- XRP’s market cap has soared to $162 billion, surpassing BlackRock and iconic brands like Disney and Nike.

- Wallets holding 1M–10M XRP have increased their holdings by 37% in just two months, fueling bullish momentum.

- Analysts predict XRP could hit $7.80 if its dominance reaches 14% amid a surging $3.3 trillion crypto market.

Ripple’s XRP has not just captured the hearts of crypto enthusiasts—it’s now giving traditional finance giants a run for their money. According to fresh on-chain data, XRP has officially surpassed BlackRock, the world’s largest asset manager, in market capitalization. Yeah, you read that right.

As of January 15, 2025, XRP boasts a market cap of $162 billion, leaving BlackRock’s $154 billion in the dust. This isn’t just some crypto niche victory either—it puts Ripple ahead of household names like Coca-Cola, Disney, and Nike. Wild, huh?

Crypto Mania Surges Ahead of Trump Inauguration

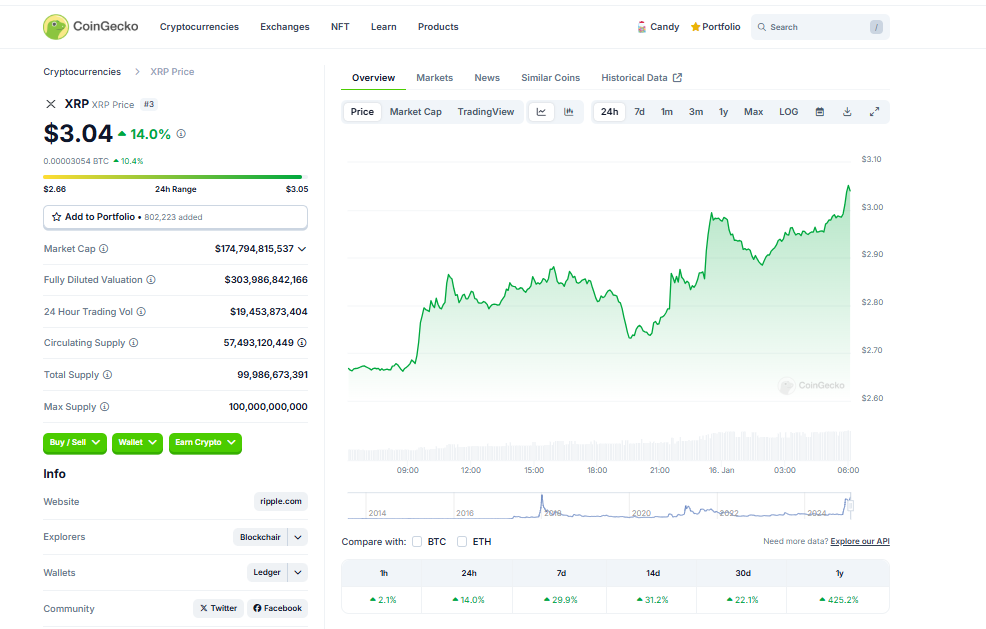

There’s no denying it: the crypto world is on fire as Trump’s second inauguration nears on January 20, 2025. Ripple seems to be riding this wave perfectly, with its price hitting $2.8—a level it hasn’t touched since December 17, 2024. In just 24 hours, XRP climbed 9%, with weekly and monthly gains of 21.54% and 18.67%, respectively.

Oh, and by the way, BlackRock may want to keep an eye on these developments. XRP’s meteoric rise in the past two weeks, from $2 to nearly $2.9, now values its market cap at a hefty $31.6 billion. That’s no small potatoes.

Big Players Are Doubling Down on XRP

Data from Santiment, an on-chain analytics platform, shows serious accumulation activity. Wallets holding between 1M and 10M XRP have ramped up their holdings by over 37% in just two months. Do the math, and that’s around $3.8 billion in XRP scooped up since November 12, 2024.

The price chart doesn’t lie either—XRP is flashing all the hallmarks of a bullish trend, with higher highs and, well, higher lows. Traders are particularly excited about buying action near the 0.5–0.618 Fibonacci retracement levels, which seems to be propelling the coin’s impressive run.

That said, there’s still some resistance in the $2–$3 range. Analysts are crossing their fingers for a breakout to confirm the start of a long-term trend. Without it, XRP could just meander in this range for a while.

Ripple’s Market Dominance Inches Higher

Over on X (formerly Twitter), crypto analyst Bobby A threw in his two cents, pointing out that XRP.D—Ripple’s market cap dominance—is closing in on 14%. He linked this to the 4.236 Fibonacci extension, which sounds technical but basically means Ripple could be aiming even higher.

For context, if the entire crypto market cap (currently at $3.3 trillion) keeps climbing, a 14% dominance would peg XRP’s price at an eye-popping $7.80. Big dreams, or is it just a matter of time?

BlackRock: Still Bullish on Crypto

Meanwhile, over at BlackRock HQ, the vibe around crypto is surprisingly optimistic. Robbie Mitchnick, their digital assets head honcho, recently told Bloomberg that Bitcoin remains a unique, decentralized asset free from country-specific risks.

According to Mitchnick, institutions are only just dipping their toes into crypto. He praised BlackRock’s IBIT spot Bitcoin ETF for its strong 2024 performance but emphasized that they’re playing a long-term game. Unlike MicroStrategy, BlackRock isn’t into flashy, leverage-heavy Bitcoin buys. Their approach? Measured and investor-focused.

“We’re not buying Bitcoin for ourselves,” Mitchnick clarified. “This is about creating value for our investors. The asset’s already volatile enough without adding leverage to the mix.”

So there you have it—a clash of titans, with XRP making waves and BlackRock quietly holding its own. Whether this marks a turning point for crypto or just another blip on the radar, one thing’s for sure: the battle between traditional finance and digital assets is just heating up.