- Binance listed Jelly perpetuals amid rising concerns over alleged market manipulation linked to HyperLiquid.

- Analysts flagged suspicious wallet activity and high-leverage trades that reportedly caused millions in losses.

- HyperLiquid delisted JELLY after confirming unusual activity, while Binance faces scrutiny over its timing and motives.

Binance Futures just dropped USD-margined perpetual contracts for Jelly (yes, JELLYJELLY)—and yeah, people are talking. Loudly.

The move comes while the crypto space is buzzing (and not in a good way) over alleged manipulation tied to HyperLiquid. Tensions were already high, and then Binance added fuel by listing Jelly perps in the middle of it all.

Suspicious Wallets and Coordinated Trades?

It started with weird wallet activity. A handful of addresses—like 0xb8ebd8ec41 and 0x1072—popped up across Ethereum, Mantle, Base… all of ’em. Analysts like RunnerXBT and ZachXBT flagged the trades. Said they looked way too coordinated. The implication? Someone’s pulling strings.

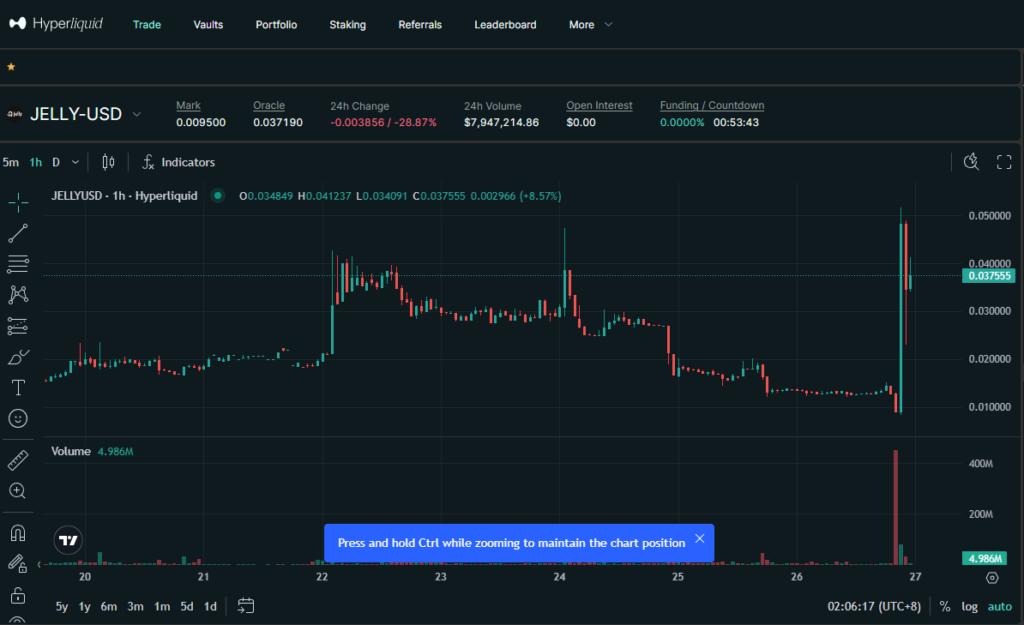

JELLY Price Manipulated? Liquidity Providers Take the Hit

The trades seemed designed to pump JELLY hard—really hard. A known whale, dubbed “Hyperliquid 50x,” reportedly used wild leverage to juice the token’s price. It worked. But it also torched liquidity providers. HyperLiquid’s vault (aka HLP) allegedly took close to $12 million in losses. That’s not pocket change.

Crypto voice Abhi chimed in, writing,

“its no secret centralized exchanges have been bleeding perp volume to hyperliquid, but the latest drama around $JELLY may shift narrative.”

Is Binance Targeting a Competitor?

Some folks are even asking the big question: Is Binance doing an FTX to HyperLiquid?

Because the timing? Kinda sus. Rolling out leveraged JELLY perps right when the market’s jittery—it raised eyebrows. Some are saying it could ramp up volatility, not calm it down. Especially when you look back at Binance’s… let’s call it complicated role in FTX’s downfall.

Losses Mounting for HyperLiquid Vaults

HyperLiquid’s vaults have already taken hits before—over $4 million gone in earlier exploits tied to aggressive perp trading. So this isn’t their first rodeo. But the community’s getting louder now, calling for more oversight, better guardrails. Less chaos.

Binance Responds… Sort Of

Binance, for its part, says the listings are just standard ops. They also launched MAVIAUSDT perps, aiming to “broaden opportunities” for traders. Maybe true. But timing matters.

ZachXBT even suggested some of the manipulating wallets were funded directly from Binance. That’s not a good look. Then there’s this: allegedly, Binance Co-Founder Yi He responded “Ok, received/got it” when someone asked to list Jelly in a bid to knock out HyperLiquid. People are taking that as confirmation of behind-the-scenes sabotage.

HyperLiquid Reacts, Delists JELLY

And now? HyperLiquid’s delisting JELLY.

“After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps,” the platform said in a statement.

“HLP’s 24 hour pnl as of writing is approximately 700k USDC. Technical improvements will be made, and the network will grow stronger as a result of lessons learned. More details will be shared shortly.”

Final Thoughts: Innovation or Instigation?

So what does this all mean?

Honestly—it’s messy. Binance might just be doing business as usual… or maybe there’s more to it. Either way, it’s another reminder: in crypto, the line between innovation and manipulation is razor thin. And when the giants make a move? Everyone feels the quake.