- Bitcoin’s price may peak mid-2025, with the 52-week SMA signaling July.

- Analysts suggest the current price correction is in its final consolidation phase.

- Possible outcomes include a head-and-shoulders pattern targeting below $77,000 or $110,000.

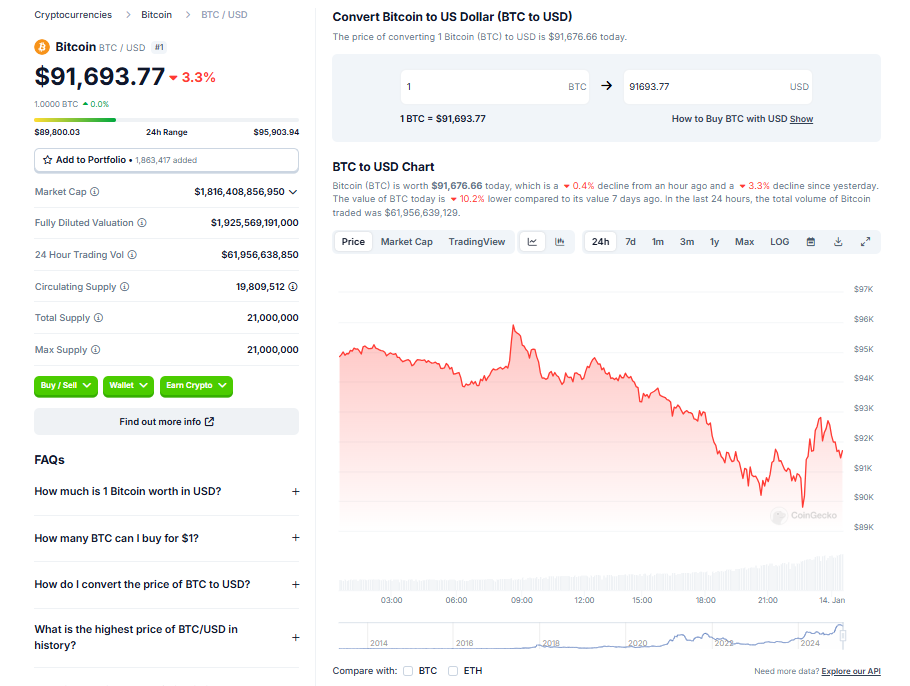

Bitcoin has seen a 3% drop in the past 24 hours and is down 8% this week, but such January drawdowns aren’t unusual, analysts say. Looking ahead, BTC’s price might reach its peak around mid-July 2025, based on insights from the 52-week simple moving average (SMA).

According to crypto analyst Dave the Wave, Bitcoin has historically peaked when the 52-week SMA touched the midpoint of the logarithmic growth curve (LGC). This pattern, observed during previous bull cycles, suggests BTC could hit a top shortly before or after the SMA crosses the LGC’s middle band. While exact timing remains uncertain, the signal points to mid-2025 for the next potential price high.

Bitcoin’s Current Correction Nears Final Stages

The ongoing Bitcoin price correction has lasted four weeks, with prices consolidating around the $91,000 level after hitting an all-time high of $108,268 in December 2024. Crypto analyst Rekt Capital described this as part of the “first price discovery correction”, which typically occurs between weeks six and eight of a parabolic phase.

Rekt Capital suggests that Bitcoin’s retrace is likely in its final stages, and while the dip has been milder than past corrections, further downside remains possible. Fellow analyst Axel Adler Jr. compared this to last year’s sharper 26% drawdown in July and believes the current retrace reflects healthier consolidation.

Head-and-Shoulders Pattern: Bearish or Bullish?

Veteran trader Peter Brandt highlighted a potential head-and-shoulders (H&S) pattern forming on Bitcoin’s daily chart, presenting three possible scenarios. The bearish outcome could see BTC drop to below $77,000, aligning with the H&S target. Alternatively, Bitcoin might complete the pattern but fail to hit the target, forming a bear trap or morphing into a broader trend.

Meanwhile, bids between $85,000 and $92,000 on Binance have caught the attention of analyst Bitcoin Munger, sparking speculation about whether BTC will fill these orders or instead surge toward $110,000 ask levels.

Final Thoughts: Bitcoin’s Dual Narrative

Bitcoin’s current trajectory reflects both near-term uncertainty and long-term potential. With key indicators like the 52-week SMA signaling a mid-2025 peak and active support levels at $85,000–$92,000, Bitcoin traders face a delicate balancing act. Whether this is a final correction or the prelude to new highs, the coming months promise plenty of market action.