- Hyperliquid leads all blockchains with $1.7M in daily fees, driven by $2.4B in trading volume and strong perpetual futures activity.

- HYPE’s supply is shrinking while price consolidates near resistance—suggesting a breakout to $47–$50 could be on the horizon.

- With 300K+ wallet addresses and nearly $800M in projected annual revenue, Hyperliquid’s ecosystem growth backs the bullish momentum.

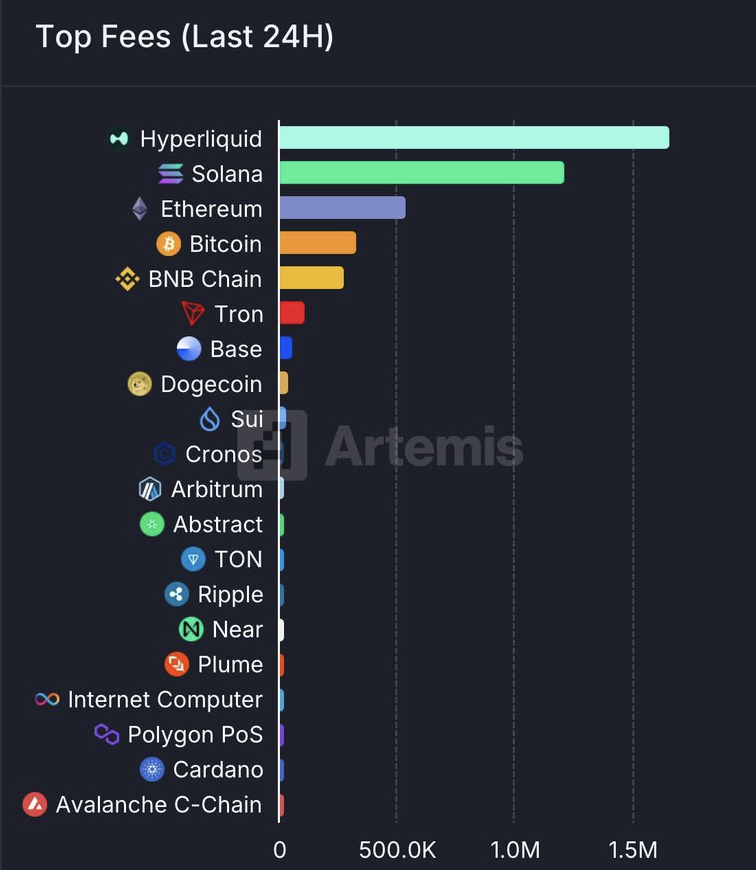

Hyperliquid just stole the spotlight—again. In the past 24 hours, the network pulled in a whopping $1.7 million in transaction fees, topping some big names like Ethereum, Solana, and even Bitcoin. Yep, that’s according to fresh data from Artemis, and it’s got people talking.

The platform pushed through a staggering $2.4 billion in trading volume, most of it coming from its red-hot futures market. Around $2.3 billion of that came from leveraged positions, showing how deep users are going into risk territory. Perpetuals alone brought in over $712K in fees—so, no signs of slowing there.

HYPE Token Holding Steady—For Now

At the time of writing, the HYPE token is sitting around $38.83. It’s dipped just a bit in the past 24 hours, but nothing dramatic. With a $13.3 billion market cap, it’s still very much in the heavyweight league and hovering close to resistance levels around the $40 zone.

There’s something interesting happening behind the scenes, though. The liquid supply has dropped from 106M to 97M tokens since June. That’s nearly 9 million tokens taken out of circulation—likely due to staking or lock-up mechanisms. Less supply means more potential price pressure… upward, that is.

And yeah, HYPE’s been closing the week in green lately. Weekly candles show buyers keep stepping in every time there’s a dip, with long downside wicks showing those rebounds are strong.

Is a Breakout Brewing?

Right now, all eyes are on the $41 level. That’s been the ceiling on the weekly timeframe. If HYPE smashes through it, analysts say we could be heading toward the $47–$50 zone pretty fast.

What’s more, this resistance has been poked a few times now—and it’s not punching back as hard. That’s usually a sign sellers are starting to lose grip. On the flip side, the $35 level is acting as solid support. As long as HYPE doesn’t fall below that, the bullish structure is still very much in play.

Some folks are even comparing this setup to Solana’s monster rally in 2021. Remember when SOL went from like $2 to over $200? Yeah, similar vibes… though of course, that kind of moonshot is always speculative (and a little wild).

Ecosystem Growth Backing the Hype

HyperEVM wallet addresses have officially crossed the 300K mark—yep, more people are jumping in. That kind of user growth backs up the whole bullish thesis and shows the ecosystem’s gaining traction fast.

And here’s a fun stat: Hyperliquid’s estimated annual revenue now clocks in around $798 million, with fees hitting about $791M. Not bad for a network still making a name for itself. In fact, that makes it one of the top earners in all of crypto.