- Chainlink’s large transaction volume jumped 105% in 24 hours, hitting $54.8 million amid a broader market sell-off.

- Whale activity hints at strategic positioning, despite LINK’s slight dip to $13.10 and ongoing macro uncertainty.

- Recent wins include a Mastercard partnership, ACE compliance rollout, and powering tokenized equities via Kraken’s xStocks.

Chainlink (LINK) just lit up the charts with a huge 105% jump in large transaction volume—yeah, that’s a lot of movement in a single day. This burst comes right as July kicked off with a pretty messy start across the crypto market. According to CoinGlass, around $202 million got liquidated, so yeah… things are a bit shaky out there.

Most of the top coins were painted red, with Bitcoin and Ethereum both dipping. Investors are clearly taking profits and rethinking their positions as macro vibes remain… uneasy. LINK was down slightly too—just 0.89%—sitting at $13.10. Honestly, that’s not bad considering the carnage. Only a handful of coins (looking at you, XRP, ALGO, and BCH) managed to stay green among the top 100.

Whales Making Moves, LINK Doesn’t Flinch

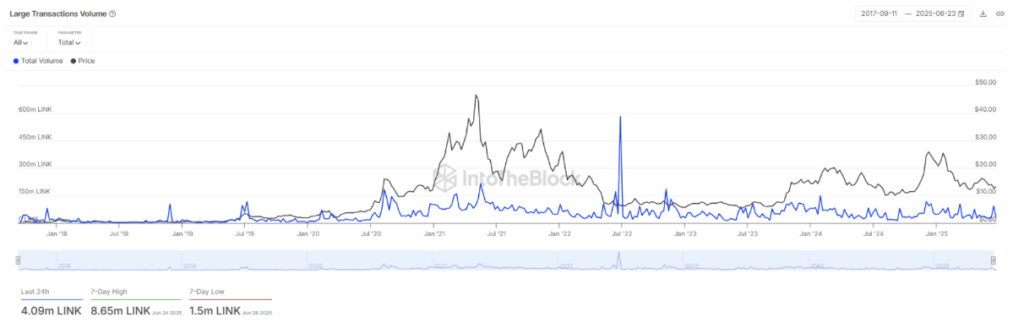

Now, the big number: $54.8 million. That’s how much moved in large Chainlink transactions (we’re talking $100K+ per transfer) in just 24 hours. According to IntoTheBlock, that adds up to about 4.09 million LINK sloshing around the network. Kinda smells like whales are either gearing up for something—or quietly stacking while the rest of the market sleeps.

This kind of volume isn’t normal during downturns. It might be whales trying to front-run a potential rally, or it could just be a whole lot of reshuffling ahead of bigger moves. Either way, someone’s watching LINK closely.

Recent Wins Keep LINK in the Spotlight

Despite the wobbly start to July, Chainlink’s been having a moment lately. Just last week, they locked in a huge partnership with Mastercard—that’s right, Mastercard. The goal? Make it possible for billions (yeah, billions) of cardholders to buy crypto directly on-chain. That’s not small potatoes.

And now, they’ve rolled out something called ACE—short for Automated Compliance Engine. Sounds fancy, but the idea’s simple: give institutions an easier, more compliant way to get into crypto. Big money likes things clean and clear. This might be a step toward unlocking some of that institutional capital.

Meanwhile, Kraken also dropped a banger. They’ve launched tokenized U.S. equities—dubbed xStocks—for their non-U.S. users. And guess who’s powering the pricing behind the scenes? Yep, Chainlink. The oracle king is now feeding real-time data into tokenized stocks and ETFs. This move makes real-world equities available through DeFi, which is kinda wild when you think about it.