- Smart money is sitting on big AVAX profits but hasn’t sold—yet.

- Retail sentiment is bearish, with increased selling and short positions stacking up.

- AVAX needs to break $19.81 to spark serious upside—but resistance and weak momentum might get in the way.

After weeks of red candles, Avalanche (AVAX) finally caught a break—climbing 2.62% in the last 24 hours. It’s the first green day after a pretty brutal 26% drop over the past month. Not exactly party time, but hey, it’s something.

What’s interesting though? The rally seems to be riding on the back of some serious smart money plays. These early investors? They’re sitting on some juicy profits, but they haven’t dumped yet. That’s got some folks thinking this might just be the start of a trend reversal. Or… is it just the calm before retail panic?

Big Gains for Smart Money—But They’re Not Selling… Yet

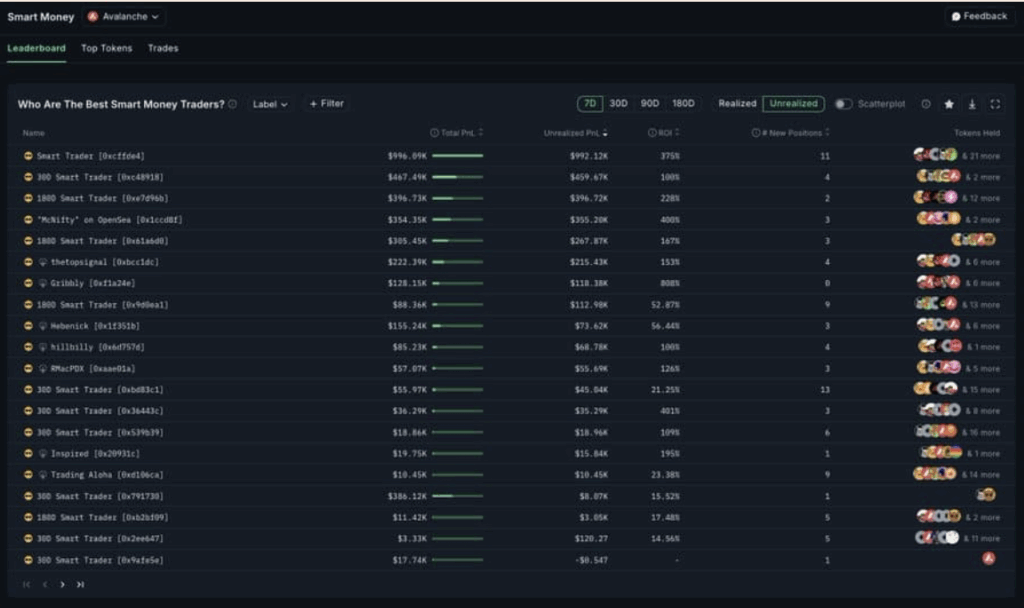

According to Nansen, a bunch of AVAX’s so-called “smart money” players—y’know, the folks who time their buys better than most—are up huge. Like, 375% kind of huge. Across 11 tracked wallets, they’re sitting on nearly $1M in unrealized gains, even though AVAX is still down around 13% overall.

Now normally, when smart money sees this kind of run, the playbook says they hit sell. Cash out, move on. But… not this time. They’re holding. Which is odd. Meanwhile, retail folks? They’re running for the exits.

Retail Pulls Back, Shorts Stack Up

CoinGlass data paints a not-so-cheery picture on the retail side. Just a week ago, retail investors scooped up almost $12M in AVAX. Now? They’re dumping. In the last 24 hours alone, about $821K in sell pressure came from retail wallets.

On the derivatives side, the mood’s souring too. Shorts are stacking up as small traders bet AVAX is gonna fall again. One key signal? The Open Interest Weighted Funding Rate—it just dipped below zero to -0.0022%, a bearish tell if there ever was one.

So, you’ve got retail bailing out while the whales are oddly quiet. Weird setup, right?

AVAX Chart Tries to Break Free—But Resistance Is Lurking

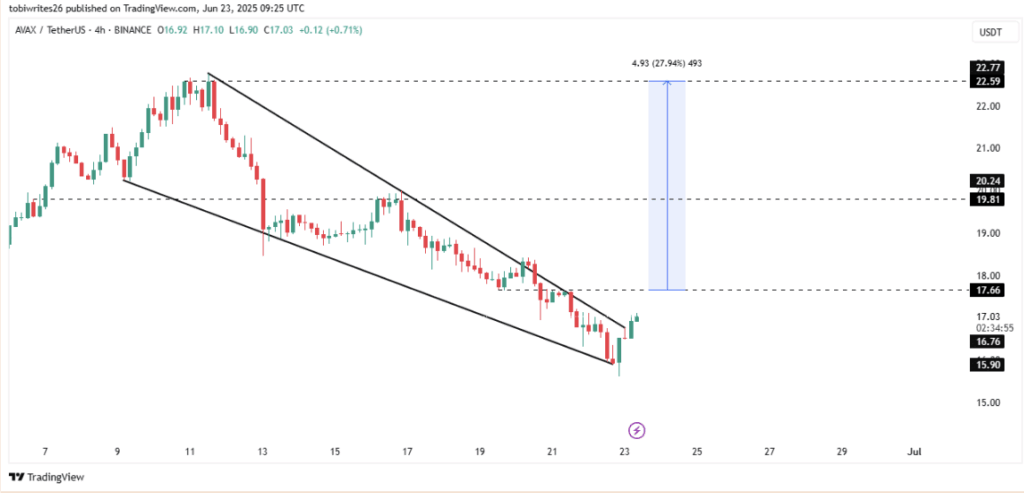

On the technical side, things aren’t all doom and gloom. AVAX broke out of its descending channel, which—normally—can signal the start of a run back to previous highs. But… it’s not a smooth path up.

First, there’s a key resistance zone straight ahead. If AVAX can punch through that, maybe bulls stick around. But then comes the real test: $19.81. If it breaks that? There’s room to run to $22. That’s a 27% jump from the current zone. Not bad—if it gets there.

But if selling pressure builds again, this whole breakout could fizzle out just as fast as it started.

Market Mood? Kind of Meh.

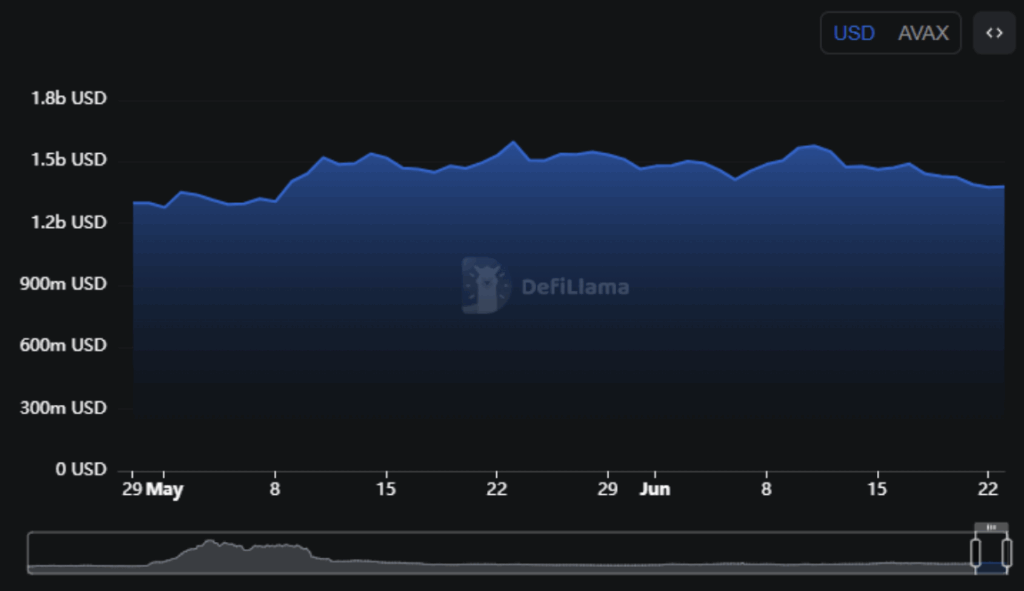

Looking at AVAX’s Total Value Locked (TVL), nothing’s really changed. No big spikes. No big drains. It’s flat. Which kinda sums up the mood—investors are watching, but no one’s diving in headfirst.

With retail fleeing and sentiment turning shaky, this bounce might not have the fuel to go the distance. If things cool off even more, a pullback could be around the corner.