- Bitcoin briefly surged to $120,998, sparking over $812 million in liquidations, with shorts hit the hardest.

- Ethereum, Bitcoin, and XRP led asset liquidations, with Binance, Bybit, and OKX topping the platform losses.

- Total crypto market cap hit $4 trillion, approaching the valuation of Nvidia amid renewed investor interest.

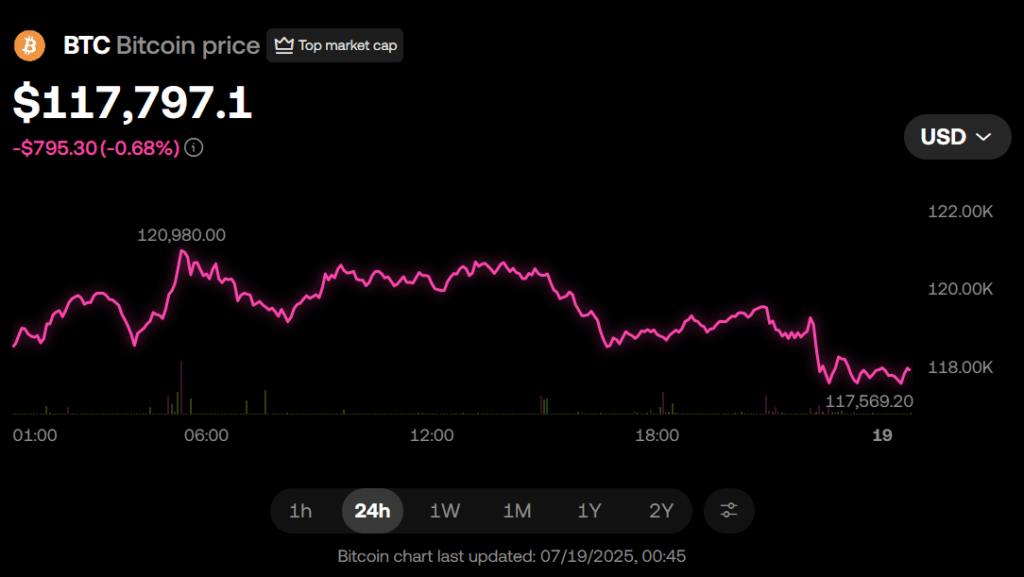

Bitcoin broke through the $120,000 barrier overnight between July 17 and 18, reaching a peak of $120,998 and marking a 2.5% daily gain. This move ignited widespread rallies across the altcoin market, with XRP leading the charge and hitting a new all-time high of $3.65. The sharp rise caught many off guard, particularly traders betting against the market.

Liquidations Spike as Shorts Get Crushed

According to data from CoinGlass, the total liquidations over the past 24 hours soared to $812.7 million. A staggering $483 million came from short positions that were wiped out as Bitcoin and altcoins moved sharply higher. Long traders weren’t entirely spared, suffering $329.7 million in losses during the same period. The largest single liquidation, worth nearly $51 million, occurred on Binance.

In total, 174,391 traders were liquidated, reflecting the brutal effects of high leverage in volatile markets. Binance, Bybit, and OKX were the top three platforms by liquidation volume, while Ethereum led in asset-specific losses at $238 million—followed by Bitcoin at $146 million and XRP at $102.5 million.

Market Cap Tops $4 Trillion as Bull Run Heats Up

The crypto market’s momentum pushed total capitalization past the $4 trillion mark, a new all-time high. This milestone puts crypto’s collective value close to that of Nvidia, the world’s most valuable public company, which was valued at around $4.2 trillion on July 18. The rapid rise is pulling in both retail speculators and institutional investors seeking exposure to what’s shaping up to be one of the most explosive bull markets in crypto history.

As markets continue to push upward, volatility and liquidation risks remain elevated—offering huge upside potential but also significant downside if sentiment shifts.