- Whales dumped 170M ADA over two weeks, with large wallet balances falling significantly—suggesting institutional pullback.

- Derivatives data shows open interest and funding rates declining, pointing to reduced confidence from traders.

- ADA remains stuck in a bearish channel, with critical support at $0.5419 and upside targets needing a break above $0.5896.

Cardano’s been sliding for two days straight now, and the vibe’s still pretty bearish. At the time of writing, ADA’s down close to 1%, tagging along with broader market jitters. Some of that anxiety? It’s tied to Trump’s decision to extend the tariff pause through August 1—just enough uncertainty to spook risk assets a bit.

But it’s not just the headlines causing friction. The big players—Cardano’s so-called “whales”—have been offloading serious bags. We’re talking around 170 million ADA dumped in the past two weeks. That’s not exactly what you wanna see if you’re hoping for a bounce.

Whales Offload 170M ADA—Retail Gets Left Holding the Bag?

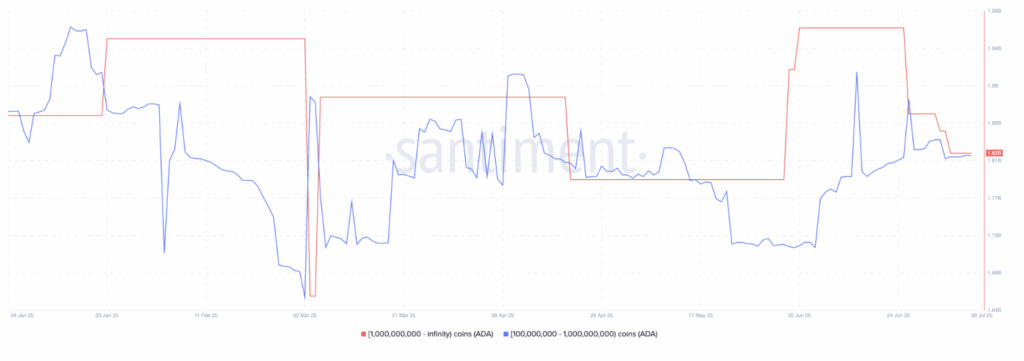

Let’s dig into the numbers. On-chain data from Santiment shows that investors holding between 100 million and 1 billion ADA have scaled back. Their collective stash dropped from 1.87B on June 26 to 1.82B today. And those with over a billion ADA? They trimmed from 3.34B to 3.22B during the same period.

It’s a clean sign that the smart money’s lightening up, probably not by accident. When whales start unloading, retail demand often gets used as the exit ramp. That supply flood can weigh on price action—especially if there’s no fresh demand to soak it up.

Derivatives Market Sheds Optimism

Things aren’t looking too pretty on the derivatives front either. According to Coinglass, ADA’s open interest dropped 3.38% in the last 24 hours, now sitting at $791.47M. Less open interest generally means traders are closing out positions—cooling off expectations for upside.

Funding rates tell the same story. They fell from 0.0087% earlier to just 0.0018%, which might sound like a small change, but it’s meaningful. Lower funding usually hints at weaker buying pressure, and traders sitting on the sidelines are watching, not rushing in.

Bearish Channel Still in Play—Watch That $0.5419 Support

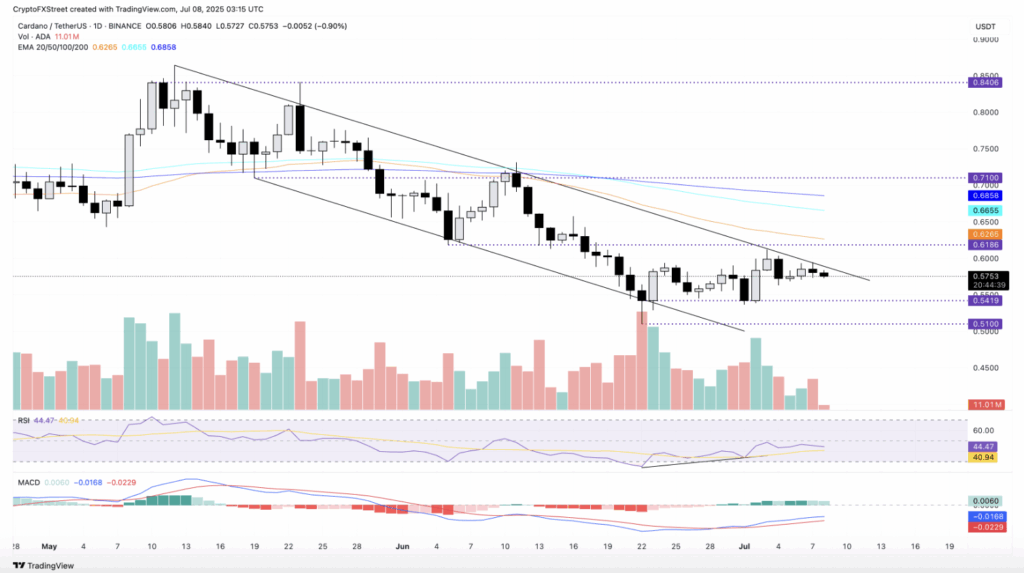

ADA is stuck under a key resistance trendline right now—the one drawn from the May 12 high to the June 11 close. It failed to break through, and the pullback has kicked ADA back into a descending channel.

If the price continues to trend lower, the next key level to watch is $0.5419—that’s the last solid support hit back on July 1. Bears may target that in the short term.

Momentum’s also fading. The MACD shows shrinking green bars and could be setting up for a bearish crossover. Meanwhile, the RSI can’t seem to break past 50 and is lingering around 44. In plain terms? Sellers are still in control here.

What Needs to Happen for a Recovery?

For bulls to reclaim the narrative, ADA needs to close decisively above $0.5896. That would break it out of the descending pattern and open the door to $0.6186—last touched back in mid-June. But until that happens, the pressure’s on, and the downside risks are very real.