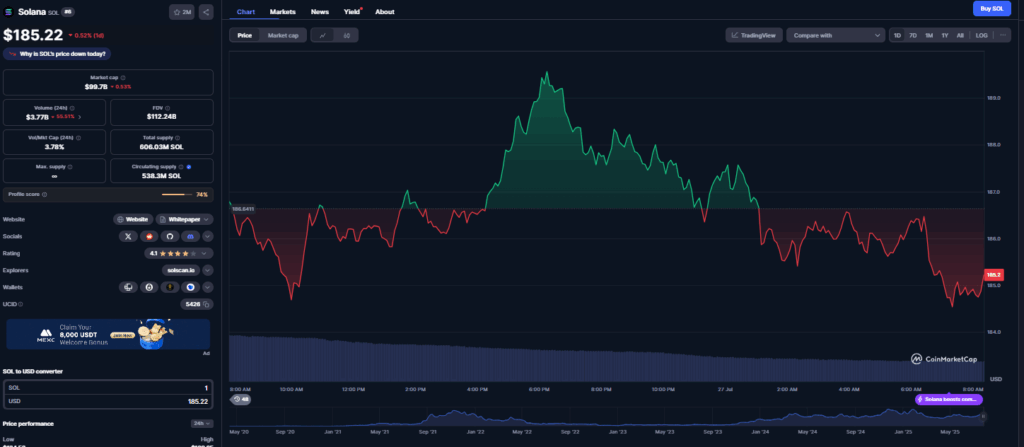

- Solana dropped 3.2% to around $180, holding key support near $177.

- Analysts predict a push toward $205, with higher targets if bullish momentum holds.

- The July 29 FOMC meeting could influence SOL’s next major move, especially if rate cuts are hinted.

Solana (SOL) recently cooled off after its rally, slipping about 3.2% over the past week. The sixth-largest crypto is now hovering around $180, a level where it’s finding some decent support. There’s talk that SOL could hang around the $177 zone for a bit, maybe even pick up momentum if buyers step in. It’s been a choppy market though, so the next move might depend on how much patience traders have.

Analysts Predict a Push Toward $205

Several analysts are leaning bullish despite the dip, saying this might just be a pause before another climb. The idea? SOL could scoop up liquidity here and then aim back at $200, or even push higher. Still, some think investors may keep selling with all the uncertainty floating around. The SEC hasn’t helped much either—five Solana ETF applications, including ones from Fidelity and Grayscale, have been delayed until Fall 2025. Even so, Polymarket odds are betting 80% that approval will come eventually.

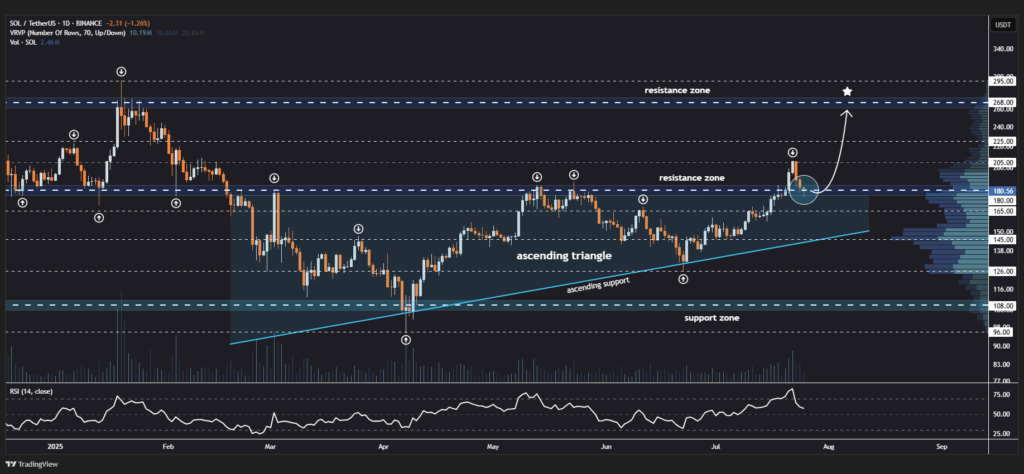

Technical Setup Points to Breakout Potential

On the charts, SOL just broke above the top of an ascending triangle—a bullish pattern that’s been in play since March. It’s now testing that breakout zone, and if it holds, we could see fireworks. Analyst Jonathan Carter says a solid bounce here might push SOL toward $205 first, and potentially to $225 or even $268 if momentum builds. That $205 level is being watched closely, especially since it was a reversal point back in April.

Market Sentiment and the Fed Factor

Of course, the broader crypto mood is shaping what happens next. The Federal Open Market Committee (FOMC) meeting on July 29 is likely to be a big driver. If the Fed signals rate cuts, markets could get that shot of adrenaline they’ve been waiting for. Until then, buying the dip might be tempting but risky—SOL could easily dip further before the trend flips. Some traders are holding off for clearer signals from the Fed before jumping in.