- BlackRock’s Robbie Mitchnick says Ethereum criticism is overblown and sees strong potential ahead.

- ETHA, BlackRock’s Ethereum ETF, pulled in $6B in six months—despite market skepticism.

- Mitchnick believes adding staking to ETFs could unlock major value for Ether investors.

While Ethereum hasn’t exactly been lighting up the charts lately—especially compared to Bitcoin—Robbie Mitchnick, head of digital assets at BlackRock, thinks the fear is overblown.

Sure, Ether didn’t hit a new all-time high after Trump’s return to the White House sent crypto markets flying. But according to Mitchnick, the negativity around Ethereum is “a bit overdone.”

Speaking at Blockworks’ Digital Asset Summit in New York on Thursday, Mitchnick said there’s still “a lot to be optimistic about.”

Why Ethereum Still Matters to BlackRock

Mitchnick pointed to BUIDL, BlackRock’s tokenized treasuries product built on Ethereum, which just crossed $1 billion in assets under management. “There was no question the blockchain we’d use was Ethereum,” he said.

BlackRock’s Ethereum ETF, ETHA, also launched last year, shortly after its wildly successful Bitcoin ETF rollout in January. That fund, IBIT, has already grown to more than $51 billion in net assets, redefining what crypto ETFs can be.

Even as Ethereum struggles, BlackRock is doubling down. CEO Larry Fink has openly supported tokenization—bringing traditional assets like bonds and stocks on-chain. Ethereum, being the most-used smart contract platform, remains central to that vision.

Ethereum’s Rough Patch

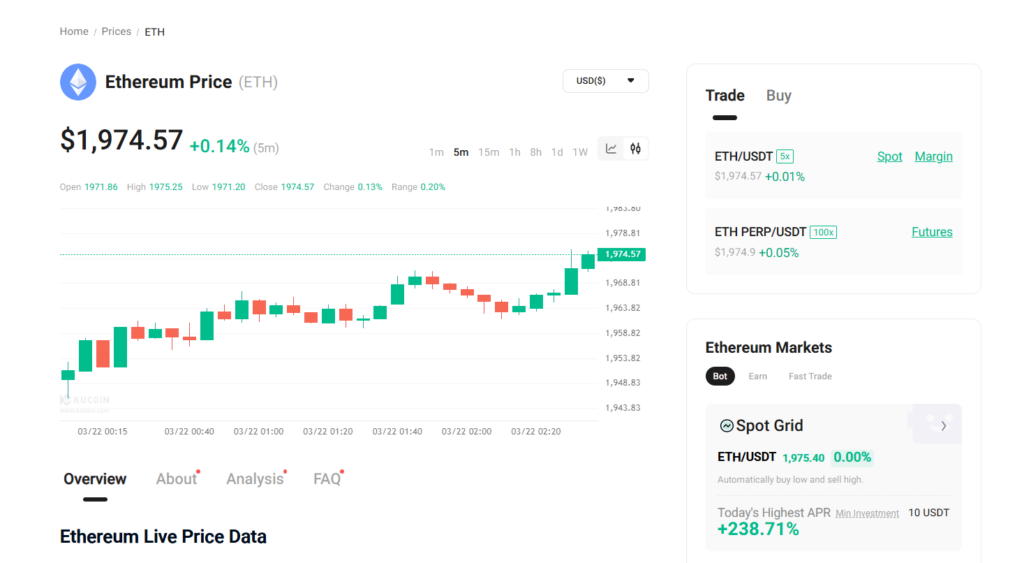

Let’s be real though—Ethereum’s had a rough few months. Ether dropped below $2,000 for the first time since November 2023, falling harder than Bitcoin as markets reacted to Trump’s on-again, off-again tariff policies.

That slump stirred up some drama in the Ethereum community. There have been calls to restructure the Ethereum Foundation, and even Vitalik Buterin has faced criticism.

Mitchnick, however, is still bullish—especially if regulators give the green light to staking within ETFs.

The “Meh” Misconception

Despite what people think, Ethereum ETFs haven’t flopped, Mitchnick said. “There’s a bit of a misconception out there that ETH ETFs have been meh.” ETHA, for example, saw $6 billion in inflows in its first six months.

That may not stack up to Bitcoin’s numbers—but compared to most ETFs? It’s an elite performance.

Why Staking Matters

Still, Mitchnick admits Ethereum ETFs are “less perfect” without staking. Staking, where Ether holders earn yield by helping secure the network, is a key part of Ethereum’s investment appeal. And right now, ETH held in ETFs just… sits there.

A proposed rule change from NYSE Arca could change that. If approved, ETFs like Grayscale’s ETHE and EZET could start staking Ether—and return that value to investors.

Advocates, including Jito Labs and Multicoin Capital, say this would better reflect Ethereum’s native benefits and even help support the network.

“There’s obviously a next phase in the potential evolution of this,” Mitchnick said. “Staking yield is a meaningful part of how you can generate investment return in this space.”

Bottom line: Ethereum might not be on top right now, but BlackRock seems to think it’s far from done.