- XRP offers more direct upside tied to real-world adoption by banks and institutions; solid, but unlikely to 10x overnight.

- Chainlink could grow alongside broader crypto infrastructure, benefiting from adoption behind the scenes—but it’s a bumpier ride.

- Neither is a “get rich quick” play, but both have room to grow if crypto’s institutional shift keeps accelerating.

The crypto market’s buzzing with possibilities again, and two familiar names—XRP and Chainlink—are pulling a lot of investor attention. With prices climbing and use cases expanding, folks are asking the obvious: Could one of these actually be the investment that flips your portfolio upside down—in a good way?

Let’s be real though—millionaire-maker investments? They’re rare. But that doesn’t mean these two coins don’t have solid potential.

XRP Looks Solid… But Don’t Expect a Moonshot

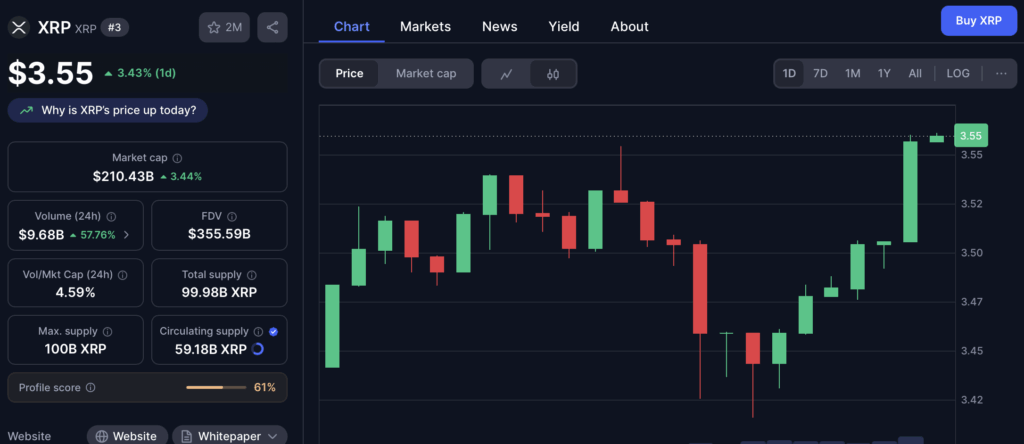

Right now, XRP is trading around $3.35, with a market cap flirting with $200 billion. For it to 10x from here, you’d be looking at a $2 trillion valuation—pretty much in Bitcoin territory. Not impossible, sure, but… that’s a big ask. Even if you dropped $10K into it today, you’d come up just shy of millionaire status.

Still, XRP has some muscle. It’s geared toward institutional investors, the kind that manage massive pools of cash and are constantly looking for faster, cheaper, more efficient ways to move money. Ripple, the company behind XRP, has built this thing with compliance in mind, aiming for smooth sailing with banks and big finance.

That’s not small. The XRP ledger cuts down on money transfer fees, trims exchange costs, and opens up yield options for folks managing stablecoins. So, if there’s a steady wave of traditional capital coming into crypto? XRP’s right in the splash zone.

Chainlink’s Slow Burn Could Still Be Big

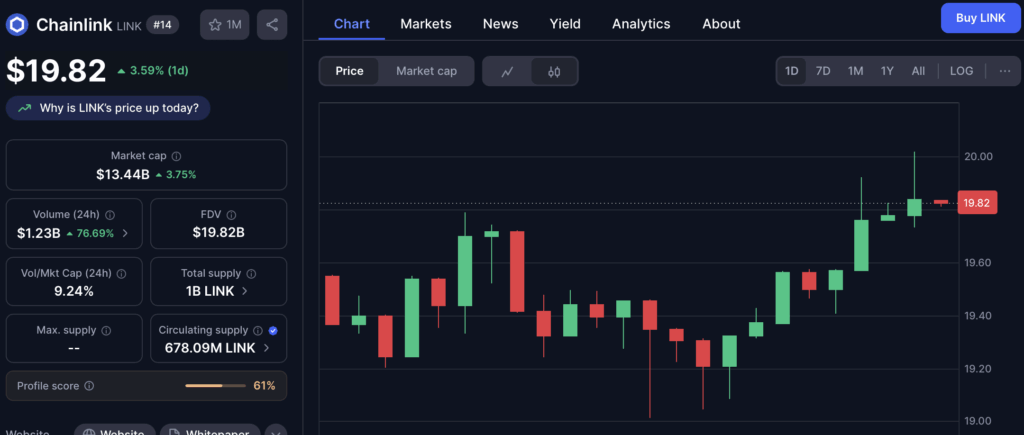

Chainlink, priced around $17, is working a whole different angle. It’s basically the data layer for blockchains—a system of “oracles” that feed real-world info into smart contracts. Think: prices, interest rates, even weather data (seriously).

It’s sitting on a $11 billion market cap, so yeah, a 10x jump only asks for another $100 billion in value—not exactly a moonshot in the grand scheme of things. But the challenge with LINK is that its demand isn’t quite as direct. Users of Chainlink services (banks, devs, apps) don’t have to hold huge bags of LINK to use the network.

So price appreciation really hinges on whether staking rewards and fee mechanisms keep scaling. If they do? Chainlink could be collecting tiny tolls on a lot of global value flow. It’s more like betting on infrastructure—less flashy, but sometimes more durable.

Which One’s the Better Bet?

If you’re chasing steady gains with less noise, XRP might be the move. It doesn’t need to conquer the entire finance world—just catch a meaningful chunk of it—and the upside could still be pretty solid. Ripple knows its audience, and if they keep nailing product-market fit with compliance-hungry institutions, that could fuel some nice growth.

On the other hand, Chainlink’s value is a bit more subtle. But if decentralized apps and tokenized assets go mainstream, LINK could be one of the key players behind the curtain, pulling in revenue by the second. It won’t be a smooth ride, though. Expect bumps.

Bottom line? Neither coin’s likely to turn a $500 gamble into a Lamborghini. But both could nudge your portfolio in the right direction—especially if you’re playing the long game and not just hoping for overnight riches.