- Bitcoin Cash ($BCH) surged over 30% in 24 hours, hitting its highest level since early February.

- BCH outperformed major cryptocurrencies like Bitcoin, Ethereum, and XRP, with trading volume soaring 83%.

- Market sentiment is driven by crypto policy shifts and upcoming macroeconomic reports, keeping investors on edge.

Bitcoin Cash is on a tear, surging over 30% in the past 24 hours to become the top gainer among major cryptocurrencies.

What’s Driving BCH’s Rally?

Bitcoin Cash ($BCH) soared to an intraday high of $391 during early U.S. trading on March 5, 2025—its highest level since early February, when it briefly dipped below $400. This latest jump follows a breakout from a falling wedge pattern, signaling a potential end to its long-term accumulation phase.

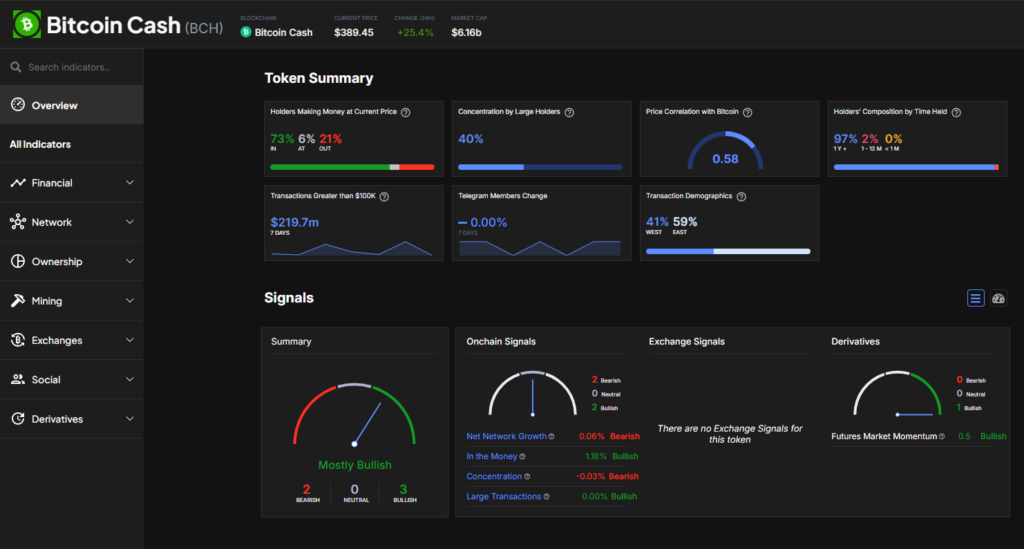

On-chain data from IntoTheBlock shows that 73% of BCH holders are now in profit, coinciding with a spike in whale transactions. This surge in activity has fueled confidence among traders, pushing BCH ahead of the broader market.

Outpacing the Top Coins

At the time of writing, BCH is hovering around $389, up nearly 30%—far outpacing Bitcoin (up 6.5%), Ethereum (7.2%), and XRP (3.9%).

With daily trading volume skyrocketing 83% to over $942 million and a market cap of $7.65 billion, BCH is currently the best-performing asset among the top 100 cryptocurrencies. It even outperformed recent high flyers like Jito, Ondo Finance, and Chainlink, which posted gains between 14% and 22%.

BCH also outshined Arbitrum ($ARB), which saw a 13% jump after Robinhood announced trading support for the token.

Market Sentiment and Upcoming Events

The broader crypto market has been bouncing back after sharp volatility saw Bitcoin briefly dip below $80K before reclaiming $90K. Sentiment has also been lifted by news of U.S. crypto policy shifts, including the upcoming White House Crypto Summit. Michael Saylor, founder of Strategy, confirmed he’ll be attending, alongside Secretary of Commerce Howard Lutnick, who made bullish comments on Wednesday.

“Markets are on edge, and crypto is moving in sync with equities,” noted QCP Capital in a post on X.

Analysts suggest that Friday’s summit could be a key catalyst for market direction. Beyond that, all eyes are on next week’s macroeconomic reports, particularly the non-farm payrolls and consumer price index (CPI) data, which could set the tone for risk assets moving forward.

For now, Bitcoin Cash is stealing the spotlight—but whether it can sustain this momentum remains to be seen.