- Tom Lee believes ETH will break its $4,880 all-time high due to rising stablecoin demand and asset tokenization.

- Ethereum is up 30% in two weeks; now trading at a five-month high of $3,140.

- Institutions are leading the charge, with over $1B in ETF inflows last week—retail hasn’t shown up yet.

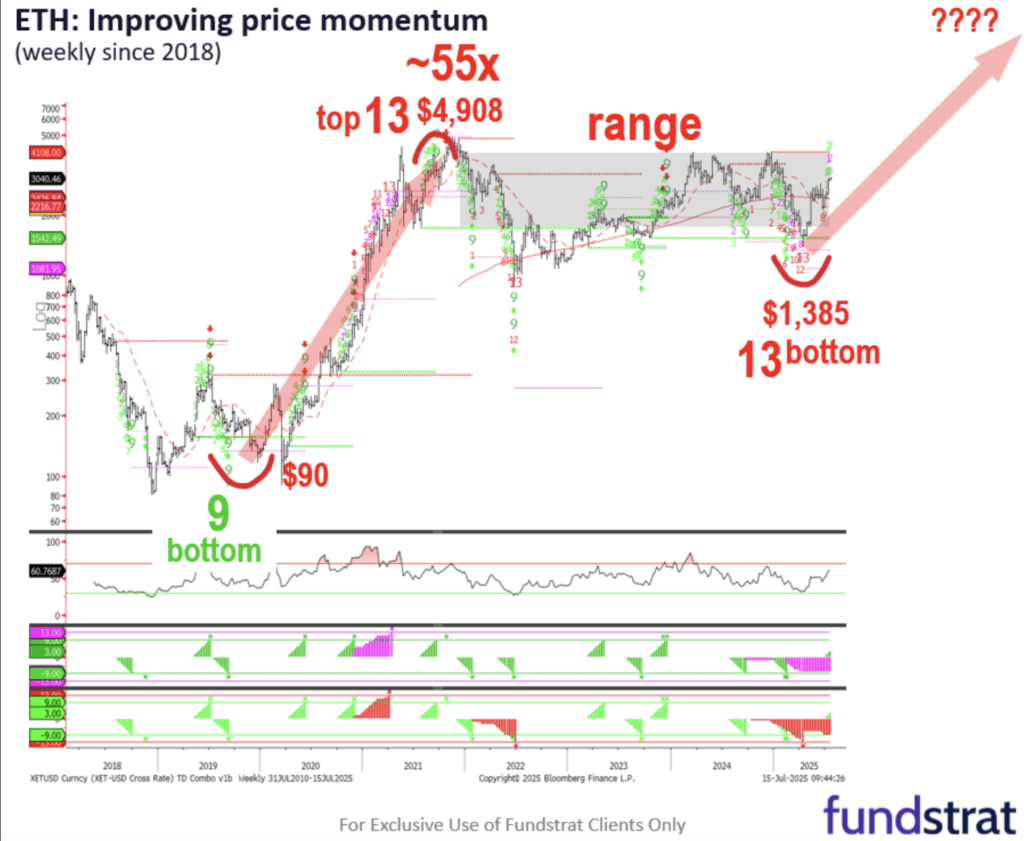

Ethereum’s been kinda stuck since 2021. It’s up 22% over the past month, sure—but still down 10% on the year. Feels like it’s been coiling for ages. But according to Tom Lee, that sideways chop might finally be running out of road.

Lee believes the combo of rising stablecoin usage and Wall Street diving headfirst into real-world asset tokenization is about to shift everything. Both are boosting demand for ETH, he said Tuesday. And if he’s right, Ethereum could go way beyond its 2021 all-time high of ~$4,880 in the next couple years.

All Eyes on Ethereum—Again

Sean Farrell, Fundstrat’s Head of Digital Assets, noted that Ethereum’s transaction volume is ticking up—and that’s usually one of the earliest signs something’s brewing. According to Lee, ETH is also about to benefit from an uptick in risk appetite, especially if the Fed finally cuts rates later this year. More liquidity = more flow into crypto, historically.

Oh, and this bit? PayPal’s Peter Thiel just scooped up a 9.1% stake in Tom Lee’s BitMine, per an SEC filing. Not exactly a coincidence. Treasury momentum around ETH is quietly building.

Community voices aren’t staying quiet either. DeFi Dad went full bull, thanking Lee and tossing out a $15,000–$30,000 top for ETH this cycle. Income Sharks called ETH “one of the best-looking charts right now,” and sees $5K by September. Meanwhile, CryptoELITES threw in a $10K target, adding bluntly: “ETH is going to explode.”

And then there’s Merlijn The Trader, pointing to an RSI triple bounce, a strong macro channel, and months of coiling. In his words? “The chart is screaming breakout.”

Price Action Finally Moves

ETH popped 5.7% today, hitting $3,140 during early Asian trading—its highest price in over five months. It’s been lagging for over a year, but this latest surge—up nearly 30% in just two weeks—has the market paying close attention. Ethereum’s outpacing most of crypto right now. Still, it’s not all sunshine. ETH is still trading below its July 2024 local top of $3,500.

But here’s the kicker: institutions are already circling. Ether ETFs just pulled in over $1 billion in inflows last week alone. And Ethereum treasury firms? They’ve stacked more than $1.6 billion worth of ETH in just the past month.

Retail’s not even here yet.