- Franklin Templeton has filed for an XRP ETF, aiming to let investors gain exposure to XRP without directly buying or storing it.

- Nine major financial firms, including Bitwise, Grayscale, and ProShares, have applied for XRP ETFs, signaling growing institutional interest.

- If approved, XRP ETFs could make crypto investing more accessible, bridging the gap between traditional finance and digital assets.

Franklin Templeton has taken a major step toward launching an XRP ETF, filing a 19b-4 application with the U.S. Securities and Exchange Commission (SEC). If approved, this exchange-traded fund would allow investors to gain exposure to XRP without having to buy or store it themselves.

Why an XRP ETF Matters

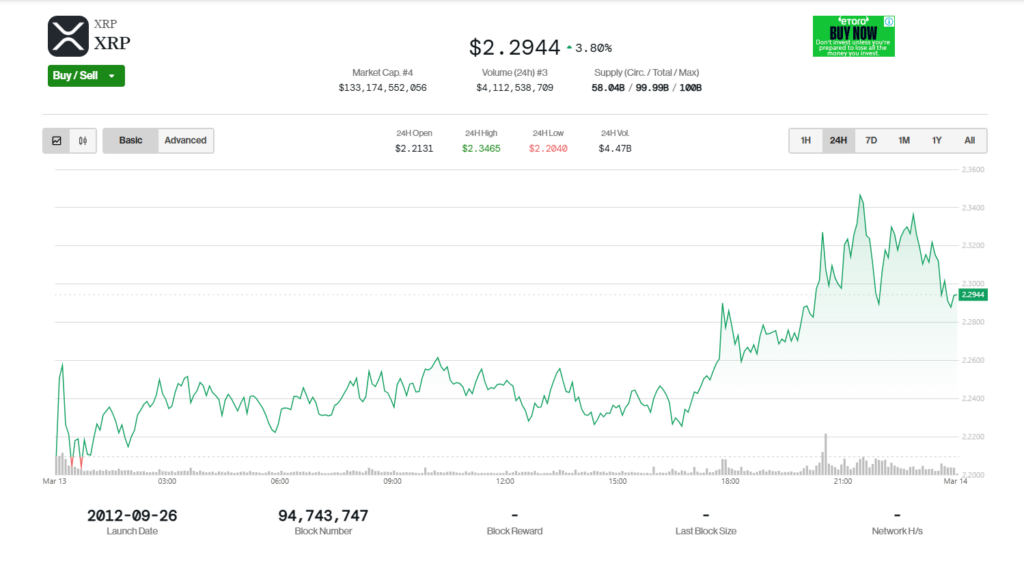

XRP has been a rollercoaster asset, dealing with regulatory hurdles and an ongoing legal battle with the SEC. Despite these challenges, institutional demand is growing, and Franklin Templeton’s filing signals confidence in XRP’s future as a mainstream investment vehicle.

For those unfamiliar, an ETF (Exchange-Traded Fund) lets investors buy shares representing an underlying asset, in this case, XRP. Instead of navigating crypto exchanges or handling private keys, investors could gain exposure through traditional brokerage accounts.

A Surge in XRP ETF Filings

As of March 13, 2025, nine major financial firms have filed for XRP ETFs, marking a significant milestone for the crypto industry. Leading applicants include:

- Bitwise (Bitwise XRP ETF)

- Canary Capital (Canary Capital XRP ETF)

- 21Shares (21Shares Core XRP ETF)

- WisdomTree XRP ETF

- Grayscale XRP ETF

- Franklin Templeton XRP ETF

- ProShares (offering multiple XRP ETFs, including Short, Ultra, and UltraShort)

- CoinShares XRP ETF

- Volatility Shares (Volatility Shares XRP ETF & 2X XRP ETF)

What’s Next?

With institutional interest heating up and multiple ETF applications pending, XRP’s accessibility to traditional investors could soon skyrocket. If the SEC grants approval, it could pave the way for broader adoption of crypto-based ETFs, bringing digital assets into mainstream finance like never before.