- Powell says U.S. banks can work with crypto firms if done safely and responsibly.

- The move could boost crypto adoption by making it more accessible via traditional banks.

- Critics call Powell’s rate cut plan confusing amid forecasts of rising inflation.

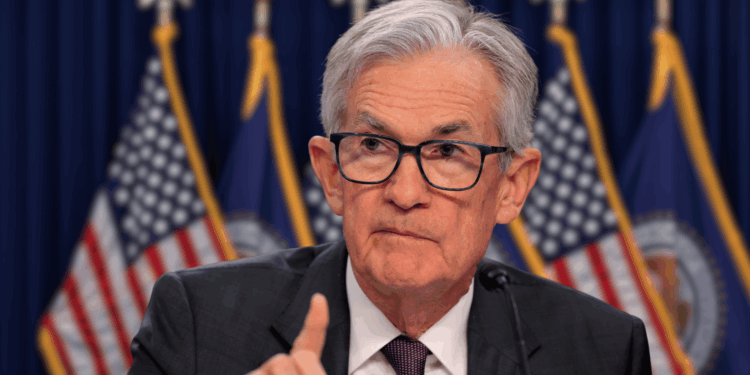

Federal Reserve Chair Jerome Powell has declared that U.S. banks are allowed to engage with crypto companies and participate in crypto-related activities. The move signals growing institutional acceptance of the crypto industry, provided that banks manage associated risks and ensure customer protections are in place. This policy shift could dramatically increase access to crypto services for mainstream users.

Greater Crypto Integration on the Horizon

With traditional banks now greenlit to work alongside crypto firms, the crypto ecosystem may see broader adoption. This development could streamline the process of buying, selling, and holding digital assets, potentially paving the way for more crypto-financial products backed by trusted banking institutions. Still, regulators are emphasizing caution to prevent financial instability.

Interest Rate Policy Sparks Confusion

Powell also made headlines for stating that interest rate cuts might be appropriate later this year, even as the Fed anticipates a rise in inflation.

This stance has sparked criticism, with many economists and commentators pointing out the contradiction in lowering rates while expecting inflation to increase. They warn this could create uncertainty and undermine the Fed’s credibility.