- ADA dropped 1% Tuesday, continuing a sideways trend while whales quietly grabbed 490M tokens.

- Derivatives data hints at lingering bullish bias—but liquidation pressure on longs is building.

- A close above $0.5939 could kickstart a rally toward $0.6186, but failure at $0.5450 risks deeper losses.

Cardano (ADA) slid another 1% on Tuesday, adding to Monday’s 0.88% dip—and yeah, it’s still stuck in that sideways chop. While price has basically been bouncing around the same 7-day range, one thing has changed: the whales are making moves. A cool 490 million ADA just got scooped up by large holders, even as smaller investors bailed out.

So what’s the deal? ADA’s pulling back, retail’s selling, and big money’s quietly stacking.

Smart Money Snaps Up ADA, While Retail Heads for the Exit

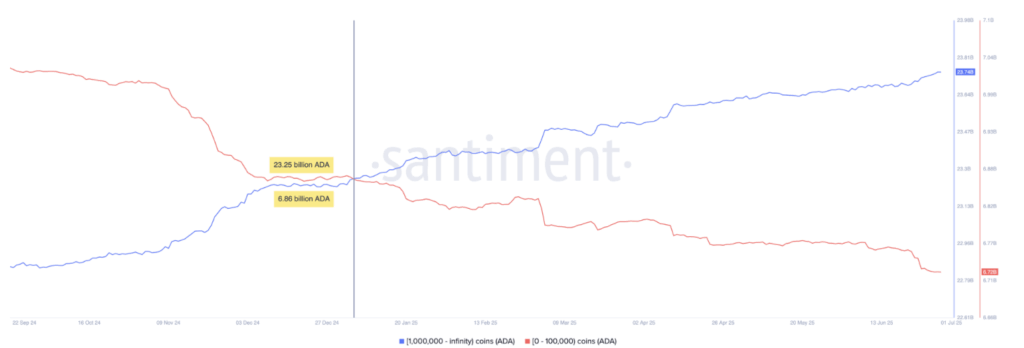

According to Santiment, the gap between whale wallets and retail ones is getting wider. Addresses holding over a million ADA now control 23.74 billion tokens—that’s up from 23.25B since January 4. On the flip side, wallets with less than 100K ADA have shrunk their stash to 6.72 billion, down from 6.86B.

This split tells a story. Retail investors are cutting losses. Whales? They’re buying the dip. Again.

Derivatives Say There’s Still Hope (Kinda)

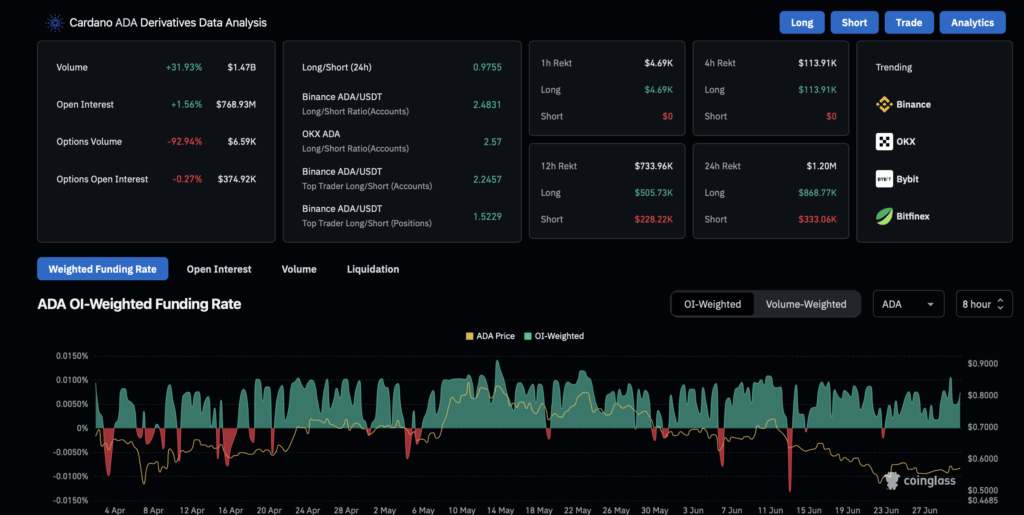

Coinglass data shows a slight bump in open interest—up 0.68% to $769.92M. Nothing wild, but it hints that people are still betting on ADA. The funding rate also ticked higher by 0.0074%, suggesting leveraged buyers are paying to hold their positions. That’s usually a sign of bullish lean.

But it’s not all sunshine. In the last 24 hours, $949.9K in long positions got wiped out. Shorts, by comparison, lost $333K. That imbalance pushed the long/short ratio down to 0.9704, showing a subtle lean toward bearish sentiment.

Cardano’s Price Is Squeezed in a Falling Channel

Right now, ADA’s stuck. The price is hovering between Friday’s low of $0.5450 and Tuesday’s high of $0.5939. Technically, it’s bouncing inside a falling channel formed by the May 23 and June 10 peaks on top, and a string of recent lows—May 19, June 5, and June 23—down below.

If ADA breaks below $0.5450, it could fall toward $0.5100, which is just above the channel’s bottom edge. That would be ugly.

Still, not all the indicators are flashing red. The MACD showed a buy signal on Sunday, with green bars showing up and the MACD line crossing over the signal line. But RSI? It’s sitting at 37—pretty weak and edging toward oversold territory. Momentum clearly isn’t on the bulls’ side just yet.

Can ADA Break the Pattern?

To flip things bullish again, Cardano needs to break above the upper trendline—and close above $0.5939. If that happens, it could set up a push toward $0.6186, a level last touched on June 14.

But until then, ADA’s stuck in limbo—caught between whale accumulation and cautious charts.