- XLM is trading around $0.2622, up 11% in the past month, with bullish signals like whale accumulation (295M+ tokens) and rising futures interest suggesting growing confidence.

- Technical indicators are mixed: XLM is forming a potentially bullish falling wedge and ascending triangle, but risks a bearish “death cross” if it fails to hold above key support at $0.21.

- Reaching $1 would be a major milestone, but it depends on sustained market strength, successful breakouts above resistance zones, and continued ecosystem growth (e.g. CBDC or institutional adoption).

Stellar Lumens (XLM) is back in the spotlight, and yeah—people are starting to ask the big question again: Can it finally crack a buck in 2025?

It’s been a while since XLM had this much energy behind it, but with the crypto market heating up, Bitcoin knocking out new highs, and altcoins trailing in its wake, Stellar’s trajectory is suddenly looking a whole lot more interesting.

XLM’s Recent Moves—A Slow Grind Upward

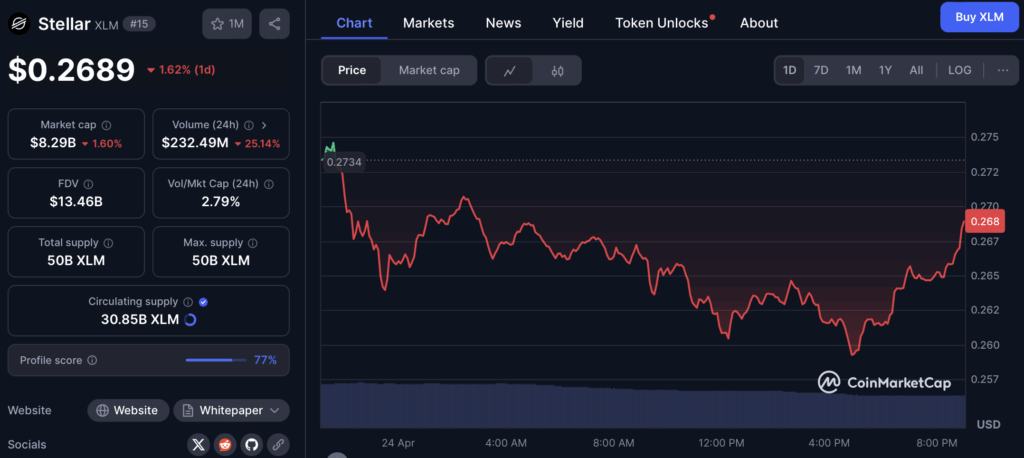

As of now, XLM is trading around $0.2622, after gaining close to 11% over the past month. Not bad—not moon-level stuff, but enough to turn some heads.

- Market cap? $8.09 billion

- Circulating supply? Just under 31 billion

- Max supply? 50 billion

Over the last week, it’s been mostly green candles—up four out of five days, tapping a high of $0.262 before running into resistance. And that’s the problem: the 50-day simple moving average (SMA) has been acting like a ceiling since February. So far, no clean break above it.

Whales Are Moving—And That Matters

But here’s where things get a little more spicy.

Between April 16 and 17, whale wallets moved close to 295 million XLM. That’s not retail FOMO. That’s big money positioning. Plus, XLM futures open interest jumped 1.49% in one day, hinting that more traders are betting on an upside move.

Add to that some strong on-chain activity and you’ve got the setup for something bigger—if the market plays along.

Technicals: It’s Complicated

XLM is currently consolidating inside a falling wedge pattern, which (if you’re into chart patterns) usually leans bullish. A break above the $0.25 level could send it running toward $0.375 or even $0.514.

But… and it’s a big but: the dreaded death cross is hovering in the background. If the 50-day MA crosses below the 200-day MA, it could spell trouble. We’re talking possible drops to $0.19 or even $0.14 if $0.21 fails to hold.

Still, there’s a glimmer. Analyst Ali Martinez flagged a SuperTrend reversal signal on April 5—the first one since Jan 2022. Pair that with a forming ascending triangle, and we could be in for a 15–17% price swing. If momentum holds, that could be the push toward $0.375.

Macro Clouds and What’s at Stake

Of course, this isn’t happening in a vacuum. The broader crypto market is dealing with macro stress—trade tensions, tariff noise, economic jitters, the usual. Bitcoin’s volatility affects everyone, and XLM’s performance is pretty tightly tied to BTC.

There’s also the never-ending regulatory wild card, and growing competition from other blockchains trying to eat Stellar’s lunch in the cross-border payments game.

Still, XLM’s core value prop remains solid—cheap, fast transactions, and real-world financial partnerships. If we start seeing CBDC integration or more institutional adoption, things could accelerate fast.

Why $1 Is a Big Deal

Getting to $1 isn’t just about price—it’s a mental milestone. XLM has never been there before. But in a bull run? With the right mix of market conditions, ecosystem wins, and solid price structure—it’s not out of reach.

That said, it won’t happen on hype alone. A push past $0.262, hold above $0.25, then a breakout past $0.40+—those are the steps. Skip those, and $1 stays a dream.

Final Take

Stellar’s in a pressure zone. Break above $0.262 cleanly? Could spark a rally toward $0.40 or beyond. But slip below $0.21? Things could unravel fast.

Right now, it’s all about momentum, support levels—and whether the market gives XLM the space to finally run.