- Ethereum dips closer to $2,000 as bearish sentiment dominates the market.

- Fibonacci retracement suggests a potential reversal, but momentum remains weak.

- A break below key support could trigger a deeper sell-off.

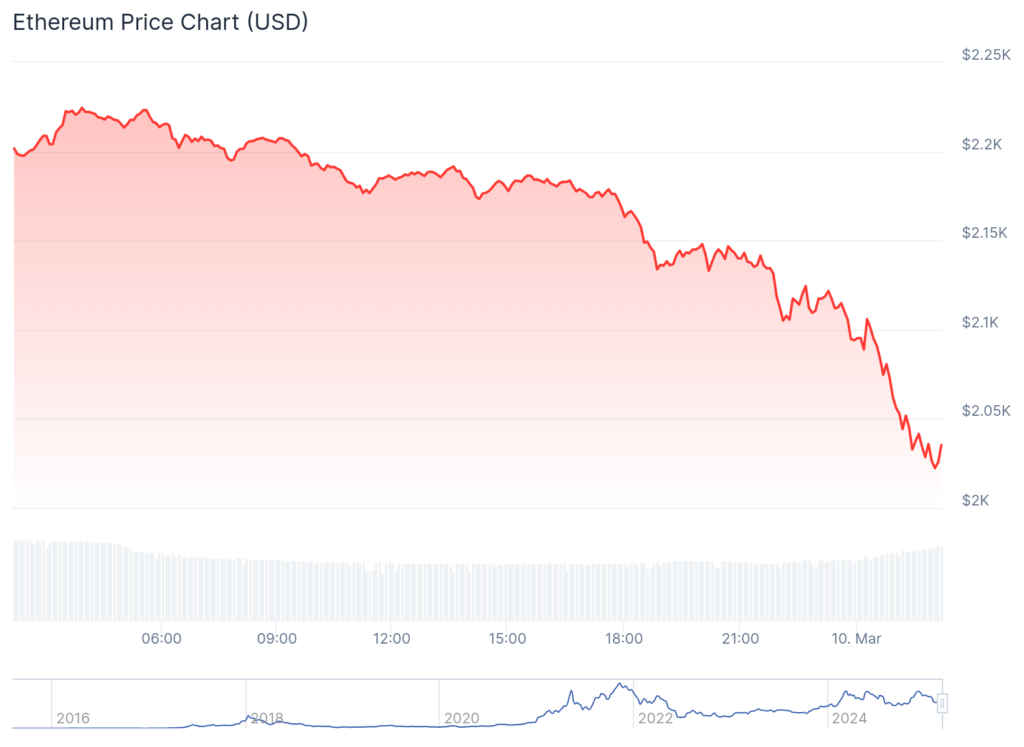

Ethereum’s price has been on a steady decline, with sellers pushing it closer to the crucial $2,000 level. After briefly trading above $2,200, ETH has been losing ground, showing signs of exhaustion in bullish momentum. The recent drop as seen in the CoinGecko chart aligns with the broader market correction, as many altcoins follow Bitcoin’s lead in a pullback phase.

While some traders anticipated a bounce around $2,100, that level failed to hold as support, allowing further downside movement. Now, ETH is testing a zone that has historically been an area of high interest. If buyers step in at $2,000, a short-term reversal could play out, but if this level breaks, it could trigger a sharper decline toward $1,900 or lower.

Ethereum Struggles to Maintain Momentum

Examining Ethereum’s recent pullback through Fibonacci retracement, the price has now dipped into a region where a potential bounce could occur. The 61.8% retracement level sits right near the $2,000 mark, which often acts as a key turning point in price action. If Ethereum holds above this range, traders may see a rebound toward $2,100 or even $2,150.

On the flip side, losing this level would be a major warning sign. If ETH falls below the Fibonacci golden pocket, it could lead to further liquidation, potentially testing deeper supports near $1,850. Market participants should watch how price reacts at these key levels in the coming sessions.

Bollinger Bands Suggest Increased Volatility

Ethereum’s Bollinger Bands have started widening, a classic sign of increasing market volatility. The price has been riding the lower band, which suggests that ETH is currently oversold. This could lead to a relief rally if buyers regain control. However, without strong demand, any rebound could be short-lived.

If Ethereum manages to reclaim the mid-band, which aligns with the $2,100 resistance zone, it could indicate the beginning of a recovery. But if the price remains stuck below, it may signal that further downside is still on the table. Traders should stay cautious and look for confirmation before making any major moves.

Ethereum was created in 2015 by Vitalik Buterin and a team of developers with the vision of building a decentralized platform for smart contracts and applications. Unlike Bitcoin, which primarily serves as digital gold, Ethereum powers an entire ecosystem of decentralized finance (DeFi), NFTs, and blockchain-based innovations.

As ETH hovers around $2,000, traders are on edge. If this level holds, Ethereum could see a recovery, but if it breaks, a deeper correction could unfold. All eyes are now on whether buyers can defend this key support zone.