- BNB climbed over 1.5% in 24 hours, reclaiming $810 and closing in on $815 resistance.

- CEA Industries became the largest corporate BNB holder with a $160M purchase, signaling growing institutional adoption.

- Price action and repeated defense of the $800 zone suggest steady accumulation by larger players.

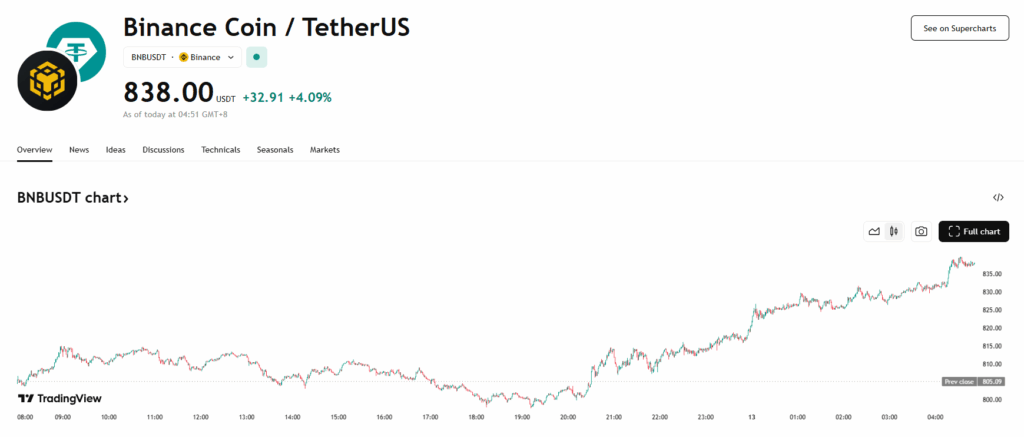

BNB saw a solid move higher over the past 24 hours, climbing more than 1.5% and breaking through the $810 barrier. The rally came after buyers defended the $800 zone multiple times, absorbing sell pressure and turning it into fuel for a push toward the $815 resistance.

The action wasn’t just retail enthusiasm. Ongoing corporate adoption played a big role, with CEA Industries making waves after becoming the largest corporate holder of BNB through a $160 million purchase. Several other firms, like Nano Labs and Windtree Therapeutics, have also been quietly stacking, building out their own BNB treasuries — a sign of deeper, institutional-level accumulation.

Price Action Shows Classic Accumulation Signs

BNB’s trading behavior over the past day fits the blueprint of disciplined, professional buying. The token moved within a $22.41 range, from $792.47 to $814.88, with buyers stepping in each time price dipped toward $800–$803. Those defense points weren’t random — they came with consistent volume, showing a clear willingness to protect that zone.

Resistance first showed up around $811.71, then again between $814 and $815, where algorithmic selling kicked in. Even so, BNB kept building a series of higher lows — $800.44, $801.20, $802.47, and $804.08 — gradually chewing through sell orders. Once the $803.50, $807.20, and $809.50 barriers were gone, momentum shifted decisively upward.

The Next Test for Bulls

A big burst of volume at $800.44 set off the breakout sequence, pushing price above $804 and eventually toward $810.57 before easing just shy of $815. That level now stands as the next hurdle for bulls. If broken cleanly, it could open the door for a stronger run and potentially new local highs.