- HBAR sits just below major resistance at $0.154, with bulls eager for a breakout.

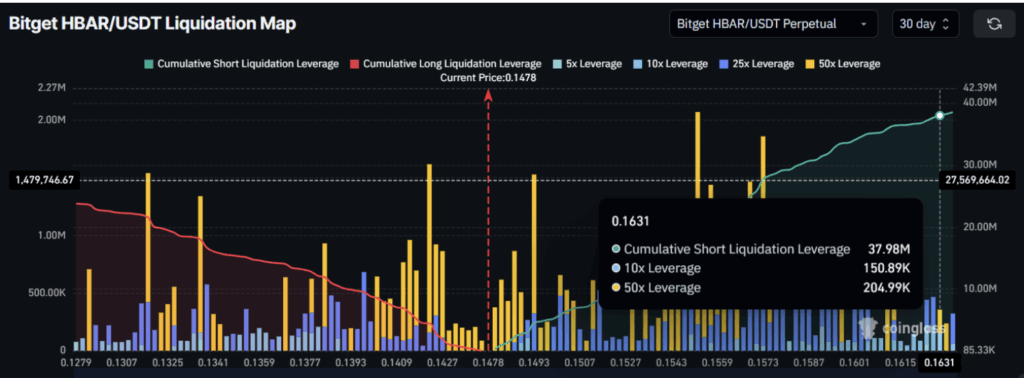

- Nearly $38M in short positions could be liquidated if price hits $0.163.

- Failure to break resistance might drag price back to $0.139 or even $0.133.

HBAR’s been on a bit of a rollercoaster lately. Over the past few weeks, it’s had a hard time shaking off its downtrend—more than a month and a half of just grinding lower. Every rally gets smacked down, and every dip leaves traders wondering if this is the bottom. Still, despite the mess, there’s a surprising sense of optimism in the air.

Traders seem to think a breakout could be right around the corner. That is, if HBAR can actually punch through resistance. If not, well… things might get uglier before they get better.

Bulls Still Backing the Bounce

Throughout this rough patch, HBAR hasn’t lost its fans. Funding rates have been holding steady in the green, meaning more folks are betting long. That’s a pretty loud vote of confidence considering the coin’s price action hasn’t been all that inspiring.

This bullish lean suggests traders are prepping for a turnaround—maybe not tomorrow, but soon. They’re putting money where their mouth is, which says a lot. The steady positive funding rate implies that even while the chart looks rough, belief in HBAR’s recovery isn’t fading.

The $38M Short Squeeze Scenario

Here’s where things get spicy. If HBAR climbs up to $0.163 and busts through that level, short sellers could be in serious trouble. There’s nearly $38 million in short contracts that could get wiped out, and if that happens? Well, that’s like tossing gasoline on a fire—price could rip higher fast.

Basically, if HBAR starts moving and short positions get liquidated, the resulting buying pressure could send it flying. It’s that fragile moment where one push might flip the whole market mood.

$0.154: The Line in the Sand

Right now, HBAR’s hanging out just under $0.154. That’s the spot everyone’s watching. If it breaks above that—and actually holds—it could be game on. That flip would be a solid technical signal, potentially opening the path to $0.163 and beyond.

But if it slips instead? We’re looking at a possible drop to $0.139. And if that level cracks, $0.133 might be next. That would put the bulls on the defensive again and probably kill off this rebound narrative for now.