past the $219–$222 supply zone, a rally toward $244–$250 becomes more realistic. In a more extended run, $268 isn’t out of the question.

The Risk of a Pullback

Of course, if SOL fails to hold $200, we could see a dip to the $180–$185 demand zone before another attempt higher. Still, the combination of strong fundamentals, active network growth, and bullish technicals suggests that Solana’s uptrend could stay intact well into August 2025.