Ethereum price is holding above the $1,200 psychological level after rising 4.46% in the past 24 hours. ETH has been recovering for the last few days and might even complete a bullish reversal pattern to $1,342 soon.

Ethereum Price Bulls Eye A Sustained Recovery

Ethereum price turned down from highs around $1,700 at the beginning of November at the FTX/SBF/Alameda research fiasco. The largest altcoin by market capitalization lost as much as 35% to reach multi-year lows below $1,080. Since then, Ether has been recording higher highs and higher lows, leading to a V-shaped recovery pattern on the daily chart.

A V-shaped pattern is created when an asset undergoes massive losses before making a sustained recovery. If this price action is sustainable, market participants would expect ETH to rise sharply before retesting the $1,342 swing high, embraced by the 50-day simple moving average (SMA). This would represent a 5% move from the current price.

The upward movement of the Relative Strength Index (RSI) validated the above optimistic forecast for ETH. The price strength at 52 indicates more buyers than sellers in the market.

Ethereum price upward trajectory would gain more traction once the RSI moves further away from the 50-point line toward the overbought territory. In the near term, this may signal an increasing demand for the asset, propelling the price higher.

Further adding credence to Ethereum’s positive outlook is the Arms Index (TRIN), which has just sent a bullish signal when it fell below the green line at 0.70. Its value of 0.43 indicates that more buyers than sellers are determined to push the price higher.

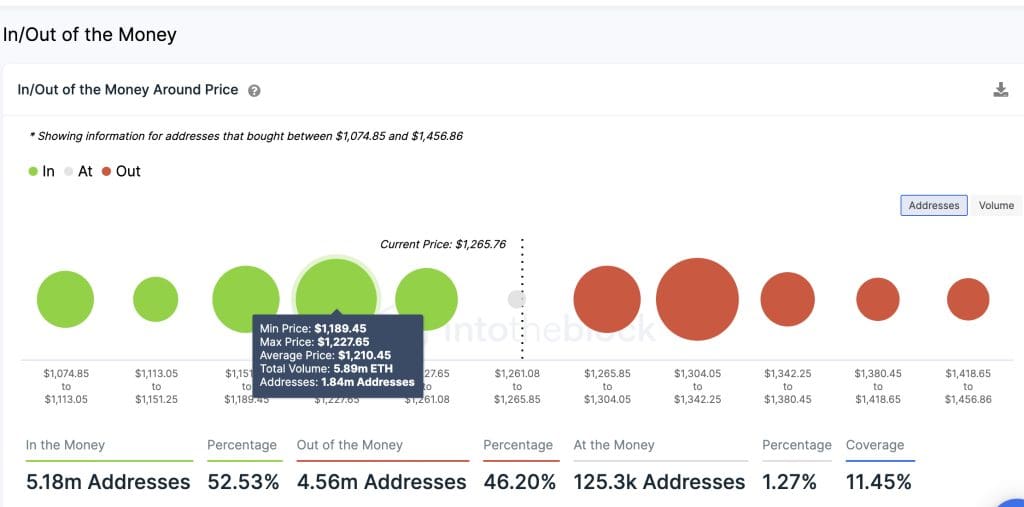

Also supporting Ethereum’s optimistic forecast is on-chain data from IntoTheBlock, a blockchain and market data analytics firm. Its In/Out of the Money Around Price (IOMAP) model indicated that ETH sits on relatively strong support around the $1,200 psychological level.

According to the IOMAP chart below, this area lies within the $1,189 and $1,227 price range, where approximately 1.84 million addresses previously bought roughly 5.89 million ETH. This could be the cohort of investors pushing Ether’s price higher to maximize their profits.

The chart also revealed that almost half of ETH holders are currently in losses. This means that these investors will be bolstered to move the price higher to increase their profits and avoid further losses.

However, a look at the same IOMAP chart revealed stiff resistance from the $1,300 area. This means that even though the ETH price forecast is significantly bullish, the upside may be capped at $1,300, as analyzed earlier.

On the flip side, should ETH close the day below immediate support at $1,212, it would slip back to the intermediate support at $1,165 with the possibility of dropping toward the $1,100 psychological level. Increased selling pressure could send Ethereum back to revisit the November 22 swing low at $1,078.