- AVAX is trading steadily near $17.85, with bullish technicals forming despite a sluggish market.

- 2025 predictions range from ultra-conservative to moonshot territory, with targets between $17.56 and $39+.

- Grayscale’s inclusion of AVAX is a quiet but important stamp of approval, boosting its case with institutions.

Avalanche (AVAX) isn’t exactly soaring, but it’s holding its ground—and that alone says a lot right now. As of today, it’s trading around $17.85, which is up a modest 1.74%. Nothing wild, but considering the broader market’s been dragging its feet, that’s something. Trading volume over the last 24 hours? $152.9 million, though that’s down more than 26%. Still, AVAX managed to climb nearly 4% this week, hinting that investors might be sniffing around again.

Now, let’s not pretend it’s all sunshine. The overall crypto space still feels kinda bearish, but AVAX is showing signs of life. And honestly, in times like these, resilience matters more than hype.

Bullish Pattern or Just Another Tease?

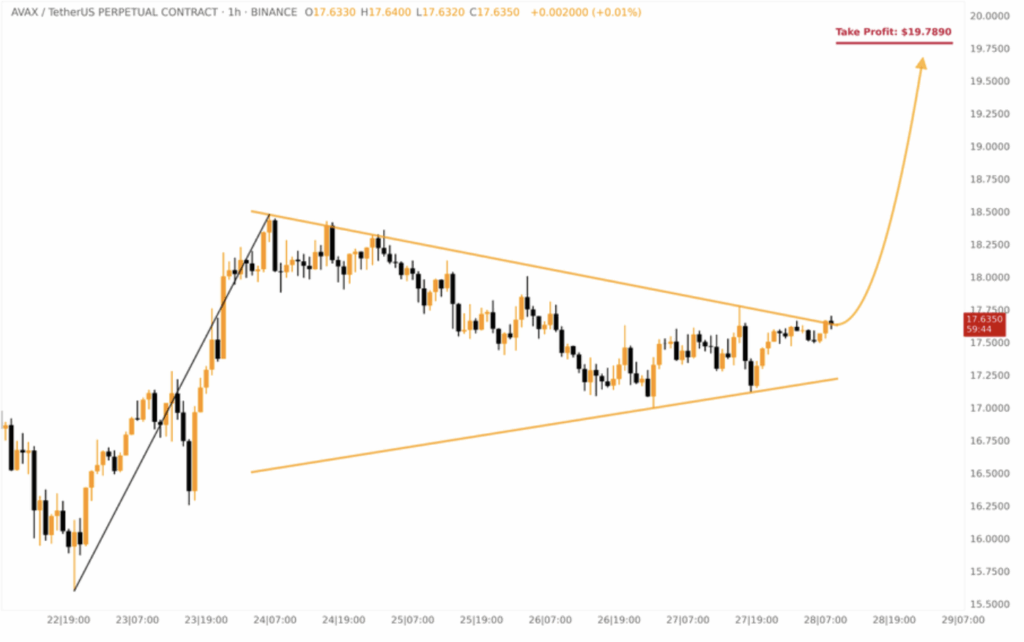

Technical analysts over at Crypto AI (via Klondike) are seeing a bullish pennant formation on AVAX’s chart. For those not glued to TradingView all day, that usually signals potential for a breakout—if momentum holds. The suggested trade setup? Enter around $17.64, keep a stop at $17.21, and aim for a target near $19.79. It’s a solid short-term play, but in this macro? Risky business, as always.

The pennant forming during a downtrend-heavy environment is what’s getting attention. If AVAX actually breaks out from here, it could turn a lot of heads. Big if, though.

2025: Moonshot or Meh?

When it comes to price predictions for 2025, the outlooks couldn’t be more split. DigitalCoinPrice is throwing out a bullish scenario, saying AVAX could retest the $39 zone—maybe even head back toward its old ATH of $146. Wild? Maybe. But if the stars align—sentiment, fundamentals, new hype—it’s not out of reach.

Changelly, on the other hand, is much more grounded. Their latest call says AVAX might just hang around $17.56 through the year. Barely up. They see a max price of $18.48 for 2025, which is… yeah, kind of a buzzkill. That forecast comes with a potential return of -0.1%, so they’re clearly playing it safe amid all the market chop.

Grayscale Gives AVAX a Nod

One of the more bullish headlines lately? Grayscale added Avalanche to its Q3 2025 portfolio. That’s no small deal—Grayscale’s picks carry weight in institutional circles. It signals that big-money players might be warming up to AVAX again, even if retail’s still on the fence.

The move stands out even more when you consider who got the boot. XRP and Cardano didn’t make the cut, and neither did Lido DAO (LDO) or Optimism (OP), which were dropped due to growth uncertainties and—you guessed it—regulatory drama. Meanwhile, AVAX gets the spotlight. It’s a subtle shift, but one that could matter long-term.