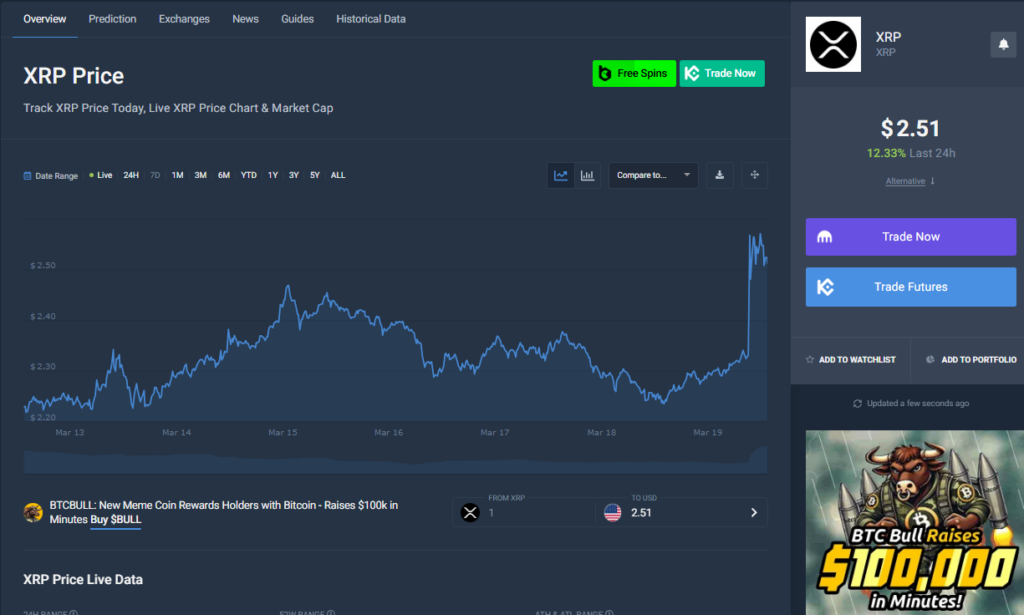

- XRP surged 11% to $2.52 after the SEC dropped its appeal against Ripple.

- Ripple CEO Brad Garlinghouse slammed the SEC, calling the legal battle a “bad faith” attack on crypto.

- XRP is up over 390% post-election, as regulatory uncertainty fades and momentum builds.

XRP skyrocketed after Ripple CEO Brad Garlinghouse revealed that the U.S. Securities and Exchange Commission (SEC) has abandoned its appeal in its long-running case against the payments company.

The price of XRP spiked nearly 11%, hitting $2.52, following the announcement.

Garlinghouse Slams the SEC’s Legal Battle

“It’s been almost four years and three months since the SEC first sued us—an exhausting journey in many ways,” Garlinghouse said at the Digital Assets Summit in New York on Wednesday. “I’ve always believed we were on the right side of the law and, frankly, on the right side of history.”

Taking a direct shot at regulators, he added: “The system just feels broken. We had to fight not just for Ripple but for the entire industry, while the SEC relentlessly attacked crypto. There were no victims, no investor losses—just a bad faith campaign against innovation.”

Ripple’s Legal Battle: A Landmark Case

The legal fight began back in 2020, when the SEC sued Ripple for allegedly violating U.S. securities laws by selling XRP without registering it as a security. Ripple secured a partial victory in 2023 when U.S. District Judge Analisa Torres ruled that XRP is not a security when sold on exchanges to retail investors. However, the ruling stated that institutional sales were considered unregistered securities offerings.

Now, the SEC’s withdrawal marks a significant shift in regulatory stance—potentially setting a precedent for future crypto cases.

The SEC Softens Its Crypto Stance

The decision to back off Ripple aligns with the SEC’s recent pivot away from strict enforcement actions in the crypto space. In just the past month, the agency has:

- Ended its enforcement case against Coinbase.

- Closed investigations into Robinhood’s crypto unit, Uniswap, Gemini, and Consensys with no further action.

- Scaled back its crypto enforcement unit.

- Officially declared meme coins are not securities.

Additionally, the newly formed SEC crypto task force is launching roundtable discussions to define the security status of digital assets—a signal that the agency may be looking for a more balanced regulatory approach.

XRP’s Role and Market Impact

XRP was created in 2012 by Ripple’s founders and serves as the native token of the XRP Ledger, an open-source blockchain used for cross-border payments. With 95% of Ripple’s business taking place outside the U.S., the SEC’s legal attack had long been seen as a roadblock to its expansion.

Ripple remains the largest holder of XRP, and the token has seen an explosive rally post-election. Since then, XRP has surged over 390% and is up 20% this year alone, making it one of the strongest performers in the crypto market.

With regulatory uncertainty fading and momentum building, could XRP finally be ready for a sustained breakout?