- Accumulation or Setup? LINK exchange reserves have hit their lowest since mid-2022, hinting at long-term holders moving assets off exchanges—possibly prepping for accumulation or a long hold.

- Bullish Signs, But Not Fully Baked: Active addresses and new wallets are on the rise, but overall network activity is still below previous highs. Momentum’s building, but it’s not breakout-level just yet.

- Resistance in Focus: For LINK to really flip bullish, it needs to break and hold above the $14.5–$15.55 range. Until then, whale activity and occasional big inflows may keep traders cautious.

Chainlink’s been riding a rollercoaster lately. After pulling off a pretty solid 21.6% rally from April 9th to the 21st, the token slipped by 3.9% in just 24 hours. Not exactly panic-worthy… but still, worth keeping an eye on.

This pullback might just be a short breather after that run-up—but zoom out a little, and the bigger picture isn’t all that rosy. LINK’s been in a fairly steady downtrend through most of 2025.

Exchange Reserves Tell a Bullish Story… Maybe

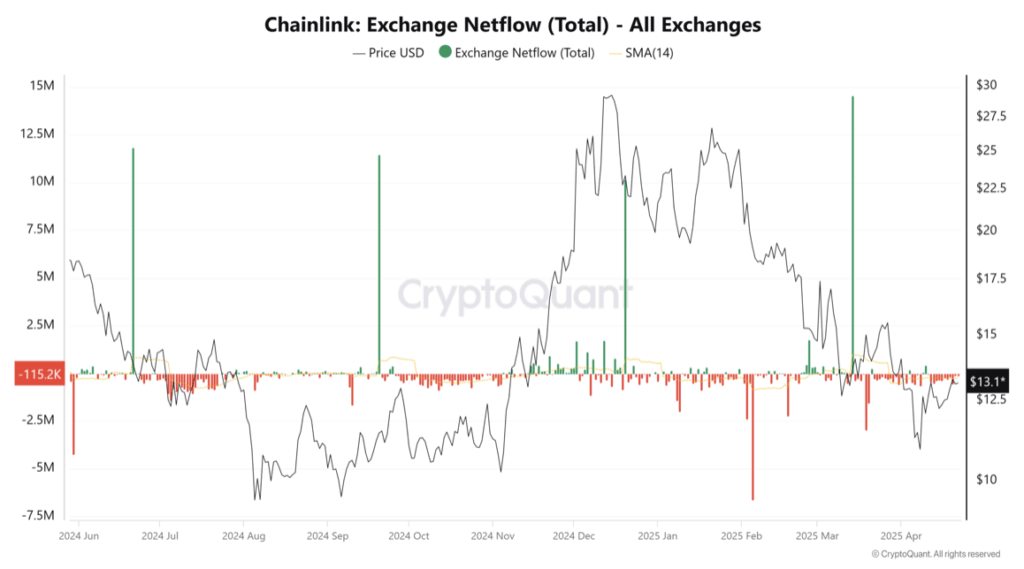

Looking at the numbers from CryptoQuant, something interesting pops up. Chainlink reserves on exchanges have been falling consistently since way back in July 2024.

Now, this usually means holders are moving their tokens off exchanges—likely to cold storage—which often hints at accumulation rather than selling.

And even after a big ol’ spike on March 14th, reserves continued their downward slide, hitting levels we haven’t seen since June 2022.

So, should investors start stacking more LINK here? Let’s keep going.

Active Addresses Spiked, But Caution Is Still Warranted

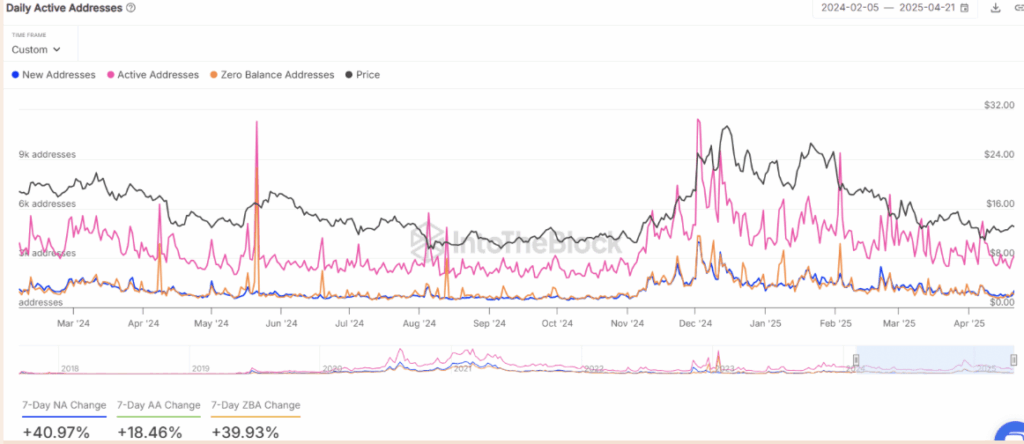

IntoTheBlock data shows new addresses are up nearly 41%, and active addresses jumped by 18.5%. Not bad, especially since LINK also grew 6.88% in price during that same stretch.

That’s a bullish sign… in the short term.

But hold on. If you zoom out a bit, network activity’s still nowhere near what we saw during November and December’s highs. So while the uptick looks nice, it’s not time to pop champagne just yet. Real, sustained growth? That’s what will matter most in the long run.

Whales Are Playing Both Sides

Here’s where it gets a little murky. A recent snapshot showed that whales control around 46.1% of all LINK supply. That’s a big chunk.

And back in mid-March, a massive 14.57 million LINK got sent to exchanges in one shot. Now, that could’ve been for selling, or maybe used as collateral in derivatives—either way, it raised eyebrows.

Since then, there’s been more movement out of exchanges, which looks good… but those big inflows keep showing up here and there, with outflows rarely matching them. Could be whales trimming their bags quietly—something that could cool off long-term bullish momentum.

Key Levels to Watch

Looking ahead, Chainlink really needs to clear that sticky $14 to $14.5 resistance zone. That’s the first real hurdle. But the bigger one? It’s at $15.55.

If LINK can break through that level on the daily chart, it could flip its current structure bullish—and that might be the green light swing traders have been waiting for.