- Solana forms bearish rounding top pattern, risking a 30% drop to $85

- Network activity is weakening, with user count and stablecoin TVL both in decline

- Bulls need to reclaim $187 to invalidate the pattern and aim for $200 again

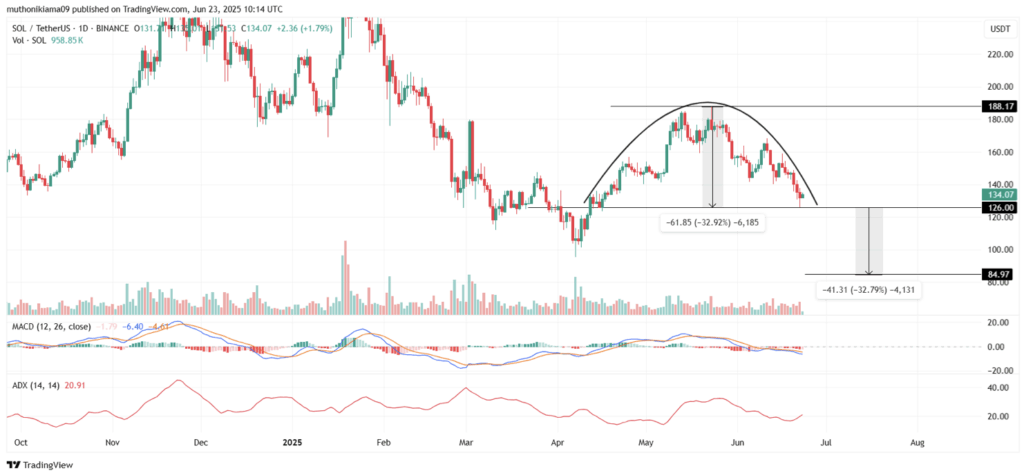

Solana’s trading around $134 today, June 23, but it’s been anything but steady. Within just 24 hours, price action swung from a low of $126 to a peak near $135. The broader market’s still shaky—thanks in part to rising geopolitical tension like the Israel–Iran situation—and all that uncertainty has Solana forming a worrying rounding top on the daily chart. That pattern, yeah, it’s not exactly bullish.

The setup hints at a major cooldown after SOL ran hot earlier this year. From under $100 in April to its $187 high in May, the party might be over. Right now, Solana’s testing a big support level at $126. If that cracks, we could be staring down a 30% drop—taking prices to somewhere near $85. Not great. Especially since momentum indicators like ADX and MACD are leaning heavily toward the bears.

Technicals Aren’t Playing Nice for Solana

Zooming in on the one-day chart, this rounding top is becoming clearer—and uglier. The lack of strong buying volume lately is worrying. Sellers have been slowly draining the juice out of this rally, and the $126 support is starting to look like wet paper. If it breaks, the full height of this pattern points to $85 as a likely bottom.

Adding to the pressure, ADX is climbing, which basically means the downtrend is picking up steam. MACD has slipped into the red too, another red flag. In plain terms? The current setup spells trouble unless bulls get back in fast. That said, if SOL manages to flip $187 again, it’d cancel out the bearish scenario and could send it sprinting past $200.

On-Chain Activity Tells a Similar Story

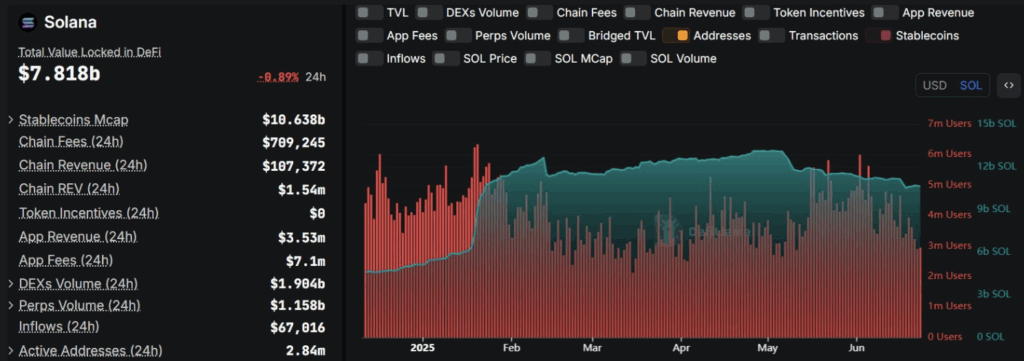

It’s not just the charts—on-chain data is flashing warning signs too. According to DeFiLlama, stablecoin market cap on Solana has shrunk by around $2.5 billion in less than two months. That’s a pretty hefty chunk. User activity’s also tanked, dropping from 6 million in early June to under 3 million now.

With fewer DeFi users and less demand for SOL to run network transactions, the fundamentals don’t exactly scream strength. If that downward trend in usage keeps up, even the most bullish setups might struggle to play out.

Will Bitcoin Save the Day?

There’s still a wildcard here: Bitcoin. If BTC stages a strong rebound and market sentiment flips, Solana could get swept up in the upside. A reclaim of $187 would be a solid sign, potentially invalidating this rounding top and putting $200 back on the map.

But for now, the pressure’s on. If $126 gives way, a fast trip down to sub-$100 levels could be next. Keep your eyes on both the price and the chain activity—it’s all part of the story.