- Dogecoin led memecoins with a 22% weekly rally, leaving SHIB and PEPE trailing, and solidifying its spot at the top of the meme ladder.

- On-chain metrics show old holders are taking profits, but longer-term accumulation is still trending positively—a bullish longer-term signal.

- The $0.25 level is a key test, and flipping it to support could kick off a fresh breakout, especially if volume stays strong.

Dogecoin’s still sitting at the top of the meme heap—no surprise there. With a whopping market cap of $35.8 billion, it’s miles ahead of its closest rival, Shiba Inu, which is lagging behind at $8.67 billion. That’s a pretty wild gap for two coins powered mostly by internet jokes and vibes.

Sure, it’s a little crazy that meme-based tokens hold this kind of value, but hey, that’s crypto. The past week gave DOGE a nice 22% pump. SHIB and PEPE? They managed 12.5% and 8.7% each—not bad, but still trailing behind the dogfather. Even though upstarts like Bonk have been making noise, Dogecoin’s still the big dog in the kennel. Question is… can it keep this up?

Accumulation or Exhaustion?

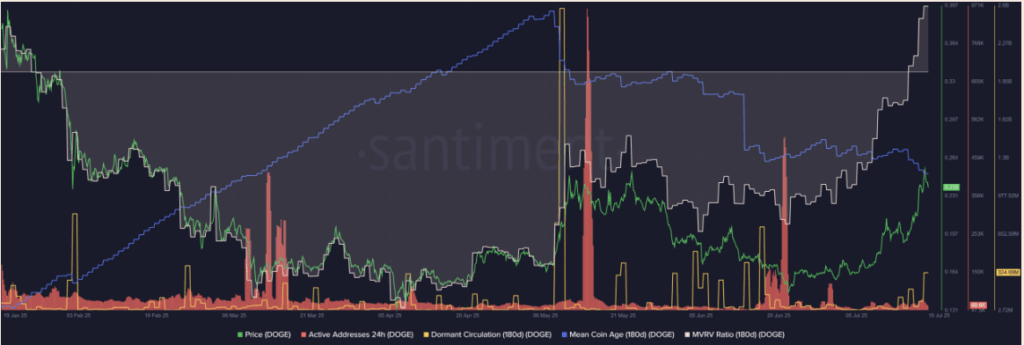

Looking at the on-chain stuff, there’s been a lot of action under the hood. Holders have been sitting pretty since May, mostly in profit. And when wallets that have been sleeping for months start moving coins? That’s a sign.

The mean coin age and MVRV ratio have both dipped lately—basically, folks are finally moving old DOGE, probably to take profits. MVRV for the past 180 days? Up 15%, on average. That kind of return starts tempting people to hit the sell button.

Still, zoom out and things look decent. The HODLer net position has mostly been positive this year. Slowed a bit in the last month, yeah, but the long-term trend is still accumulation, and that’s usually a good sign.

Technicals Point to a Key Test

DOGE’s daily chart has held up nicely. Trading volume has been cranking—way above average over the last 10 days. The price just popped back above that mid-range support at $0.196 and took a swing at the range top near $0.25.

It got as high as $0.257 but couldn’t quite hang on. Price slipped back 6.6% to around $0.24—not a disaster, but worth watching. The RSI still says bullish momentum’s alive and well, but the CMF shows inflows cooling off a bit in the last day or so.

So what now? Traders are keeping a close eye on that $0.25 mark. If DOGE can flip it from resistance to support, that could open the door for a breakout. And if that happens? Buyers might get a solid re-entry chance for another leg up.