- China and Russia have begun settling energy trades in Bitcoin, aiming to bypass the U.S. dollar.

- Economic tensions and Trump’s tariff policies are pushing nations to explore crypto and gold as trade alternatives.

- China has ordered state-run banks to reduce U.S. dollar holdings, signaling a shift toward de-dollarization.

According to a fresh report from VanEck, China and Russia—yeah, two of the biggest BRICS players—are now settling some of their trade using Bitcoin. Yep, real-world deals, like energy transactions, happening in BTC and other digital assets. VanEck’s Head of Digital Assets Research, Matthew Sigel, says this shift is already underway… and it’s catching people’s attention.

And it’s not just about snubbing the U.S. dollar for the yuan or ruble anymore. With Trump’s fiery new tariff blitz sparking fresh global trade tension, it seems China and Russia are ready to ditch fiat altogether—at least in certain transactions.

Global Trade Is Shifting—Crypto Creeping Into the Spotlight

Sigel dropped some extra nuggets too—like Bolivia looking to import electricity using crypto. Not exactly your typical trade route, right? Meanwhile, over in France, utility giant EDF is testing the waters with Bitcoin mining, hoping to repurpose surplus electricity (currently exported to Germany) into something a little shinier: sats.

“These are early signs,” Sigel explained, “that Bitcoin is slowly evolving from a speculative play into a working, cross-border monetary tool. Especially for economies wanting to bypass dollar dominance.” And let’s be honest—who isn’t looking to dodge U.S. financial systems right now?

Dollar Weakens as Investors Flee to Gold, Crypto

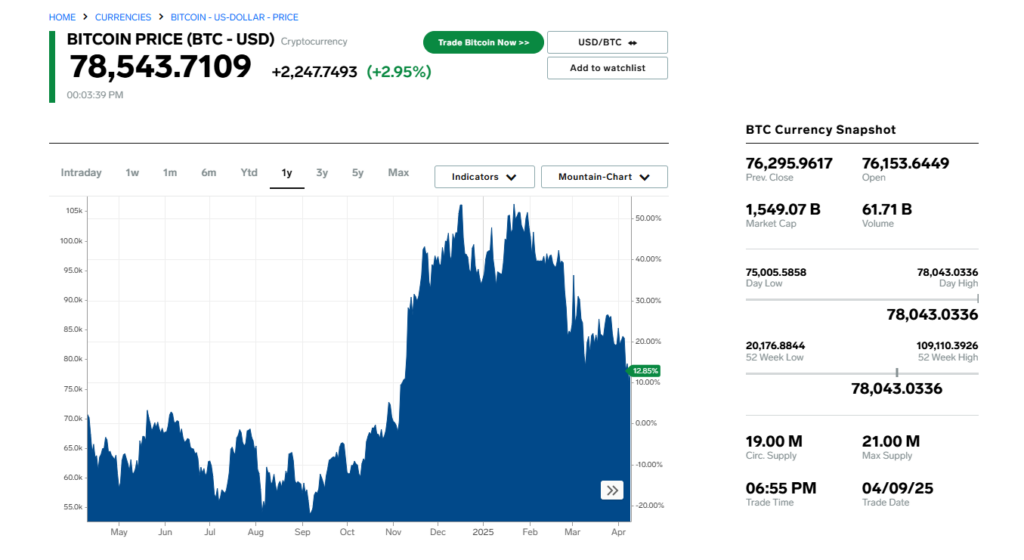

The U.S. dollar? It’s not having the best year. Since January, it’s slipped about 6.1%. Foreign holdings of U.S. assets hit a whopping $62 trillion last year, but that flow is now, well, kinda reversing. Investors are hedging their bets elsewhere—gold, Bitcoin, whatever feels less tied to Washington’s mood swings.

VanEck’s other analyst, Imaru Casanova, believes gold might have its moment in the sun again soon. “Gold and gold stocks should ultimately benefit from the uncertainty we’re seeing across the global economy,” she said. “When policies are unpredictable and markets are jumpy, gold tends to shine as the go-to safety net.”

China Hits the Brakes on the Dollar

Interestingly, Russia—half of this whole crypto trade deal—hasn’t even been hit with tariffs (yet), while China just took a wallop from the U.S. on that front. In response, China has reportedly told its state-run banks to start dialing back their dollar purchases. Less dollar in the reserves, more wiggle room for alternatives… like Bitcoin.

So yeah, what was once some weird internet money may now be creeping into the world’s biggest trade lanes. Keep an eye on this one—it’s starting to get real.