- Cboe BZX filed 19b-4 applications for spot XRP ETFs on behalf of Bitwise, 21Shares, and Canary Capital.

- The SEC approval process for crypto ETFs accelerated after spot Bitcoin and Ethereum ETFs were approved in 2024.

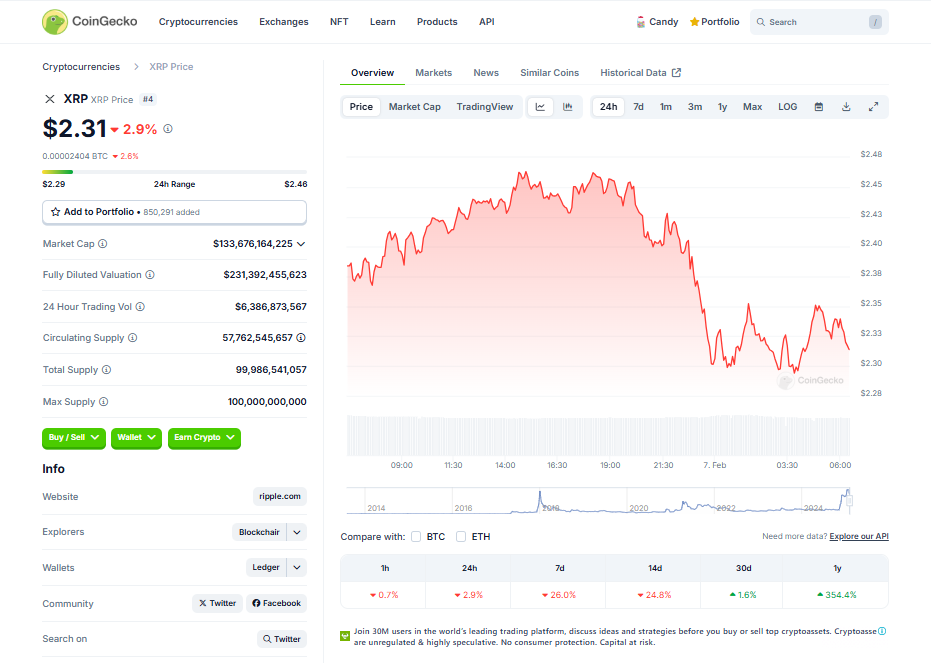

- XRP’s price dropped 2.5% to $2.34 despite increased ETF filings and regulatory activity.

Cboe BZX Exchange has filed multiple 19b-4 applications on behalf of Bitwise, 21Shares, and Canary Capital to list and trade a spot XRP ETF, marking the latest push for more crypto-backed financial products in the U.S. market. XRP, currently the fourth-largest cryptocurrency by market cap, is the focus of this new wave of filings.

What’s a 19b-4 Filing?

A 19b-4 is the second step in proposing a crypto ETF to the U.S. Securities and Exchange Commission (SEC). Once the SEC acknowledges the filing, it’s published in the Federal Register, kicking off the formal approval process. Bitwise began the race for a spot XRP ETF in October, followed by 21Shares in November, and other firms like WisdomTree and CoinShares soon joined the competition.

NYSE Arca recently filed to convert Grayscale’s XRP trust into an ETF, and Canadian firm Purpose Investments is vying to become the world’s first XRP ETF issuer after submitting a prospectus on January 31.

A Pro-Crypto Regulatory Landscape

Since the SEC approved spot Bitcoin ETFs in January 2024 and spot Ethereum ETFs last summer, crypto issuers have rushed to file new applications. The current Trump administration’s pro-crypto stance has only fueled this trend, creating an environment where spot crypto ETFs are gaining momentum.

XRP Market Impact

Despite these developments, XRP’s price slipped by 2.5% to $2.34 at the time of reporting. Market watchers speculate that successful ETF approvals could boost demand and price stability for XRP in the long run. For now, competition among major asset managers and exchanges to secure ETF listings continues to intensify.