- Tether is launching its $140 billion USDT stablecoin on Bitcoin and the Lightning Network for faster, global payments.

- The integration is powered by Taproot Assets, enabling secure, low-cost transactions through Lightning’s scalability.

- This move aims to expand Bitcoin’s role from a store of value to a practical platform for remittances and everyday financial services.

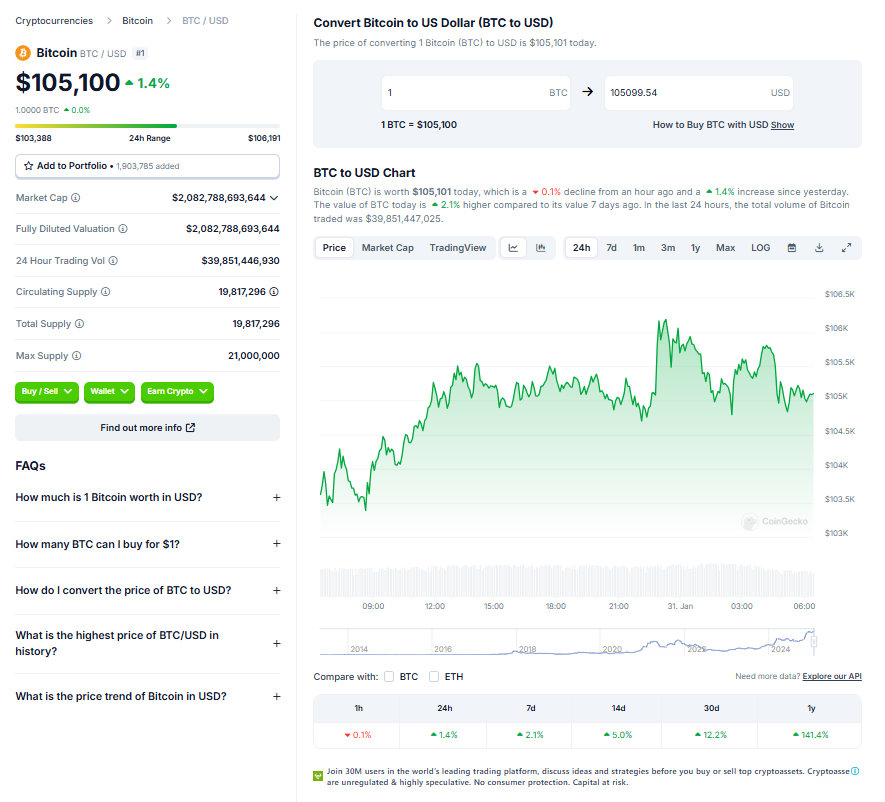

San Salvador – In a major move for crypto, Tether is bringing its $140 billion USDT stablecoin to Bitcoin and the Lightning Network, the company revealed Thursday. Yep, you heard that right—USDT is coming to the world’s largest and oldest <a href="https://blocknews.com/how-blockchain-technology-will-change-leadership/" title="<strong>How Blockchain Technology Will Change Leadership?blockchain, aiming to revolutionize remittances, payments, and other financial services that rely on both speed and reliability.

The announcement came during the Plan B conference in San Salvador, where Tether CEO Paolo Ardoino outlined the plan. According to Ardoino, this integration seeks to offer “practical solutions” for global money movement—particularly in regions where traditional financial infrastructure is either limited or too expensive.

Why It Matters

Stablecoins, worth a whopping $200 billion collectively, are pegged to external assets like the U.S. dollar. They act as a bridge between fiat currency and digital assets, becoming increasingly popular for everyday financial needs like savings, payments, and international remittances. This is especially true in emerging markets, where faster, cheaper transactions are crucial.

Until now, most of that stablecoin activity has lived on smart contract platforms like Ethereum, Tron, and Solana. Bitcoin, despite its dominance, hasn’t been a major player in this space—until now.

The Tech Behind It

The integration is possible thanks to Taproot Assets, a protocol developed by Lightning Labs. This technology enables asset issuance directly on Bitcoin’s base layer and allows fast, low-cost transfers through the Lightning Network, a system designed to handle micropayments with minimal fees. Essentially, it opens the door for stablecoins and other external tokens to become part of the Bitcoin ecosystem.

Elizabeth Stark, CEO of Lightning Labs, emphasized the significance of this move. “Millions of people will now be able to use the most open, secure blockchain to send dollars globally,” she said. “Bringing USDT to Bitcoin combines Bitcoin’s security and decentralization with the speed and scalability of Lightning.”

What’s Next?

With this integration, Tether aims to cement Bitcoin’s role not just as a store of value but as a practical platform for everyday financial transactions. Stablecoin adoption has been growing rapidly, and this development could push that growth even further by expanding access to faster, cheaper digital payments worldwide. It’s a big bet—and one that could redefine Bitcoin’s utility in the evolving world of digital finance.