- Ethereum surged past $2,850, signaling a bullish breakout, but is currently retesting that level amid signs of consolidation after a 20% rally.

- Whale activity is split, with Sharplink buying $64M worth of ETH while leveraged short positions totaling $143M suggest some traders are betting against further gains.

- Over $206M in ETH outflows from exchanges suggests strong accumulation, though a 35% dip in trading volume adds uncertainty to short-term direction.

Ethereum just broke past that stubborn $2,850 level and, for the moment, it’s looking pretty bullish. Classic move: it’s now kinda pulling back to retest the breakout zone—a usual play before it kicks higher again. But hold on, the price action isn’t telling the whole story here.

$64M Long vs $143M in Shorts—Who’s Bluffing?

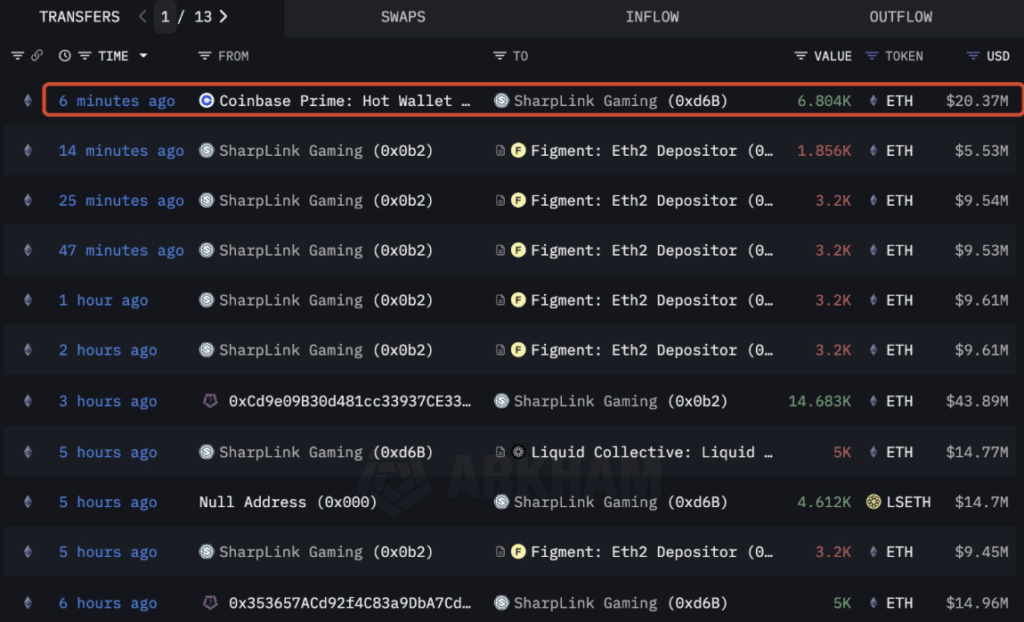

On July 12, Lookonchain spotted something pretty wild: Sharplink (yep, the betting platform SBET) scooped up 21,487 ETH worth $64.26M. That came just after it grabbed another 10,000 ETH ($25M) directly from the Ethereum Foundation. Sounds like someone’s loading up before liftoff.

But not everyone’s feelin’ it.

At the same time, three wallets started piling on aggressive shorts—leverage as high as 25x. In total? 48,458 ETH shorted, valued at $143.37M, but only backed by $10.5M in margin. That’s either gutsy or reckless. Depends who you ask.

So yeah, bulls and bears are squaring off here. But with ETH holding above key support and the broader setup leaning positive, short-term downside might be a long shot—unless something unexpected hits.

Big Outflows, Quiet Volumes

According to CoinGlass, ETH saw $206M leave centralized exchanges on July 11 alone. That’s usually a bullish signal—whales shifting to cold storage, possibly holding for the long haul.

Still, there’s a catch. Even though the outflows look solid, trading volume has dropped off—down 35% in 24 hours. So yeah, there’s demand… but not a lot of action right now. It’s kinda like everyone’s waiting to see what happens next.

Chart Hints: $4K Might Be in Play

Technically, ETH looks strong. It’s sittin’ above its 200-day EMA, which is a green flag for long-term bulls. After gaining more than 20% in just three days, it seems to be cooling off a bit—maybe even consolidating before its next move.

If it holds above that $2,850 breakout zone, a 37% rally could push it toward $4,000. Not guaranteed, of course, but the structure’s there. It’s one of those “watch closely, don’t blink” kind of setups.