- DOGE shows signs of a reversal after weeks of decline, with increased buying pressure and a small order imbalance favoring bulls, as buyers purchased more DOGE than sellers offloaded.

- On-chain metrics look bullish, with futures longs dominating at nearly 70%, spot exchange outflows rising, and the Stock-to-Flow Ratio hitting a weekly high—suggesting accumulation and rising scarcity.

- If bullish momentum holds, DOGE could reclaim $0.187 soon, but if it fades, the price might fall back toward $0.165. Market sentiment is cautiously shifting back to the bullish side.

Dogecoin hasn’t had the smoothest ride lately. After touching $0.43 a few months back, it’s been sliding down inside a descending channel—and honestly, it’s been tough for the DOGE faithful. The price has struggled to build any solid upward momentum… until now, maybe?

Right now, DOGE is sitting at around $0.1726, which is still down about 4.24% over the past week. That said, it did pop up from $0.16 to nearly $0.175 in the last 24 hours—so, yeah, not all doom and gloom.

Volume Spikes, but Is That a Good Sign?

Interestingly, trading activity has ramped up. Options volume shot up by 34%, and regular trading volume jumped by over 23%. More eyes are back on DOGE—but here’s the thing: it’s still down 0.87% in 24 hours. Why? Well, turns out buyers had been pretty inactive recently, which kept things kind of stagnant.

But! That might be changing.

Buy Pressure Sneaking Back In

Looking at the Buy-Sell Volume, things are tilting bullish. Buyers grabbed 748.7 million DOGE in the last 24 hours, while sellers offloaded 730 million. That leaves a 14 million DOGE gap favoring the bulls—small, but it counts. A positive order imbalance like this? Usually a sign that buyers are starting to take the wheel again.

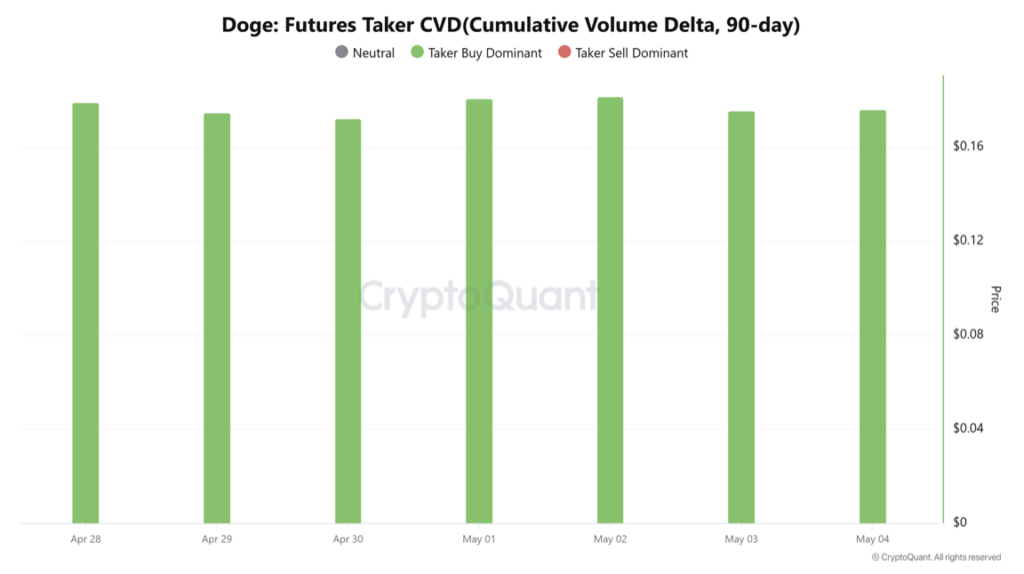

And if that wasn’t enough, both the Futures and Spot Taker CVD charts show buyer dominance. That’s fancy talk for “people are buying DOGE across the board.”

Right now, longs make up nearly 70% of the market. Only 30% are shorting. That’s a solid sign of rising optimism.

Outflows Signal Accumulation

Even better—on the spot market side, DOGE is showing negative netflow. More coins are being pulled off exchanges than put back on, which usually means one thing: accumulation. Folks are taking their DOGE and sticking it in private wallets, waiting for the next leg up.

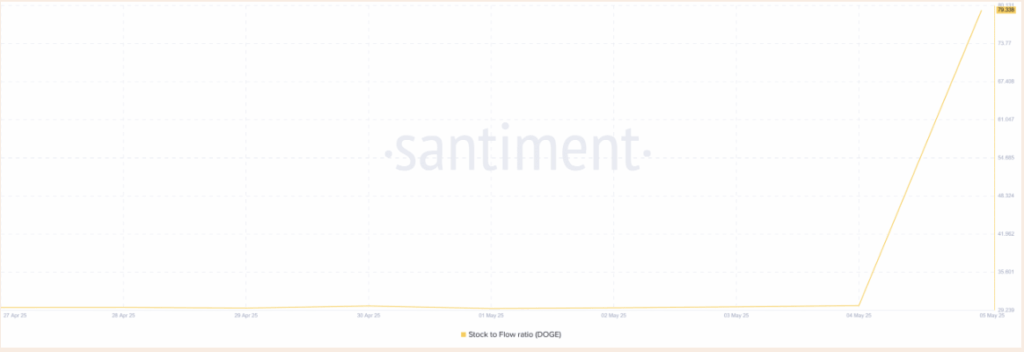

Plus, the Stock-to-Flow Ratio (kind of a scarcity indicator) hit 79 this week. That’s a high for the week and suggests that DOGE is getting… well, scarcer. And if demand keeps up while supply tightens? Price usually follows.

So… What’s Next?

Here’s the bottom line: if buyers stay active, we could see DOGE climb toward $0.187 soon and maybe break out of this drawn-out range. But if the bulls lose steam? A dip to $0.165 might be on the table again.

All eyes are on whether this little meme pup still has some bite left in the tank.