- The Fed kept rates steady at 4.25%–4.5% for the fifth time, citing economic uncertainty and rising inflation due to Trump’s tariffs.

- Trump-appointed governors Waller and Bowman dissented, marking the first double dissent in over 30 years and highlighting internal Fed division.

- Markets now look to September, with nearly 60% odds of a rate cut, contingent on inflation trends, economic data, and tariff developments.

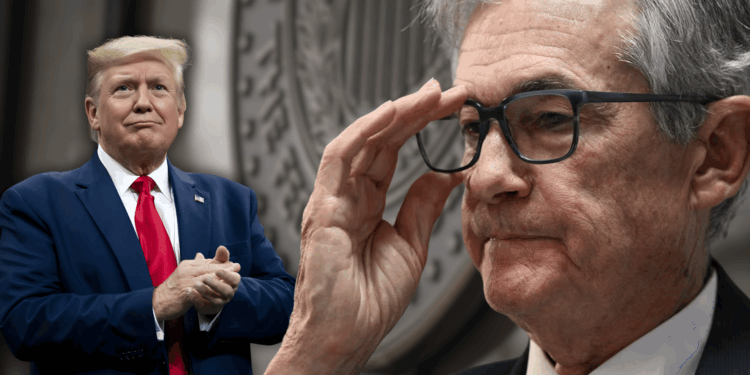

The Federal Reserve has once again chosen to leave interest rates unchanged, maintaining its benchmark rate at 4.25% to 4.5% for the fifth consecutive meeting. Despite mounting political pressure from President Donald Trump and dissent from two of his appointed governors, the Fed offered no clear signal of a rate cut in September. The central bank’s latest statement points to “elevated uncertainty” and acknowledges that economic activity has “moderated,” a downgrade from its previously more upbeat assessments.

Notably, Christopher Waller and Michelle Bowman dissented, preferring a rate cut, marking the first double dissent from Fed governors since 1993. Their argument hinges on the belief that tariff-induced inflation will be a temporary bump, while economic data increasingly signals a slowdown. Trump, meanwhile, has launched repeated personal attacks on Fed Chair Jerome Powell, pushing aggressively for immediate cuts. Although he recently backed off firing Powell, his administration continues to apply pressure, especially as his tariff policies begin to elevate inflation metrics.

Economic Data Adds Complexity to Fed’s Balancing Act

The Fed’s decision reflects a delicate balancing act. On one hand, June inflation rose to 2.7%, its highest annual rate since February, in part due to Trump’s new tariffs. On the other, the labor market is cooling, and Q2 GDP growth came in at a solid 3%, helped by a sharp drop in imports. With many forecasters expecting inflation to moderate and economic growth to slow in the second half of the year, the case for a September rate cut remains alive, though far from certain.

The central bank acknowledged a deterioration in economic conditions, dropping its previous language that “uncertainty had diminished.” The Fed’s own June projections suggested two rate cuts were likely in 2025, aligning with market expectations that peg the odds of a September rate cut at nearly 60%. Still, Powell and the majority of FOMC members opted to wait for more clarity, especially on how tariffs will continue to affect inflation and demand.

Political Backlash Intensifies as Fed Holds Line

President Trump continued his verbal assault on Powell, again referring to him as “Too Late” and accusing the Fed of mishandling interest rates. Trump argues the U.S. should pursue the lowest global interest rate to boost exports and consumer borrowing. Treasury Secretary Scott Bessent joined the fray, dismissing June’s inflation spike as a possible “rounding error” and accusing critics of suffering from “tariff derangement syndrome.”

While Trump insists August 1 will bring a new wave of tariffs on countries not complying with U.S. trade demands, analysts warn that further cost pressures could complicate the Fed’s path to easing. Still, Bessent maintains that deals can be struck even after the deadline, suggesting flexibility despite Trump’s public hard line.

September in Focus: Will the Fed Cut Rates Then?

All eyes now turn to September 16–17, the next FOMC meeting. Powell is expected to address media today at 2:30 p.m. ET, where he will likely be pressed about the dissent within the committee, the impact of Trump’s tariffs, and prospects for future rate cuts. Many economists still expect two 25-basis-point cuts by the end of 2025, particularly if inflation eases and the labor market shows further signs of strain.

For now, the Fed is choosing caution, resisting political interference while acknowledging the potential need for policy flexibility. The central bank remains committed to data-dependent decision-making amid complex and politically charged economic conditions.