- XRP may be heading for a 40–50% correction, with bearish technical patterns like the inverse cup-and-handle signaling a drop toward the $1.24–$1 range.

- On-chain data shows most XRP holders are in profit, a setup that historically leads to profit-taking and deeper pullbacks—especially near the realized price level.

- Odds of XRP hitting a new all-time high before 2026 have dropped to just 35%, reflecting fading bullish sentiment amid rising global trade tensions.

XRP’s recent bounce was nice while it lasted—up nearly 30% from its four-month low of $1.61—but that rally? It might be running on fumes. Between a brewing bearish setup, on-chain red flags, and good ol’ fashioned profit-taking, there’s a growing chance we see XRP tumble right back toward its realized price near $1. Yikes

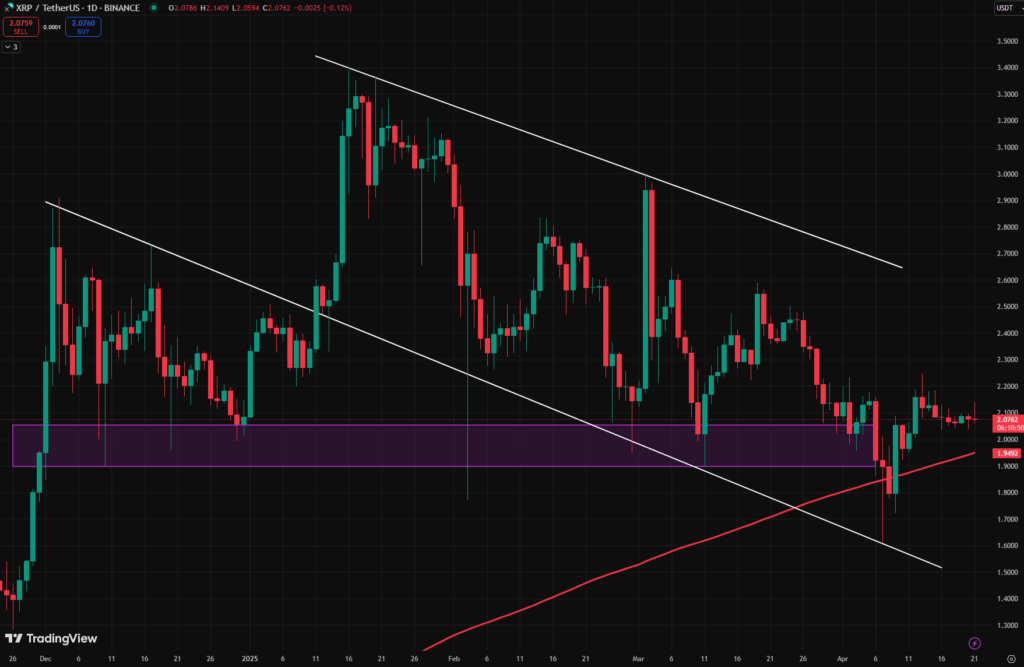

Bearish Setup Brewing: The Inverse Cup-and-Handle

Alright, so here’s the deal—XRP seems to be printing a textbook inverse cup-and-handle, which for the uninitiated, is not good news. It’s basically a pattern that signals the bulls are running out of steam.

We’re already in the “handle” part of the pattern, and if XRP decisively breaks below the $2 neckline, it could be looking at a nasty drop—possibly down to $1.24. That’s a rough 40% cut from where it’s sitting now around $2.12.

Even worse? That target matches up with its 200-day EMA around $1.28, which also aligns with the highs we saw back in November 2024. Everything’s starting to point to the same ugly level.

Oh, and legendary trader Peter Brandt? Yeah, he’s tossing around a 50% market cap drop prediction for XRP in the next few weeks. Just what we needed, right?

History Rhymes: XRP’s Realized Price Could Be the Magnet

Now let’s talk on-chain. The realized price—basically the average price all XRP coins last moved at—has historically been a magnet after big bull runs. And right now, it’s hovering around $1, which is also about 50% below current market levels.

We saw similar behavior in 2018 and 2021. After massive rallies, XRP corrected hard right back to its realized price. Kinda spooky how closely this current setup resembles those moments.

According to Polymarket, chances of XRP hitting a new ATH (above $3.55) before 2026 have dropped to just 35%, down a steep 25% since March. That kind of sentiment shift doesn’t just happen out of nowhere. It reflects growing doubt in XRP’s short-term upside—especially with global markets shaky thanks to rising tariff tensions.

So yeah… if you’re hoping for a moonshot soon, might want to manage those expectations.

Bottom line? XRP’s holding ground for now, but the bears are circling. If it cracks below $2, don’t be surprised if $1 starts flashing on the charts again—and quick.