• Crypto liquidations totaled $712 million across 237,375 traders over the past 24 hours as Bitcoin’s price fell to $95k

• Bitcoin’s price drop was influenced by the correlation with the U.S. stock market downturn on January 7th

• Long positions accounted for 88.83% of the total liquidations, with $631.21 million cleared compared to $79.35 million in short positions

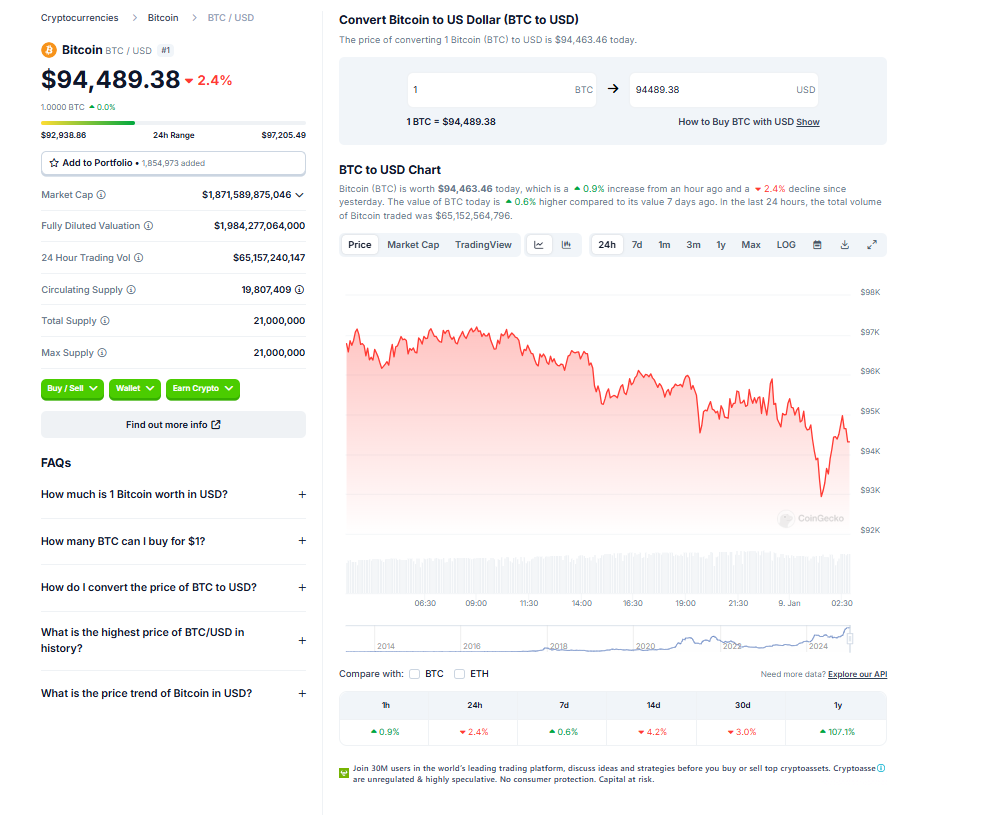

The world of cryptocurrencies experienced a significant upheaval as Bitcoin’s price dropped to $95,000, sparking a liquidation frenzy that exceeded $700 million. This incident illuminated the increasingly undeniable correlation between the US stock market and Bitcoin’s price trends. This article offers an in-depth examination of the liquidation scenario and its implications for the future of the cryptocurrency market.

The Onset of the Liquidation Spree:

In a span of just 24 hours, the cryptocurrency market was subjected to unprecedented volatility, triggering liquidations that amounted to a staggering $712 million, affecting 237,375 traders. The data, obtained from Coinglass, reveals that long positions bore the brunt of the liquidations, accounting for 88.83% of the total.

Highlighting Key Players:

During this period of turmoil, Binance emerged as the platform contributing the highest activity, with $315.12 million in liquidations. This figure includes a single liquidation of an ETHUSDT order amounting to $17.74 million, representing the largest order during this period.

The Role of the US Stock Market:

The liquidation surge was primarily triggered by the opening of the US stock market on January 8. Bitcoin, which was trading at around $102,500 early in the day, fell towards $100,000 as the US market opened. This was a reaction to the significant downturn the US stock market experienced on January 7, where all major indices closed lower.

The Aftermath and Future Implications:

The severe sell-off and subsequent liquidation cascade underscored the market’s vulnerability and traders’ misjudgment of the US market’s influence on Bitcoin. The drastic fluctuations in trading volumes amplified the impact of the liquidations, demonstrating a critical lesson for future trading practices. As Bitcoin continues to consolidate, the resistance and support levels remain key markers.

Conclusion:

While the liquidation spree has highlighted the inherent risks and volatility of the cryptocurrency market, it also serves as a critical reminder of the influence other financial markets can have on cryptocurrency prices. As traders continue to navigate this volatile landscape, they must remain diligent and attentive to the ever-evolving correlations between various financial markets.